DEF 14A: Definitive proxy statements

Published on March 17, 2021

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to §240.14a-12 | |

Clear Channel Outdoor Holdings, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

|

|||

| (2) | Aggregate number of securities to which transaction applies:

|

|||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|||

| (4) | Proposed maximum aggregate value of transaction:

|

|||

| (5) | Total fee paid:

|

|||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount previously paid:

|

|||

| (2) | Form, Schedule or Registration Statement No.:

|

|||

| (3) | Filing Party:

|

|||

| (4) | Date Filed:

|

|||

Table of Contents

Table of Contents

|

|

A LETTER FROM OUR CEO AND INDEPENDENT CHAIR OF THE BOARD

|

|

Dear Fellow Stockholders:

On behalf of Clear Channel Outdoor Holdings, Inc.s Board of Directors, it is our pleasure to invite you to our annual meeting of stockholders.

The past year brought unprecedented challenges to all of us as we adjusted to the many impacts of the COVID-19 pandemic. In response, we took a range of steps to protect and enhance our operations with the aim of maximizing our performance near-term, while continuing to position our organization for success well into the future. We strengthened our liquidity, addressed our cost base and adjusted our sales approaches, while continuing to invest in our digital platform and data analytics products.

As a result, we believe we are well-positioned to return to growth as the worldwide recovery takes hold and we emerge from the pandemic. With the support of our board of directors and talented and committed team of employees, we remain focused on pursuing our ongoing priorities of revenue expansion, debt reduction, free cash flow generation and investments in profitable growth.

Thank you for your continued support and confidence in Clear Channel Outdoor. We hope you will join us for our Annual Meeting webcast on May 5, 2021.

Sincerely,

|

|

|

|

| C. William Eccleshare | W. Benjamin Moreland | |

| Chief Executive Officer and Director | Chair of the Board |

|

|

Table of Contents

Table of Contents

|

Notice and Proxy Statement 2021

|

Table of Contents

This summary highlights information you will find in this Proxy Statement. As it is only a summary, please review the complete Proxy Statement before you vote.

2021 Annual Meeting Information

|

|

|

|

|||

| Date and Time: Wednesday, May 5, 2021 at 9:00 a.m. Eastern Time |

Location: www.meetingcenter.io/241105734 |

Record Date: March 9, 2021 |

Proxy Mail Date: On or about March 24, 2021 |

|||

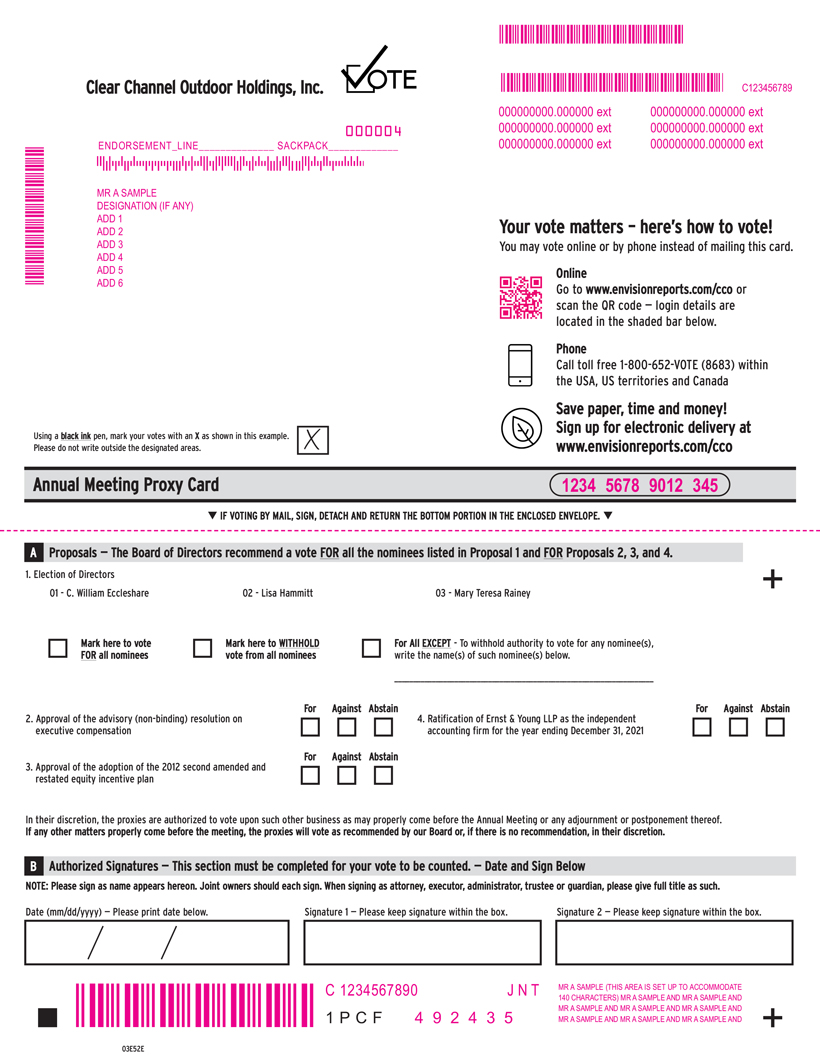

HOW TO VOTE

|

By Internet: Visit the website listed on your proxy card |

By Phone: Call the telephone number on your proxy card |

By Mail: Sign, date and return your proxy card in the enclosed envelope

|

During the Annual Meeting: Participate in the Annual Meeting webcast

|

| Voting: | Each share of common stock is entitled to one vote for each director nominee and one vote for each of the other proposals to be voted on.

|

|

| Admission: | Admission to the Annual Meeting is limited to stockholders as of the record date. If you plan to attend the annual meeting, please follow the registration instructions set forth in this proxy statement. |

ANNUAL MEETING AGENDA AND VOTE RECOMMENDATIONS

| Matter

|

Board Vote Recommendation |

Page Reference (for more details) |

||||||

| Proposal 1 | Election of Directors |

ü

|

FOR | 17 | ||||

| Proposal 2 | Advisory Resolution on Executive Compensation |

ü

|

FOR | 69 | ||||

| Proposal 3 |

Approval of the adoption of the Clear Channel Outdoor Holdings, Inc. 2012 Second Amended and Restated Equity Incentive Plan

|

ü

|

FOR | 70 | ||||

| Proposal 4 |

Ratification of the selection of Ernst & Young LLP as the independent registered public accounting firm for the year ending December 31, 2021 |

ü

|

FOR | 78 | ||||

In this Proxy Statement, we, our, us, Clear Channel Outdoor and the Company refer to Clear Channel Outdoor Holdings, Inc. and the Annual Meeting refers to the 2021 Annual Meeting of Stockholders. We first made this Proxy Statement and form of proxy card available to stockholders on or about March 24, 2021.

Table of Contents

2020 BUSINESS HIGHLIGHTS

|

Over 2,000 Digital Billboard and Street Furniture Displays in the U.S.

|

|

Over 16,000 Digital

|

||||||

|

Deployed 74

TOTAL DIGITAL DISPLAY REVENUE ACCOUNTS FOR 31%

OF REVENUE

|

DIGITAL COVERAGE

IN ALL TOP 20 DMAs

|

Deployed 1,244 Digital Displays in Europe in 2020

ACCOUNTS FOR 31%

OF REVENUE

|

|

AGGRESSIVE MANAGEMENT OF COVID-19 IMPACTS

|

PROACTIVE MOVES TO STRENGTHEN LIQUIDITY

|

|

||||||

|

- Executed cost reduction and rightsizing efforts to restructure and align operations with market conditions

- Strengthened relationships

- Invested in

technologies and expanded our data analytics, digital platform capabilities

|

- Sold stake in Clear Media investment for cash proceeds of $253M

- Issued $375M of

Senior

- Made cautionary draw of $150M under Revolving Credit Facility

- Amended Revolving Credit Facility to provide covenant flexibility

|

GLOBAL AND US OOH INDUSTRY POISED TO REBOUND AND OUTPERFORM OTHER FORMS OF TRADITIONAL MEDIA (Global & US data sourced from MAGNA Dec. 2020 Report)

|

| ii Notice and Proxy Statement 2021

|

|

Table of Contents

DIRECTOR NOMINEES

Below is information about each of our Director nominees:

| Name |

Age | Independent Director |

Committee Memberships |

|||||||||||

| C. William Eccleshare |

65 | Chief Executive Officer, President and Director of Clear Channel Outdoor | None | |||||||||||

| Lisa Hammitt |

58 | Executive Vice President, Artificial Intelligence and Chief Technology, Davidson Technologies | ✓ | CC; NCGC | ||||||||||

| Mary Teresa Rainey |

65 | Founder of Rainey, Kelly Campbell Roalfe/48R | ✓ | AC; NCGC | ||||||||||

AC = Audit Committee

CC = Compensation Committee

NCGC = Nominating and Corporate Governance Committee

CORPORATE GOVERNANCE HIGHLIGHTS

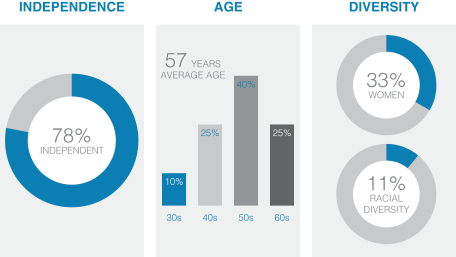

The Board of Directors (the Board) of Clear Channel Outdoor believes that good governance is key to achieving long-term stockholder value, and that the Companys long-term success requires the Companys commitment to a robust framework of guidelines and practices that serves the best interest of the Company and all of our stockholders. Below are some key highlights of our corporate governance framework:

|

Board Practices

✓ 7 out of 9 of our directors are independent.

✓ The Board is led by an independent, non-executive Chair.

✓ After 2023, all of our directors will be elected annually.

✓ All members of our Audit, Compensation and Nominating and Corporate Governance Committees are independent as defined by the NYSE listing standards and applicable SEC rules.

✓ Each Board committee operates under a written charter that has been approved by the Board and is reviewed annually.

✓ The Board conducts periodic executive sessions, where independent directors meet without management.

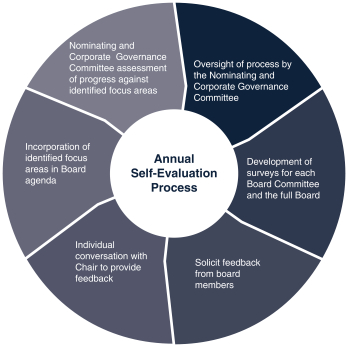

✓ The Nominating and Corporate Governance Committee oversees an annual self-evaluation process for the Board and each standing committee, and is responsible for proposing any modification or alterations in Board or committee practices or procedures. |

Compensation Practices

✓ Robust annual risk assessment of executive compensation programs, policies, and practices.

✓ Comprehensive cash and equity claw-back policy for senior executives.

✓ Significant stock ownership requirements for senior executives and directors.

Stockholder Matters

✓ Robust stockholder engagement.

✓ Annual Say-on-Pay voting.

Other Governance Practices

✓ Our Code of Business Conduct and Ethics, which applies to all employees as well as officers and all members of the Board, reinforces our core values and helps drive our workplace culture of compliance with ethical standards, integrity and accountability.

✓ Strong commitment to Corporate Social Responsibility and strengthening the Companys ESG program. |

|

|

Notice and Proxy Statement 2021 iii

|

Table of Contents

CORPORATE SOCIAL RESPONSIBILITY

Clear Channel Outdoors Board and management team are committed to the Companys guiding principle of making a difference in the communities we serve. Clear Channel Outdoor strives to behave ethically and responsibly as a company, an employer and business partner, and we endeavor to use our resources and products to drive meaningful change. We believe addressing the challenges that affect peoples daily lives is critical for influencing greater societal change. In furtherance of our goal to drive change, we donate public service advertising (PSA) on an annual basis to nonprofit and governmental organizations for their use in communicating information that positively affects the lives of those within our communities. In addition, our support extends to both local and national organizations as they:

| | improve health and public safety; |

| | ensure a sustainable environment; |

| | promote arts, education and cultural diversity; as well as |

| | support market-by-market advertising standards. |

This collaboration works to inspire citizens to make a difference within their own communities, and helps us to meet our commitment to being a responsible business, which creates value for our clients, our communities, our people and, ultimately, our stockholders.

| iv Notice and Proxy Statement 2021

|

|

Table of Contents

Commitment to Environmental Sustainability

We are focused on operating our business in ways that minimize the potential for causing harm to the environment, and as part of our Global Environmental Program, we are committed to Carbon Net Zero by 2050 (with many of our business units on target to reach this goal by 2030) and are committed to employing ecologically friendly materials and operational procedures.

| | We strive for 100% of our posters and bulletins to be converted to recyclable Polyethylene (PE) Substrates and recycled annually in the U.S. |

| | We measure our recycling and waste diversion from landfill rates across our business. |

| | Up to 98% of our digital billboard components are recyclable. |

| | We converted over 98% of our illuminated display panels and over 75% of our illuminated transit shelter displays in the U.S. to LED lighting, decreasing energy consumption by more than 60% across a three year period, and are working toward full conversion in 2021. |

| | 35% of our business by revenue is certified or benchmarked against ISO 14001 standards, and continued adoption of this standard is a goal of our Global Environmental Program. |

| | Starting in 2021 in our European and Latin American businesses, we are committed to purchasing 100% renewable electricity with intention to reduce our Scope 1 and 2 emissions. |

Ethics and Compliance

Clear Channel Outdoor is committed to maintaining the highest standards of compliance, ethics, honesty, openness and accountability in our business operations. We maintain a Code of Business Conduct & Ethics (the Code) that sets forth standards for our officers, directors, employees, interns, contractors and agents throughout our corporate structure. Training on the Code is mandatory upon employment, and we require completion of additional trainings covering certain topics contained in the Code on a periodic basis. Highlights from our Code, and its underlying policies and procedures, include:

| | No-retaliation policy for anyone who, acting in good faith, notifies us of a possible violation of the Code, our policies or the law. |

| | Human Rights Policy committed to human rights and labor protections across all of our operations, and the expectation that our business partners uphold the same standards. |

| | Anti-Corruption Policy that prohibits offering, attempting to offer, authorizing or promising any bribe or kickback for the purpose of obtaining or retaining business or an unfair advantage, imposes restrictions on government official interaction and seeks to mitigate risk in our gifts, entertainment and travel approval processes. |

| | Due Diligence procedures and contractual provisions mitigating risk areas in our supply chain, including bribery and corruption, sanctions breaches and human rights. |

| | Conflict of Interest Policy that requires the disclosure of matters that could potentially lead to a conflict of interest through an independent approval process. |

| | Supplier Code of Conduct and contractual clauses used across our business requiring key suppliers to operate at a high ethical standard. |

In addition, we maintain a Compliance and Privacy Office which sets standards and controls across the Company relating to corporate social responsibility, financial and economic crime controls, transparency, integrity and the mitigation of compliance risk, and we require that our leaders regularly report fraud risk and adhere to the standards that we set. We reflect our understanding of compliance risk through regular risk assessment, audit and assurance processes.

We are also committed to safeguarding and maintaining the privacy of personal information (PII) and honor CCPA, GDPR, and data privacy rights requests. Our Privacy Office maintains policies, procedures and training to ensure we protect PII wherever we may process or control it, and our websites include Privacy & Cookie Notices describing how we collect, protect, store, use, anonymize, aggregate and/or dispose of personal information automatically collected and/or voluntarily provided, and offer those with privacy concerns the right to object to any processing, change their PII or to request that we do not sell their PII. We honor their requests within legally prescribed time frames. In addition, we subject our supply chain to data privacy impact assessments where appropriate.

|

Notice and Proxy Statement 2021 v

|

Table of Contents

OUR PEOPLE

Advancing Diversity and Inclusion

Advancing Diversity and Inclusion

Clear Channel Outdoor is an equal opportunity employer and is committed to providing a work environment that is free of discrimination and harassment. We respect and embrace diversity of thought and experience and believe that a diverse workforce produces more innovative insights and solutions, resulting in better products and services for our customers. As we bring brands face-to-face with people, we believe our teams need to be as diverse in their composition and outlook as the audiences we reach every day, and we work together to create an inclusive environment where everyone can bring their true selves to work.

We have an ongoing priority to enhance diversity of our workforce and have implemented diversity and inclusion strategies across our global business. Amidst calls for sociopolitical change we have seen play out in all corners of the world, we have reinforced our commitment to our people and to promoting diversity and inclusion, as well as the need to do more to continue improving and evolving as an organization. In an effort to further promote a diverse and inclusive environment, we have launched the Executive Diversity Advisory Council in the U.S., implemented the International Fairness program in Europe and Latin America, and surveyed employees globally to gather insights on diversity and inclusion preferences to help guide and prioritize our efforts.

Commitment to Safety and Wellness

Commitment to Safety and Wellness

Safety is one of our core values, and we are committed to providing our employees with a safe workplace and prioritizing the physical and mental health and well-being of our employees. One of the ways in which we do this is by offering an Employee Assistance Program (EAP), which gives employees access to licensed professional counselors and other specialists at no cost for help with balancing work and life issues. We have also implemented an Employee Relief Fund to help employees facing financial hardship immediately after a disaster or during unanticipated and unavoidable personal emergencies.

In response to the COVID-19 pandemic, we implemented significant changes that we determined were in the best interest of our employees and the communities in which we operate and which comply with government regulations. This included transitioning the vast majority of our employees to work-from-home for a large portion of 2020, while implementing additional safety measures for employees continuing critical on-site work. In recent months, we have started to execute on our phased Return-to-Office plan on an office-by-office basis, ensuring compliance with applicable regulations as well as local health authority guidance and implementing robust safety procedures and protocols to protect our employees. Given the evolving-nature of COVID-19 developments, our Return-to-Office plan is nimble, allowing each office the flexibility to return to work-from-home directives as necessary based on local conditions.

In line with our priority of protecting the safety, health and well-being of our employees, we surveyed our employees in May 2020 to determine how we could more effectively provide support. This survey, administered by a third party, focused on the following areas: concern and connection; virtual work effectiveness; senior leadership response and communication; and employee wellness, health and safety. Utilizing the results of this survey, we developed an action plan to help our employees face the challenges of COVID-19 and remain engaged and productive, including communicating the availability of counseling under the EAP through company-wide notifications and HR portal updates, providing COVID-19 related resources on locating vaccines, work from home health tips and COVID-19 trainings, among other things, and regular communication of our progress through all-hands meetings, regional and departmental meetings and other forms of communication.

Compensation and Benefits Programs

Compensation and Benefits Programs

Our compensation and benefits programs are designed to attract and reward talented individuals who possess the skills necessary to support our business objectives, assist in the achievement of our strategic goals and create long-term value for our stockholders. We provide employees with compensation packages that include base salary and annual incentive bonuses tied to Company and division performance, in line with our pay-for-performance philosophy. Our sales employees are incentivized through sales commission programs, with our highest performing individuals further awarded through formal recognition programs. Our executives and certain other employees receive long-term equity awards that vest based on our relative total shareholder return or over a defined period. We believe

| vi Notice and Proxy Statement 2021

|

|

Table of Contents

that a compensation program with both short-term and long-term awards provides fair and competitive compensation and aligns employee and stockholder interests.

We also provide our employees and their families with access to a variety of healthcare and insurance benefits, qualified spending accounts, retirement savings plans and various other benefits.

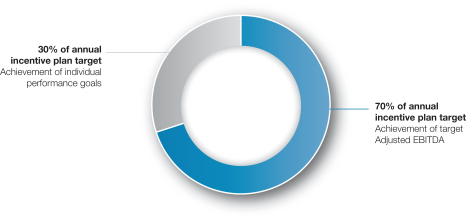

EXECUTIVE COMPENSATION HIGHLIGHTS

Our Compensation Committee, with support from our independent compensation consultant, periodically evaluates our compensation practices to ensure they support the objectives of our business, align with market practice and provide incentive to deliver key financial metrics that are explicitly linked with stockholder value creation. Certain highlights for 2020 include:

| | We continued our practice of annual incentive plan awards tied to Company and division performance and individual performance targets. |

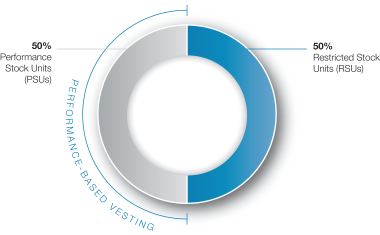

| | Our long-term incentive (LTI) program provides for annual equity awards for our executive team members made up of 50% restricted stock units and 50% performance stock units which vest based on our relative total shareholder return over a three-year period. |

| | We adopted a robust cash and equity clawback policy for current and former senior executives which applies to both cash and equity incentive compensation. |

| | We codified our executive stock ownership guidelines requiring executives to hold common stock with a value equal to a specified multiple of base salary within five years. |

| | We periodically review and updated our executive compensation peer group to consist of companies similar in size and complexity as us, companies in the media or similar industries and companies that are in competition with us for executive talent. |

|

Notice and Proxy Statement 2021 vii

|

Table of Contents

Clear Channel Outdoor Holdings, Inc.

2021 Proxy Statement

This proxy statement contains information related to the annual meeting of stockholders of Clear Channel Outdoor Holdings, Inc. (referred to herein as Clear Channel Outdoor, CCOH, Company, we, our or us) to be held on Wednesday, May 5, 2021, beginning at 9:00 a.m. Eastern Time, at www.meetingcenter.io/241105734, and at any postponements or adjournments thereof. On or about March 24, 2021, we will begin to mail to our stockholders either a notice containing instructions on how to access this proxy statement and our annual report online, or a printed copy of these proxy materials. The Company will bear the costs of preparing and mailing the proxy materials and other costs of the proxy solicitation made by the Board of Directors of Clear Channel Outdoor (the Board).

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND THE ANNUAL MEETING

| Q: | WHY AM I RECEIVING THESE MATERIALS? |

| A: | Clear Channel Outdoor is making these proxy materials available to you via the Internet or, upon your request, has delivered printed versions of these proxy materials to you by mail in connection with Clear Channel Outdoors annual meeting of stockholders (the annual meeting), which will take place on May 5, 2021. The Board is soliciting proxies to be used at the annual meeting. You also are invited to attend the annual meeting webcast and are requested to vote on the proposals described in this proxy statement. |

| Q: | WHY DID I RECEIVE A NOTICE IN THE MAIL REGARDING THE INTERNET AVAILABILITY OF PROXY MATERIALS INSTEAD OF A FULL SET OF PROXY MATERIALS? |

| A: | As permitted by Securities and Exchange Commission (SEC) rules, we are making this proxy statement and our annual report available to our stockholders electronically via the Internet. The Notice of Internet Availability of Proxy Materials contains instructions on how to access this proxy statement and our annual report and vote online. If you received a notice by mail, you will not receive a printed copy of the proxy materials in the mail. Instead, the notice instructs you on how to access and review all of the important information contained in the proxy statement and annual report. The notice also instructs you on how you may submit your proxy over the Internet or by telephone. If you received a notice by mail and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting such materials contained in the notice. |

| Q: | WHAT PROPOSALS WILL BE VOTED ON AT THE ANNUAL MEETING? |

| A: | There are four proposals scheduled to be voted on at the annual meeting: |

| | the election of the nominees for director named in this proxy statement; |

| | the approval of an advisory resolution on executive compensation; |

| | approval of the adoption of the Clear Channel Outdoor Holdings, Inc. 2012 Second Amended and Restated Equity Incentive Plan; and |

| | the ratification of the selection of Ernst & Young LLP as Clear Channel Outdoors independent registered public accounting firm for the year ending December 31, 2021. |

| Q: | WHICH OF MY SHARES MAY I VOTE? |

| A: | All shares of common stock owned by you as of the close of business on March 9, 2021 (the Record Date) may be voted by you. These shares include shares that are: (1) held directly in your name as the stockholder of record and (2) held for you as the beneficial owner through a broker, bank or other nominee. As of the Record Date, there were 467,859,064 shares of common stock outstanding. |

| Q: | WHAT IS THE DIFFERENCE BETWEEN HOLDING SHARES AS A STOCKHOLDER OF RECORD AND AS A BENEFICIAL OWNER? |

| A: | Most stockholders of Clear Channel Outdoor hold their shares through a broker, bank or other nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially. |

|

Notice and Proxy Statement 2021 1

|

Table of Contents

Stockholder of Record: If your shares are registered directly in your name with Clear Channel Outdoors transfer agent, Computershare, you are considered, with respect to those shares, the stockholder of record, and these proxy materials are being sent directly to you by Computershare on behalf of Clear Channel Outdoor. As the stockholder of record, you have the right to grant your voting proxy directly to Clear Channel Outdoor or to vote during the annual meeting.

Beneficial Owner: If your shares are held in a stock brokerage account or by a broker or other nominee, you are considered the beneficial owner of shares held in street name, and these proxy materials are being forwarded to you by your broker or nominee who is considered, with respect to those shares, the stockholder of record. As the beneficial owner, you have the right to direct your broker on how to vote and also are invited to attend the annual meeting webcast. However, since you are not the stockholder of record, you may not vote these shares during the annual meeting, unless you obtain a legal proxy from your broker, bank or other nominee giving you the right to vote the shares and register for the meeting in accordance with the instructions set forth below.

| Q: | WHAT CONSTITUTES A QUORUM? |

| A: | The holders of a majority of the total voting power of Clear Channel Outdoors common stock entitled to vote and represented in person (virtually) or by proxy will constitute a quorum at the annual meeting. Votes withheld, abstentions and broker non-votes (described below) are counted as present for purposes of establishing a quorum. |

| Q: | IF MY SHARES ARE HELD IN STREET NAME BY MY BROKER, WILL MY BROKER VOTE MY SHARES FOR ME? |

| A: | Under New York Stock Exchange (NYSE) rules, brokers have discretion to vote the shares of customers who fail to provide voting instructions on routine matters, but brokers may not vote such shares on non-routine matters without voting instructions. When a broker is not permitted to vote the shares of a customer who does not provide voting instructions, it is called a broker non-vote. If you do not provide your broker with voting instructions, your broker will not be able to vote your shares with respect to the election of directors. Your broker will send you directions on how you can instruct your broker to vote. |

As described above, if you do not provide your broker with voting instructions and the broker is not permitted to vote your shares on a proposal, a broker non-vote occurs. Broker non-votes will be counted for purposes of establishing a quorum at the annual meeting and will have no effect on the vote on any of the proposals at the annual meeting.

| Q: | HOW CAN I ATTEND THE ANNUAL MEETING? |

| A: | We are hosting the annual meeting by means of a live webcast. You will not be able to attend the meeting in person. You are entitled to participate in the annual meeting only if you were a stockholder of record of Clear Channel Outdoor as of the close of business on the record date, or if you hold a legal proxy from the record holder for the annual meeting. |

Stockholder of Record: You will be able to listen to the annual meeting, submit questions and vote by going to www.meetingcenter.io/241105734 and clicking on I have a Control Number. The password for the meeting is CCO2021.

Beneficial Owner: If you wish to attend the annual meeting, you must register in advance. See HOW DO I REGISTER TO ATTEND THE ANNUAL MEETING? below.

We encourage you to access the meeting website prior to the start time to allow ample time for check in. The virtual annual meeting will begin promptly at 9:00 a.m., Eastern Time.

| Q: | HOW DO I REGISTER TO ATTEND THE ANNUAL MEETING? |

| A: | Stockholder of Record: You do not need to register. Follow the instructions on your Notice of Internet Availability of Proxy Materials or proxy card. See HOW CAN I ATTEND THE ANNUAL MEETING? above. |

| 2 Notice and Proxy Statement 2021

|

|

Table of Contents

Beneficial Owner: If you wish to register to attend the annual meeting, you must provide our transfer agent, Computershare Trust Company, N.A. (Computershare) with your name, email address and a copy of a legal proxy from your broker, bank or other nominee reflecting your beneficial stock ownership in Clear Channel Outdoor. Registration requests must be in writing and be mailed to:

By Regular Mail

PO BOX 505000

Louisville, KY 40233-5000

UNITED STATES

By Overnight Delivery

462 South 4th Street

Suite 1600

Louisville, KY 40233-5000

UNITED STATES

Requests for registration must be labeled Legal Proxy and be received no later than 5:00 p.m., Eastern Time, on April 30, 2021. You will receive an email from Computershare acknowledging your registration along with a Control Number.

| Q: | HOW CAN I VOTE MY SHARES WITHOUT ATTENDING THE ANNUAL MEETING? |

| A: | If you are a stockholder of record, you may authorize a proxy to vote your shares. Specifically, you may authorize a proxy to vote: |

| | By InternetIf you have Internet access, you may submit your proxy by going to www.envisionreports.com/cco and following the instructions on how to complete an electronic proxy card. You will need the 16-digit number included on your notice of Internet Availability of Proxy Materials or your proxy card in order to authorize a proxy to vote by Internet. Internet voting is available until 11:59 p.m., Eastern Time, on May 4, 2021. |

| | By TelephoneIf you have access to a touch-tone telephone, you may submit your proxy by calling the telephone number specified on your Notice of Internet Availability of Proxy Materials or your proxy card and by following the recorded instructions. You will need the 16-digit number included on your Notice of Internet Availability of Proxy Materials or your proxy card in order to authorize a proxy to vote by telephone. Telephone voting is available until 11:59 p.m., Eastern Time, on May 4, 2021. |

| | By MailYou may authorize a proxy to vote by mail by requesting a proxy card from us, indicating your vote by completing, signing and dating the card where indicated and by mailing or otherwise returning the card in the envelope that will be provided to you. You should sign your name exactly as it appears on the proxy card. If you are signing in a representative capacity (for example, as guardian, executor, trustee, custodian, attorney or officer of a corporation), indicate your name and title or capacity. |

If you hold your shares in street name, you may submit voting instructions to your broker, bank or other nominee. In most instances, you will be able to do this over the Internet, by telephone or by mail. Please refer to information from your broker, bank, or other nominee on how to submit voting instructions.

| Q: | WHAT IF I RETURN MY PROXY CARD WITHOUT SPECIFYING MY VOTING CHOICES? |

| A: | If your proxy card is signed and returned without specifying choices, the shares will be voted as recommended by the Board. |

| Q: | WHAT IF I ABSTAIN FROM VOTING OR WITHHOLD MY VOTE ON A SPECIFIC PROPOSAL? |

| A: | If you withhold your vote on the election of directors, it will have no effect on the outcome of the vote on the election of directors. |

If you abstain from voting on (i) the approval of an advisory resolution on executive compensation, (ii) the approval of the adoption of the Clear Channel Outdoor Holdings, Inc. 2012 Second Amended and Restated Equity Incentive Plan, or (iii) the ratification of the selection of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2021, it will have the same effect as a vote against this proposal.

Abstentions are counted as present for purposes of determining a quorum.

|

Notice and Proxy Statement 2021 3

|

Table of Contents

| Q: | WHAT DOES IT MEAN IF I RECEIVE MORE THAN ONE NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS, PROXY CARD OR VOTING INSTRUCTION CARD? |

| A: | It means your shares are registered differently or are in more than one account. Please provide voting instructions for all notices and voting instruction cards you receive. |

| Q: | WHAT ARE CLEAR CHANNEL OUTDOORS VOTING RECOMMENDATIONS? |

| A: | The Board recommends that you vote your shares FOR: |

| | the nominees for director named in this proxy statement; |

| | the approval of an advisory resolution on executive compensation; |

| | approval of the adoption of the Clear Channel Outdoor Holdings, Inc. 2012 Second Amended and Restated Equity Incentive Plan; and |

| | the ratification of the selection of Ernst & Young LLP as Clear Channel Outdoors independent registered public accounting firm for the year ending December 31, 2021. |

| Q: | WHAT VOTE IS REQUIRED TO ELECT THE DIRECTORS AND APPROVE EACH PROPOSAL? |

| A: | The directors will be elected by a plurality of the votes properly cast. The approval of an advisory resolution on executive compensation and the ratification of the selection of Ernst & Young LLP as Clear Channel Outdoors independent registered public accounting firm for the year ending December 31, 2021 will require the affirmative vote of the holders of at least a majority of the total voting power of the voting stock present in person (virtually) or by proxy at the annual meeting and entitled to vote on the matter. |

| Q: | WHERE CAN I FIND A LIST OF STOCKHOLDERS OF RECORD ENTITLED TO VOTE AT THE ANNUAL MEETING? |

| A: | A list of stockholders of record entitled to vote at the Annual Meeting will be accessible on the virtual meeting website during the meeting for those attending the meeting, and for ten days prior to the meeting, at our corporate offices at 4830 North Loop 1604W, Suite 111, San Antonio, Texas 78249. |

| Q: | MAY I CHANGE MY VOTE OR REVOKE MY PROXY? |

| A: | If you are a stockholder of record, you may change your vote or revoke your proxy at any time before your shares are voted at the annual meeting by sending the Secretary of Clear Channel Outdoor a proxy card dated later than your last submitted proxy card, by authorizing a new proxy to vote on a later date on the Internet or by telephone (only your latest Internet or telephone proxy submitted prior to the annual meeting will be counted) notifying the Secretary of Clear Channel Outdoor in writing, or voting during the annual meeting. If your shares are held beneficially in street name, you should follow the instructions provided by your broker or other nominee to change your vote or revoke your proxy. |

| Q: | WHERE CAN I FIND THE VOTING RESULTS OF THE ANNUAL MEETING? |

| A: | Clear Channel Outdoor will announce preliminary voting results at the annual meeting and publish final results in a Current Report on Form 8-K, which we anticipate filing with the SEC by May 11, 2021. |

| Q: | MAY I ACCESS CLEAR CHANNEL OUTDOORS PROXY MATERIALS FROM THE INTERNET? |

| A: | Yes. These materials are available at www.envisionreports.com/cco. |

| 4 Notice and Proxy Statement 2021

|

|

Table of Contents

The Board of Directors and Corporate Governance

Our Board is responsible for overseeing the direction of Clear Channel Outdoor and for establishing broad corporate policies. However, in accordance with corporate legal principles, it is not involved in day-to-day operating details. Members of the Board are kept informed of Clear Channel Outdoors business through discussions with the Chief Executive Officer, the Chief Financial Officer and other executive officers, by reviewing analyses and reports sent to them, by receiving updates from Board committees and by otherwise participating in Board and committee meetings.

Our Board is currently comprised of nine directors, including C. William Eccleshare, our Chief Executive Officer, John Dionne, Lisa Hammitt, Andrew Hobson, Thomas C. King, Joe Marchese, W. Benjamin Moreland, Mary Teresa Rainey and Jinhy Yoon.

COMPOSITION OF THE BOARD OF DIRECTORS

Our Board is currently divided into three classes serving staggered three year terms. Our amended certificate of incorporation provides for a phase out of the classification of the Board. Directors elected at this annual meeting will be elected for a two-year term expiring at our 2023 annual meeting of stockholders. Directors elected at our 2022 annual meeting of stockholders will be elected for a one-year term expiring at our 2023 annual meeting of stockholders.

From and after our 2023 annual meeting of the stockholders, the Board will no longer be classified and each director will be elected for a one-year term. In case of any increase or decrease, from time to time, in the number of directors prior to our 2023 annual meeting of stockholders, other than those who may be elected by the holders of any series of preferred stock under specified circumstances, the number of directors added to or eliminated from each class will be apportioned so that the number of directors in each class thereafter shall be as nearly equal as possible, but in no case will a decrease in the number of directors constituting the Board shorten the term of any incumbent director.

In 2020, the Board held 15 meetings and also acted by written consent. All of our incumbent directors attended at least 75% of the aggregate of all meetings of the Board held during the periods in which they served during 2020. All of our incumbent directors also attended at least 75% of the aggregate of all meetings of the Board committees on which they served during 2020.

STOCKHOLDER MEETING ATTENDANCE

Clear Channel Outdoor encourages, but does not require, directors to attend the annual meeting of stockholders. All of our directors attended the annual meeting of stockholders in 2020. In 2021, Board committee meetings will be held immediately following the annual meeting.

Our Board currently consists of nine directors, one of whom currently serves as our Chief Executive Officer. For a director to be independent, the Board must determine that such director does not have any direct or indirect material relationship with Clear Channel Outdoor. Pursuant to our governance guidelines (the Governance Guidelines), the Board has undertaken its annual review of director independence.

|

Notice and Proxy Statement 2021 5

|

Table of Contents

The Board has adopted the following standards for determining the independence of its members:

| 1. A director must not be, or have been within the last three years, an employee of Clear Channel Outdoor. In addition, a directors immediate family member (immediate family member is defined to include a persons spouse, parents, children, siblings, mother and father-in-law, sons and daughters-in-law and anyone (other than domestic employees) who shares such persons home) must not be, or have been within the last three years, an executive officer of Clear Channel Outdoor.

|

||||

| 2. A director or immediate family member must not have received, during any 12 month period within the last three years, more than $120,000 in direct compensation from Clear Channel Outdoor, other than director or committee fees and pension or other forms of deferred compensation for prior service (and no such compensation may be contingent in any way on continued service).

|

||||

| 3. A director must not be a current partner or employee of a firm that is Clear Channel Outdoors internal or external auditor. In addition, a director must not have an immediate family member who is (a) a current partner of such firm or (b) a current employee of such a firm and personally works on Clear Channel Outdoors audit. Finally, neither the director nor an immediate family member of the director may have been, within the last three years, a partner or employee of such a firm and personally worked on Clear Channel Outdoors audit within that time.

|

||||

| 4. A director or an immediate family member must not be, or have been within the last three years, employed as an executive officer of another company where any of Clear Channel Outdoors present executive officers at the same time serve or served on that companys compensation committee.

|

||||

| 5. A director must not be a current employee, and no directors immediate family member may be a current executive officer, of a material relationship party (material relationship party is defined as any company that has made payments to, or received payments from, Clear Channel Outdoor for property or services in an amount which, in any of the last three fiscal years, exceeds the greater of $1 million, or 2% of such other companys consolidated gross revenues).

|

||||

| 6. A director must not own, together with ownership interests of his or her family, ten percent (10%) or more of a material relationship party.

|

||||

| 7. A director or immediate family member must not be or have been during the last three years, an executive officer of a charitable organization (or hold a similar position), to which Clear Channel Outdoor makes contributions in an amount which, in any of the last three fiscal years, exceeds the greater of $1 million, or 2% of such organizations consolidated gross revenues.

|

||||

| 8. A director must be independent as that term is defined from time to time by the rules and regulations promulgated by the SEC, by the listing standards of the NYSE and, with respect to at least two members of the compensation committee, by the applicable provisions of, and rules promulgated under, the Internal Revenue Code of 1986, as amended (collectively, the Applicable Rules). For purposes of determining independence, the Board will consider relationships with Clear Channel Outdoor and any parent or subsidiary in a consolidated group with Clear Channel Outdoor or any other company relevant to an independence determination under the Applicable Rules.

|

The above independence standards conform to, or are more exacting than, the director independence requirements of the NYSE applicable to Clear Channel Outdoor. The above independence standards are set forth on Appendix A of the Governance Guidelines.

The Board has affirmatively determined that all current directors (other than Mr. Eccleshare and Ms. Yoon) are independent under the listing standards of the NYSE, as well as Clear Channel Outdoors independence standards set forth above. In addition, the Board has determined that each member currently serving on the Compensation Committee is independent under the heightened independence standards for compensation committee members under the listing standards of the NYSE and the rules and regulations of the SEC, and that each member currently serving on the Audit Committee is independent under the heightened independence standards required for audit committee members by the listing standards of the NYSE and the rules and regulations of the SEC. In making these determinations, the Board reviewed information provided by the directors and by Clear Channel Outdoor with regard to the directors business and personal activities as they relate to Clear Channel Outdoor and its affiliates. In the ordinary course of business during 2020, Clear Channel Outdoor entered into purchase and sale transactions for

| 6 Notice and Proxy Statement 2021

|

|

Table of Contents

products and services with certain entities affiliated with members of the Board, as described below, and the following transactions were considered by the Board in making their independence determinations with respect to Mr. Dionne, Mr. Marchese, Mr. Hobson and Mr. Moreland:

| | a subsidiary of a company for which Mr. Dionne served as a director paid us approximately $1,504,313 during 2020 for outdoor advertising services; |

| | a company for which Mr. Marchese serves as a partner/co-founder paid us approximately $46,454 during 2020 for outdoor advertising services; |

| | a client of a consulting company for which Mr. Marchese serves as chief executive officer paid us approximately $79,250 during 2020 for outdoor advertising services; |

| | a company for which Mr. Marchese serves as a director paid us approximately $771,297 during 2020 for outdoor advertising services, and we made a refund to the same company in the amount of approximately $62,917; |

| | a company for which Mr. Moreland serves as a director paid us approximately $79,048 during 2020 for rental fees, and we paid that company $2,200 for rental fees; |

| | a hospital for which Mr. Moreland serves as a director paid us approximately $1.3 million during 2020 for outdoor advertising services; and |

| | a company for which Mr. Hobson serves as a director paid us $112,905 during 2020 for outdoor advertising services. |

All of the payments described above are for arms-length, ordinary course of business transactions and we generally expect transactions of a similar nature to occur during 2021. The Board has concluded that such transactions or relationships do not impair the independence of the directors.

The rules of the NYSE require that non-management or independent directors of a listed company meet periodically in executive sessions. In addition, the rules of the NYSE require listed companies to schedule an executive session including only independent directors at least once a year. Clear Channel Outdoors independent directors met separately in executive session at least one time during 2020.

The Board has three standing committees: (i) the Audit Committee, (ii) the Compensation Committee and (iii) the Nominating and Corporate Governance Committee. Each committee consists solely of independent directors and is governed by a written charter. The committee charters are available on our website at www.investor.clearchannel.com.

The table below provides membership information for each committee of the Board as of December 31, 2020:

Board Committee Membership

| Director Name | Audit Committee |

Compensation Committee |

Nominating and Corporate Governance Committee |

||||||||||||

|

C. William Eccleshare

|

|||||||||||||||

|

John Dionne

|

|

|

|||||||||||||

|

Lisa Hammitt

|

|

|

|||||||||||||

|

Andrew Hobson

|

|

||||||||||||||

|

Thomas C. King

|

|

||||||||||||||

|

Joe Marchese

|

|

|

|||||||||||||

|

W. Benjamin Moreland

|

«

|

||||||||||||||

|

Mary Teresa Rainey

|

|

|

|||||||||||||

|

Jinhy Yoon

|

|||||||||||||||

| 2020 Meetings Held

|

8

|

7

|

4

|

||||||||||||

« = Chair of the

Board

= Committee Chair

= Committee Chair

= Committee member

= Committee member

|

Notice and Proxy Statement 2021 7

|

Table of Contents

The Audit Committee

The Audit Committee consists of Andrew Hobson, Mary Teresa Rainey and John Dionne, each of whom is independent as defined under the rules of the NYSE and Rule 10A-3 of the Exchange Act. Andrew Hobson has been designated as an audit committee financial expert, as such term is defined in Item 407(d)(5) of Regulation S-K. The Audit Committee assists the Board in its oversight of the quality and integrity of the accounting, auditing and financial reporting practices of Clear Channel Outdoor. The Audit Committees primary responsibilities, which are discussed in detail within its charter, include the following:

| | be responsible for the appointment, compensation, retention and oversight of the work of the independent registered public accounting firm and any other registered public accounting firm engaged for the purpose of preparing an audit report or to perform other audit, review or attest services and all fees and other terms of their engagement; |

| | review and discuss reports regarding the independent registered public accounting firms independence; |

| | review with the independent registered public accounting firm the annual audit scope and plan; |

| | review with management, the director of internal audit and the independent registered public accounting firm the budget and staffing of the internal audit department; |

| | review and discuss with management and the independent registered public accounting firm the annual and quarterly financial statements and the specific disclosures under Managements Discussion and Analysis of Financial Condition and Results of Operations prior to the filing of the Annual Report on Form 10-K and Quarterly Reports on Form 10-Q; |

| | review with the independent registered public accounting firm the critical accounting policies and practices used; |

| | review with management, the independent registered public accounting firm and the director of internal audit Clear Channel Outdoors internal accounting controls and any significant findings and recommendations; |

| | discuss guidelines and policies with respect to risk assessment and risk management; |

| | oversee Clear Channel Outdoors policies with respect to related party transactions; and |

| | review with management and the General Counsel the status of legal and regulatory matters that may have a material impact on Clear Channel Outdoors financial statements and compliance policies. |

The full text of the Audit Committees charter can be found on our website at www.investor.clearchannel.com.

The Compensation Committee

The Compensation Committee consists of Thomas C. King, Lisa Hammitt and Joe Marchese, each of whom is independent under the rules of the NYSE and further qualifies as a non-employee director for purposes of Rule 16b-3 under the Exchange Act. The members of the Compensation Committee are not current or former employees of Clear Channel Outdoor, are not eligible to participate in any of Clear Channel Outdoors executive compensation programs, do not receive compensation that would impair their ability to make independent judgments about executive compensation, and are not affiliates of the Company, as defined under Rule 10c-1 under the Exchange Act. The Compensation Committee administers Clear Channel Outdoors incentive-compensation plans and equity-based plans, determines compensation arrangements for all executive officers and makes recommendations to the Board concerning compensation for our directors. The Compensation Discussion and Analysis section of this proxy statement provides additional details regarding the basis on which the Compensation Committee determines executive compensation.

The Compensation Committees primary purposes, which are discussed in detail within its charter, are to:

| | assist the Board in ensuring that a proper system of long-term and short-term compensation is in place to provide performance-oriented incentives to management, and that compensation plans are appropriate and competitive and properly reflect the objectives and performance of management and Clear Channel Outdoor; |

| | review and approve corporate goals and objectives relevant to the compensation of Clear Channel Outdoors executive officers, evaluate the performance of the executive officers in light of those goals and objectives and, either as a committee or together with the other independent directors (as directed by the Board), determine and approve the compensation level of the executive officers based on this evaluation; |

| 8 Notice and Proxy Statement 2021

|

|

Table of Contents

| | review and adopt, and/or make recommendations to the Board with respect to, incentive-compensation plans for executive officers and equity-based plans; |

| | review and discuss with management the Compensation Discussion and Analysis to be included in Clear Channel Outdoors proxy statement and determine whether to recommend to the Board the inclusion of the Compensation Discussion and Analysis in the proxy statement; |

| | prepare the Compensation Committee report for inclusion in Clear Channel Outdoors proxy statement; and |

| | recommend to the Board the appropriate compensation for the non-employee members of the Board. |

The Compensation Committee has the ability, under its charter, to select and retain, at the expense of Clear Channel Outdoor, independent legal and financial counsel and other consultants necessary to assist the Compensation Committee as the Compensation Committee may deem appropriate, in its sole discretion. The Compensation Committee also has the authority to select and retain any compensation consultant to be used to survey the compensation practices in Clear Channel Outdoors industry and to provide advice so that Clear Channel Outdoor can maintain its competitive ability to recruit and retain highly qualified personnel. The Compensation Committee has the sole authority to approve related fees and retention terms for any of its counsel and consultants.

During 2020, the Compensation Committee engaged an independent compensation consultant, Willis Towers Watson (Willis), to provide executive compensation benchmarking data, and incentive and retention compensation design advice. The Compensation Committee requested and evaluated responses from Willis addressing its independence in accordance with applicable NYSE rules and concluded that Willis work does not raise any conflict of interest or independence concerns.

The full text of the Compensation Committees charter can be found on our website at www.investor.clearchannel.com.

The Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee consists of Mary Teresa Rainey, Joe Marchese, Lisa Hammitt and John Dionne, each of whom is independent under the rules of the NYSE. The Nominating and Corporate Governance Committees primary responsibilities, which are discussed in detail within its charter, include the following:

| | identify individuals qualified to become members of the Board, consistent with criteria approved by the Board; |

| | recommend director nominees to the Board for the next annual meeting of stockholders; |

| | oversee the organization of the Board to discharge the Boards duties and responsibilities properly and efficiently; |

| | develop and recommend corporate governance guidelines; |

| | oversee the evaluation of the Board and management; and |

| | oversee, review with management and report to the Board on the Companys environmental, social and governance (ESG) strategy, policies and practices in order to manage risk, lay a foundation for sustainable growth and effectively communicate ESG initiatives to stakeholders. |

The full text of the Nominating and Corporate Governance Committees charter can be found on our website at www.investor.clearchannel.com.

DIRECTOR NOMINATING PROCEDURES

The Nominating and Corporate Governance Committee is responsible for identifying individuals qualified to become Board members, developing qualification standards and other criteria for selecting nominees and reviewing background information for candidates for the Board, including those recommended by stockholders. The Nominating and Corporate Governance Committee believes that all directors must, at a minimum, meet the criteria set forth in the Corporate Governance Guidelines, which specify, among other things, that the Board of the Company seeks members from diverse professional backgrounds who combine a broad spectrum of experience and expertise with a reputation for integrity. The Board strives to nominate directors with a variety of complementary skills so that, as a group, the Board will possess the appropriate mix of experience, skills and expertise to oversee the Companys businesses. Directors should: (i) have experience in positions with a high degree of responsibility; (ii) be leaders in the organizations with which they are affiliated; (iii) have the time, energy, interest and willingness to serve as a member of the Board; and (iv) be selected based upon contributions they can make to the Board and management. Our directors play a critical role in guiding our strategic direction and overseeing our management. The Nominating and Corporate Governance Committee evaluates each individual in the context of the Board as a whole, with the objective of recommending a group that can best perpetuate the success of our business and represent stockholder interests through the exercise of sound judgment using its

|

Notice and Proxy Statement 2021 9

|

Table of Contents

diversity of experience. The Nominating and Corporate Governance Committee evaluates each incumbent director to determine whether he or she should be nominated to stand for re-election, based on the types of criteria outlined above as well as the directors contributions to the Board during their current term.

The Nominating and Corporate Governance Committee will consider as potential nominees individuals properly recommended by stockholders. Recommendations concerning individuals proposed for consideration should be addressed to the Board, c/o Secretary, Clear Channel Outdoor Holdings, Inc., 4830 North Loop 1604W, Suite 111, San Antonio, Texas 78249. Each recommendation should include a personal biography of the suggested nominee, an indication of the background or experience that qualifies the person for consideration and a statement that the person has agreed to serve if nominated and elected. The Board evaluates candidates recommended by stockholders in the same manner in which it evaluates other nominees. Stockholders who themselves wish to effectively nominate a person for election to the Board, as contrasted with recommending a potential nominee to the Board for its consideration, are required to comply with the advance notice and other requirements set forth in our bylaws.

The Board exercises its discretion in combining or separating the position of chair and CEO as it deems appropriate in light of prevailing circumstances. Mr. Eccleshare currently serves as our CEO and Mr. Moreland currently serves as our independent Chair of the Board. The CEO is responsible for the strategic direction, day-to-day leadership and performance of the Company, while the Chair of the Board provides overall leadership to our Board. The leadership structure allows the CEO to focus on his operational responsibilities, while keeping a measure of independence between the oversight function of our Board and those operating decisions. Our Board believes that this leadership structure provides an appropriate allocation of roles and responsibilities and is in the best interests of stockholders at this time.

Our Board conducts an annual self-evaluation process to determine whether the Board, its committees and the directors are functioning effectively. This includes survey materials as well as individual, private conversations between directors and the Chair, as needed, and a report to, and discussion of survey results with, the Nominating and Corporate Governance Committee and the full Board. The survey materials solicit feedback on organizational issues, business strategy and financial matters, board structure and meeting administration. The directors use discussions with the Chair and the Board to provide feedback, identify themes for the Board to consider, suggest specific action steps and review Board agendas. In addition, focus areas identified through the evaluation are incorporated into the Boards agenda for the following year to monitor progress. Annually, the Nominating and Corporate Governance Committee reviews progress against focus areas identified in the self-evaluation. Each committee also conducts its own annual self-evaluation to assess the functioning of the committee and the effectiveness of the committee members, including the committee chair.

| 10 Notice and Proxy Statement 2021

|

|

Table of Contents

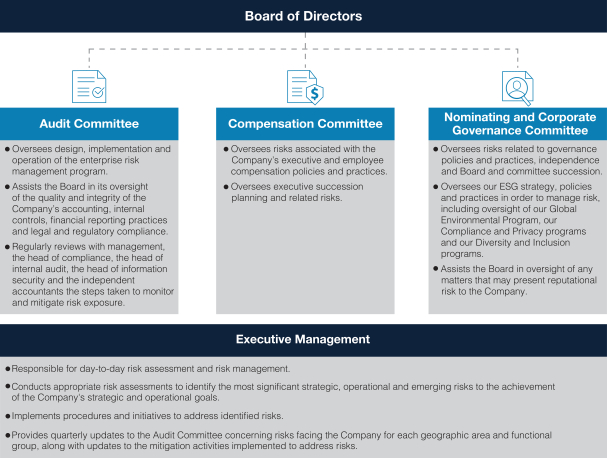

Our Board has overall responsibility for the oversight of our enterprise risk management process, which is guided by the COSO Enterprise Risk Management Framework three lines of defense model, including operational management as the First Line of Defense, Compliance and Information Security as the Second Line of Defense, and Internal and External Audit as the Third Line of Defense. The Board encourages management to promote a corporate culture that incorporates risk management into our corporate strategy and day-to-day operations. Our risk management philosophy strives to:

| | timely identify the material risks that we face; |

| | communicate necessary information with respect to material risks to senior management and, as appropriate, to the Board or relevant Board committee; |

| | implement appropriate and responsive risk management strategies consistent with our risk profile; and |

| | integrate risk management into our decision-making. |

The Board has designated the Audit Committee to broadly oversee risk management in accordance with our Audit Committee Charter. Under the oversight of the Audit Committee, and with the support of the compliance function and the internal and external audit functions, we operate an enterprise-wide risk management governance framework that sets standards and provides guidance for the identification, assessment, monitoring and control of the most significant risks facing the Company and that have the potential to affect stockholder value, our customers and colleagues, the communities in which we operate and the safety and soundness of the Company. The Audit Committee reports to the Board regarding briefings provided by management and advisors, as well as the Audit Committees own analysis and conclusions regarding the adequacy of our risk management processes.

The Board also exercises its oversight with support from the Compensation Committee and the Nominating and Corporate Governance Committee, each of which has oversight responsibilities for risks that may fall within their area of responsibility and expertise. The Board receives independent reports from each committee at its meetings.

|

Notice and Proxy Statement 2021 11

|

Table of Contents

The Boards oversight of risk management requires close interaction between the full Board, each of the committees and executive management. The Companys risk oversight framework and key areas of responsibility are illustrated below:

At least annually, the Compensation Committee reviews the Companys talent management and succession plan, including with respect to Chief Executive Officer and other executive positions. This includes the review and evaluation of development plans for potential successors to the Chief Executive Officer role and other key positions. Developing talent at all levels is a priority for the Company. We are focused on providing the Board with additional opportunities to interact with senior management, including providing informal feedback sessions where directors meet with groups of senior management below the executive level, which gives management unique access to the Board and also facilitates a deeper understanding of the organization by the Board. The Company also offers various talent development programs throughout the organization focused on building leadership and management skills, career development and other areas.

Our corporate governance practices are established and monitored by the Board. The Board, with assistance from its Nominating and Corporate Governance Committee, periodically assesses our governance practices in light of legal requirements and governance best practices.

Our primary governing documents include:

| | Governance Guidelines |

| | Board Committee Charters |

| ○ | Audit Committee Charter |

| ○ | Compensation Committee Charter |

| ○ | Nominating and Corporate Governance Committee Charter |

| | Code of Business Conduct and Ethics |

| 12 Notice and Proxy Statement 2021

|

|

Table of Contents

These documents are available on our website at www.investor.clearchannel.com. We encourage our stockholders to read these documents, as we believe they illustrate our commitment to good governance practices. Certain key provisions of these documents are summarized below.

We operate under Governance Guidelines that set forth our corporate governance principles and practices on a variety of topics, including director qualifications, the responsibilities of the Board, independence requirements and the composition and functioning of the Board. Our Governance Guidelines are designed to maximize long-term stockholder value, align the interests of the Board and management with those of our stockholders and promote high ethical conduct among our directors. The Governance Guidelines include the following key practices to assist the Board in carrying out its responsibility for the business and affairs of Clear Channel Outdoor:

| 1. | Director Responsibilities

|

|

| The basic responsibility of a director is to exercise his or her business judgment and act in what he or she reasonably believes to be in the best interests of Clear Channel Outdoor and its stockholders. Directors are expected to attend Board meetings and meetings of committees on which they serve, and to spend the time needed and meet as frequently as necessary to properly discharge their responsibilities. | ||

|

||

| 2. | Self-Evaluation Process

|

|

| The Board and each standing committee of the Board will conduct an annual self-evaluation to determine whether it and its committees are functioning effectively. The Nominating and Corporate Governance Committee is responsible for overseeing the self-evaluation process and for proposing any modification or alterations in Board or committee practices or procedures. | ||

|

||

| 3. | Executive Sessions of Non-Management Directors

|

|

| The non-management directors and/or the independent directors meet periodically in executive session without management participation. | ||

|

||

| 4. | Board Access to Senior Management

|

|

| Directors have complete access to Clear Channel Outdoors management, employees and its independent advisors and can initiate contact or meetings through the CEO or any other executive officer. | ||

|

||

| 5. | Board Access to Independent Advisors

|

|

| The Board and each Board committee have the power to retain independent legal, financial or other advisors as they may deem necessary, at our expense. | ||

|

||

| 6. | Board Tenure

|

|

| The Board believes that term limits on director service and a predetermined retirement age impose arbitrary restrictions on Board membership. Instead, the Board believes directors who, over a period of time, develop an insight into Clear Channel Outdoor and its operations provide an increasing contribution to Clear Channel Outdoor as a whole. The annual board performance evaluation is a primary determinant for Board tenure. | ||

|

||

| 7. | Directors Who Change Their Current Job Responsibilities

|

|

| A director who changes the nature of the job he or she held when he or she was elected to the Board shall promptly notify the Board of the change. This does not mean that such director should necessarily leave the Board. There should, however, be an opportunity for the Board to review the continued appropriateness of Board membership under these circumstances. | ||

|

||

| 8. | Service on Multiple Boards

|

|

| To enable the Board to assess a directors effectiveness and any potential conflicts of interest, any director who serves on more than three other public company boards must advise the Chair in advance of accepting an invitation to serve as a member of another public company board. | ||

|

||

| 9. | Management Development and Succession Planning

|

|

| The Board or a committee of the Board will periodically consider management development and succession planning, including short-term succession planning for certain of Clear Channel Outdoors most senior management positions. |

|

Notice and Proxy Statement 2021 13

|

Table of Contents

Each standing committee of the Board operates under a written charter that has been adopted by the Board. We have three standing committees: the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee. The committee charters set forth the purpose, responsibilities of the respective committee and discuss matters such as committee membership requirements, number of meetings and the setting of meeting agendas. The charters are assessed at least every other year, or more frequently as the applicable committee may determine, and are updated as needed. More information on the committees, their respective roles and responsibilities and their charters can be found under The Board of Directors and Corporate GovernanceCommittees of the Board.

CODE OF BUSINESS CONDUCT AND ETHICS

Business Conduct and Ethics (the Code of Conduct) applies to all of our officers, directors and employees, including our principal executive officer, principal financial officer and principal accounting officer. Our Code of Conduct constitutes a code of ethics as defined by Item 406(b) of Regulation S-K. Our Code of Conduct is publicly available on our website at www.investor.clearchannel.com. We intend to satisfy the disclosure requirements of Item 5.05 of Form 8-K regarding any amendment to, or waiver from, a provision of the Code of Conduct that applies to our principal executive officer, principal financial officer or principal accounting officer and relates to any element of the definition of code of ethics set forth in Item 406(b) of Regulation S-K by posting such information on our website, www.investor.clearchannel.com.

STOCKHOLDER AND INTERESTED PARTY COMMUNICATION WITH THE BOARD

Stockholders and other interested parties may contact an individual director, the Chair, the Board as a group or a specified Board committee or group, including the non-management directors as a group, by sending regular mail to the following address:

Board of Directors

c/o Secretary

Clear Channel Outdoor Holdings, Inc.

4830 North Loop 1604W, Suite 111

San Antonio, Texas 78249

| 14 Notice and Proxy Statement 2021

|

|

Table of Contents

Security Ownership of Certain Beneficial Owners and Management

Except as otherwise stated, the table below sets forth information concerning the beneficial ownership of Clear Channel Outdoors common stock as of March 9, 2021 for: (1) each director currently serving on our Board and each of the nominees for director; (2) each of our named executive officers; (3) our directors and executive officers as a group; and (4) each person known to Clear Channel Outdoor to beneficially own more than 5% of any class of Clear Channel Outdoors outstanding shares of common stock. At the close of business on March 9, 2021, there were 467,859,064 shares of Clear Channel Outdoors common stock outstanding. Except as otherwise noted, each stockholder has sole voting and investment power with respect to the shares beneficially owned.

Each share of Clear Channel Outdoor common stock is entitled to one vote on matters submitted to a vote of the stockholders. Each share of our common stock is entitled to share equally on a per share basis in any dividends and distributions by us.

| Name and Address of Beneficial Owner(a) |

Number of Shares of Common Stock |

Percent of Common Stock(b) |

||||||

| Holders of More than 5%: |

||||||||

| PIMCO(c) |

104,258,819 | 22.4 | % | |||||

| Ares Management(d) |

36,999,772 | 7.9 | % | |||||

| The Vanguard Group(e) |

30,977,587 | 6.6 | % | |||||

| Mason Capital Management LLC(f) |

30,364,927 | 6.5 | % | |||||

| Named Executive Officers, Executive Officers and Directors: |

|

|||||||

| C. William Eccleshare(g) |

2,418,253 | * | ||||||

| Brian D. Coleman(h) |

425,342 | * | ||||||

| Scott R. Wells(i) |

1,295,564 | * | ||||||

| Lynn A. Feldman(j) |

357,344 | * | ||||||

| Jason A. Dilger(k) |

136,532 | * | ||||||

| John Dionne(l) |

163,163 | * | ||||||

| Lisa Hammitt(m) |

115,369 | * | ||||||

| Andrew Hobson(n) |

315,369 | * | ||||||

| Thomas King(o) |

173,992 | * | ||||||

| Joe Marchese(p) |

186,963 | * | ||||||

| W. Benjamin Moreland(q) |

1,012,117 | * | ||||||

| Mary Teresa Rainey(r) |

115,369 | * | ||||||

| Jinhy Yoon |

| | ||||||

| All directors and executive officers as a group (13 individuals)(s) |

6,715,377 | * | ||||||

| * | Means less than 1%. |

| (a) | Unless otherwise indicated, the address for all beneficial owners is c/o Clear Channel Outdoor Holdings, Inc., 4830 North Loop 1604W, Suite 111, San Antonio, Texas 78249. |

| (b) | Percentage of ownership calculated in accordance with Rule 13d-3(d)(1) under the Securities Exchange Act. |

| (c) | As reported on a Schedule 13D/A filed on August 2, 2019. The shares of Clear Channel Outdoors common stock reported in the Schedule 13D/A may be deemed to be beneficially owned by one or more of the following persons: PIMCO Income Fund (the Income Fund), Global Investors Series plc (Global Income Fund) and Pacific Investment Management Company LLC (PIMCO). The address of the principal business office of PIMCO is 650 Newport Center Drive, Newport Beach, California 92660. |

| (d) | As reported on Schedule 13D/A filed on January 21, 2021, 36,999,772 shares of Clear Channel Outdoors common stock reported in the Schedule 13D/A may be deemed owned by one or more of the following persons: ASSF IV AIV B Holdings III, L.P., ASSF IV AIV B, L.P., ASSF Operating Manager IV, L.P., ASOF Holdings I, L.P., ASOF Investment Management LLC, Ares Management LLC, Ares Management Holdings L.P., Ares Holdco LLC, Ares Holdings Inc., Ares Management Corporation, Ares Voting LLC, Ares Management GP LLC and Ares Partners |

|

Notice and Proxy Statement 2021 15

|

Table of Contents

| Holdco LLC. The business address of each reporting person is c/o Ares Management LLC, 2000 Avenue of the Stars, 12th Floor, Los Angeles, California 90067. |

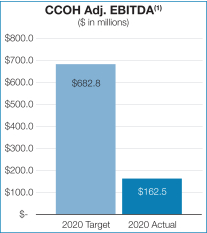

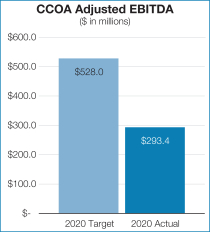

| (e) | As reported on a Schedule 13G/A filed with respect to Clear Channel Outdoors common stock on February 10, 2021. The shares of Clear Channel Outdoors common stock reported in the Schedule 13G/A may be deemed to be owned by one or more of The Vanguard Group, Inc. and its wholly owned subsidiaries, Vanguard Asset Management, Limited, Vanguard Fiduciary Trust Company, Vanguard Global Advisors, LLC, Vanguard Group (Ireland) Limited, Vanguard Investments Australia Ltd, Vanguard Investments Canada Inc., Vanguard Investments Hong Kong Limited and Vanguard Investments UK, Limited. The business address of each reporting person is 100 Vanguard Blvd., Malvern, Pennsylvania 19355. |