DEF 14A: Definitive proxy statements

Published on March 16, 2023

Table of Contents

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to §240.14a-12

|

|

| ☒ | No fee required | |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

|

|||

Table of Contents

Table of Contents

|

|

A LETTER FROM OUR CEO AND INDEPENDENT CHAIR OF OUR BOARD

|

|

Dear Fellow Stockholders:

On behalf of the Board of Directors of Clear Channel Outdoor Holdings, Inc. (“Clear Channel Outdoor”), it is our pleasure to invite you to our annual meeting of stockholders (the “Annual Meeting”).

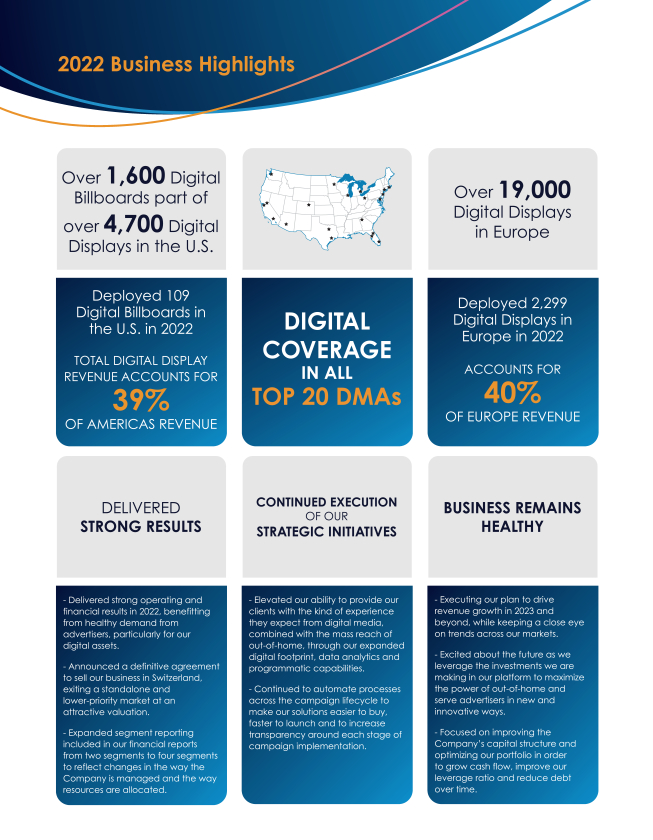

2022 was our first year together as a leadership team, and we continued to build on our strong foundation as a business. While 2022 brought its own share of challenges, including significant impacts from movements in foreign exchange rates, it was also a year of strong performance and progress on our strategic plan. Healthy demand from advertisers helped us continue to rebound from the COVID-19 pandemic, with strong results led by our digital assets in the Americas and Europe. As we look to the future, we are focused on executing our digital transformation and our efforts to innovate and modernize how we do business. We are working to expand our digital footprint and give our customers the kind of experience they expect from digital media, which we believe will help us grow now and in the future.

Even as we look ahead, we will keep a close eye on business and macroeconomic trends to ensure we are appropriately positioning our business today. Our response to the pandemic demonstrated our ability to manage costs and ensure we have ample liquidity on our balance sheet, and we will continue to leverage these skills as economic conditions require. With the support of our Board of Directors and talented team of employees, we remain focused on pursuing our ongoing priorities of revenue expansion, strengthening our balance sheet, free cash flow generation and investments in profitable growth.

Thank you for your continued support and confidence in Clear Channel Outdoor. We hope you will join us for our Annual Meeting webcast on May 3, 2023.

Sincerely,

|

|

|

|

| Scott R. Wells | W. Benjamin Moreland | |

| Chief Executive Officer and Director | Chair of the Board of Directors |

|

|

Table of Contents

NOTICE OF

2023

ANNUAL

MEETING OF

STOCKHOLDERS

AND

PROXY

STATEMENT

Wednesday, May 3, 2023

9 a.m. Eastern Time

CLEAR CHANNEL OUTDOOR HOLDINGS, INC.

4830 North Loop 1604W, Suite 111

San Antonio, Texas 78249

As a stockholder of Clear Channel Outdoor Holdings, Inc. (“Clear Channel Outdoor”), you are hereby given notice that the Annual Meeting of stockholders of Clear Channel Outdoor will be held by means of a live webcast, at meetnow.global/MTUQGHX, on May 3, 2023 at 9 a.m. Eastern Time for the following purposes:

| 1. | to elect nine nominees to serve as directors for a one-year term; |

| 2. | to approve an advisory resolution on executive compensation; |

| 3. | to approve an advisory vote on the frequency of future advisory votes on executive compensation; |

| 4. | to ratify the selection of Ernst & Young LLP as the independent registered public accounting firm of Clear Channel Outdoor for the year ending December 31, 2023; and |

| 5. | to transact any other business that may properly come before the meeting or any adjournment or postponement thereof. |

Only stockholders of record at the close of business on March 7, 2023 are entitled to notice of, and to vote at, the Annual Meeting.

If you plan to attend the Annual Meeting, please follow the voting and registration instructions set forth in the accompanying proxy statement (the “Proxy Statement”).

Your attention is directed to the accompanying Proxy Statement. In addition, although mere participation in the Annual Meeting will not revoke your proxy, if you participate in the Annual Meeting webcast, you may revoke your proxy and vote during the meeting. To ensure that your shares are represented at the Annual Meeting, please submit your vote by Internet, telephone or mail, whether or not you plan to attend the Annual Meeting.

By Order of the Board of Directors:

Lynn A. Feldman

Executive Vice President, Chief Legal Officer & Corporate Secretary

San Antonio, Texas

March 16, 2023

|

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF

The Proxy Statement and Annual Report are available at:

|

Table of Contents

TABLE OF CONTENTS

|

Notice and Proxy Statement 2023

|

Table of Contents

| Notice and Proxy Statement 2023

|

|

Table of Contents

Proxy Statement Summary

This summary highlights information you will find in this Proxy Statement. As it is only a summary, please review the complete Proxy Statement before you vote.

2023 Annual Meeting Information

|

|

|

|

|||

| Date and Time: Wednesday, May 3, 2023 at 9 a.m. Eastern Time |

Location: meetnow.global/MTUQGHX |

Record Date: March 7, 2023 |

Proxy Mail Date: On or about March 22, 2023 |

HOW TO VOTE

|

By Internet: Visit the website listed on your proxy card |

By Phone: Call the telephone number on your proxy card |

By Mail: Sign, date and return your proxy card in the enclosed envelope

|

During the Annual Meeting: Participate in the Annual Meeting webcast

|

| Voting: | Each share of Clear Channel Outdoor common stock is entitled to one vote for each director nominee and one vote for each of the other proposals to be voted on. | |

| Admission: | Admission to the Annual Meeting is limited to stockholders as of March 7, 2023 (the “Record Date”). If you plan to attend the Annual Meeting, please follow the registration instructions set forth in this Proxy Statement. | |

ANNUAL MEETING AGENDA AND VOTE RECOMMENDATIONS

| Matter

|

Board Vote Recommendation |

Page Reference (for more details) |

||||

| Proposal 1 | Election of Directors |

FOR

|

20 | |||

| Proposal 2 | Advisory Resolution on Executive Compensation |

FOR

|

74 | |||

| Proposal 3 |

Advisory Vote on the Future of Advisory Votes on Executive Compensation

|

ONE YEAR | 75 | |||

| Proposal 4 |

Ratification of the selection of Ernst & Young LLP as the independent registered public accounting firm for the year ending December 31, 2023

|

FOR | 76 |

In this Proxy Statement, “we”, “our”, “us”, “CCOH”, “Clear Channel Outdoor” and the “Company” refer to Clear Channel Outdoor Holdings, Inc., and the “Annual Meeting” refers to the 2023 Annual Meeting of Stockholders. We will begin mailing this Proxy Statement and form of proxy card to stockholders on or about March 22, 2023.

Table of Contents

| ii Notice and Proxy Statement 2023

|

|

Table of Contents

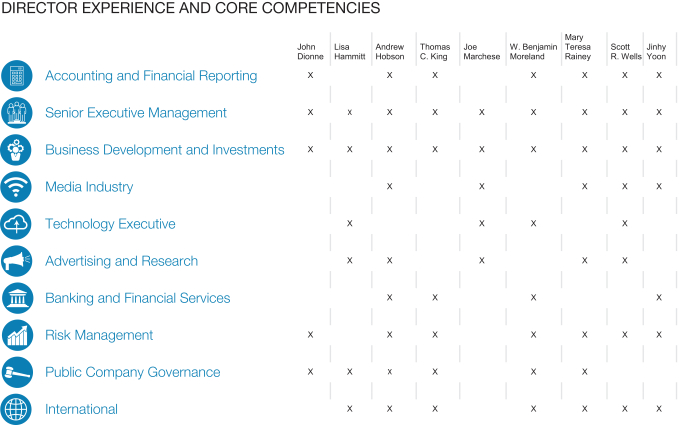

DIRECTOR NOMINEES

Below is information about each of our director nominees, as of March 7, 2023:

| Name |

Age | Most Recent Experience(s) |

Independent Director |

Committee Memberships |

||||||||

| John Dionne |

59 | Senior Advisor at Blackstone Group, L.P. | ✓ | AC, NCGC | ||||||||

| Lisa Hammitt |

60 | Former Executive Vice President, Artificial Intelligence and Chief Technology Officer at Davidson Technologies | ✓ | CC, NCGC | ||||||||

| Andrew Hobson |

61 | Partner and Chief Financial Officer at Innovatus Capital Partners, LLC | ✓ | AC | ||||||||

| Thomas C. King |

62 | Operating Partner at Atlas Merchant Capital | ✓ | CC | ||||||||

| Joe Marchese |

41 | Co-Founder and Executive Chairman of Human Ventures | ✓ | CC, NCGC | ||||||||

| W. Benjamin Moreland « |

59 | Private investor and retired Chief Executive Officer at Crown Castel International Corp. | ✓ | None | ||||||||

| Mary Teresa Rainey |

67 | Founder of Rainey, Kelly Campbell Roalfe/48R | ✓ | AC, NCGC | ||||||||

| Scott R. Wells |

54 | Chief Executive Officer at Clear Channel Outdoor | None | |||||||||

| Jinhy Yoon |

50 | Executive Vice President, Credit Research at PIMCO | None | |||||||||

« = Chair of the Board

AC = Audit Committee

CC = Compensation Committee

NCGC = Nominating and Corporate Governance Committee

CORPORATE GOVERNANCE HIGHLIGHTS

The Board of Directors (the “Board”) of Clear Channel Outdoor believes that good governance is key to achieving long-term stockholder value and that the Company’s long-term success requires the Company’s commitment to a robust framework of guidelines and practices that serve the best interests of the Company and all of our stockholders. Below are some key highlights of our corporate governance framework:

| Board Practices

✓ 7 out of 9 of our directors are independent.

✓ The Board is led by an independent, non-executive Chair.

✓ All of our directors are elected annually.

✓ All members of our Audit, Compensation and Nominating and Corporate Governance Committees are independent as defined by the NYSE listing standards and applicable SEC rules.

✓ Each Board committee operates under a written charter that has been approved by the Board and is reviewed and, if necessary, amended annually.

✓ The Board conducts periodic executive sessions, where non-executive and independent directors meet without management.

✓ The Nominating and Corporate Governance Committee oversees an annual self-evaluation process for the Board and each standing committee of the Board and is responsible for proposing any modification or alterations to Board or committee practices or procedures. |

Compensation Practices

✓ Robust annual risk assessment of executive compensation programs, policies and practices.

✓ Comprehensive cash and equity claw-back policy for senior executives.

✓ Significant stock ownership requirements for senior executives and directors.

Stockholder Matters

✓ Robust stockholder engagement.

✓ Annual Say-on-Pay voting.

Other Governance Practices

✓ Our Code of Business Conduct and Ethics, which applies to all Clear Channel Outdoor employees, as well as our executive officers and our directors, reinforces our core values and helps drive our workplace culture of compliance with ethical standards, integrity and accountability.

✓ We have made a strong commitment to Corporate Social Responsibility and strengthening the Company’s Environmental, Social and Governance (“ESG”) program. For more details, please see “Corporate Social Responsibility and Environmental, Social and Governance Initiatives“ in this Proxy Statement and our 2022 ESG Report, which is available on our website at www.investor.clearchannel.com. |

|

|

Notice and Proxy Statement 2023 iii

|

Table of Contents

CORPORATE SOCIAL RESPONSIBILITY AND ENVIRONMENTAL, SOCIAL AND GOVERNANCE INITIATIVES

Our Board and management team are committed to making a difference in the communities we serve. We are united across our business units by the common purpose of “creating a better world through our people-powered platform”. Together, we strive to improve the communities in which we operate through innovation, dedication and good governance.

ESG is integrated across CCOH’s strategic and operational endeavors. The ultimate responsibility and oversight for the Company’s ESG initiatives lies with the Board’s Nominating and Corporate Governance Committee. In addition, the Board’s Audit Committee oversees risk, including climate-related, HR, compliance, privacy and information security risks, and the Board’s Compensation Committee oversees our human capital management initiatives. On an operational level, CCOH’s legal and compliance business functions report directly to the Board and its standing committees on ESG matters and compliance initiatives. Further, the Global Compliance Office coordinates regional ESG Programs with executive oversight, and senior leaders in divisional governance committees oversee local ESG programs across the Company.

In December 2022, Clear Channel Outdoor published its most recent ESG Report (the “2022 ESG Report”), which details how we strive to behave ethically and responsibly as a company, an employer and a business partner and how we endeavor to use our resources and products to drive meaningful change in the communities in which we operate. For more information on our ESG policies, practices, initiatives and accomplishments, please see our 2022 ESG Report, which is available at www.investor.clearchannel.com. None of our 2022 ESG Report, our websites or the information included therein is a part of, or incorporated by reference into, this Proxy Statement.

Some of our ESG highlights to date include:

|

Environmental |

Social |

Governance |

||

| • Group-wide commitment to become Carbon Net Zero by 2050, with certain business units on track to achieve this target across direct emissions (Scope 1 and Scope 2) by 2030;

• Measuring our carbon emissions across the Company to help track our progress against our Carbon Net Zero target;

• Publishing our global Environmental Policy in 2022, which describes the commitments of our environmental program;

• Conducting life cycle assessments of key products by engaging environmental consultants to evaluate the environmental impact of our products and production processes;

• Requiring environmental contractual obligations and environmental impact assessments for certain suppliers in our supply chain; and

• Developing and implementing an environmental strategy that includes both a company-wide Environmental Policy and environmental program

|

• Continuing our efforts on diversity and inclusion (“D&I”) with regular D&I training and by establishing D&I committees across all of our regions;

• Establishing regional and local engagement programs to increase and support diversity across CCOH, including:

(i) the Executive Diversity Advisory Council in the U.S., which is sponsored by executive management and works to advance CCOA’s D&I efforts with respect to the workforce, workplace and local communities;

(ii) Clear Channel UK’s People with Disabilities Crew, which promotes and supports disabled talent, and Culture Crew, which celebrates and highlights diverse ethical and cultural backgrounds; and

(iii) Implementing employee surveys across multiple regions and business units to gather insights on diversity and inclusion |

• Annual Board and committee self-evaluations;

• Board led by an independent, non-executive Chair;

• Annual election of all of CCOH’s directors;

• Periodic executive sessions of non-management and/or independent directors;

• Fully independent Audit, Compensation and Nominating and Corporate Governance Committees, as defined by NYSE listing standards and applicable SEC rules;

• Service on more than three public boards or audit committees subject to notifying the Chairman of the Board prior to accepting a new public board position to ensure effectiveness and minimize potential conflict of interests;

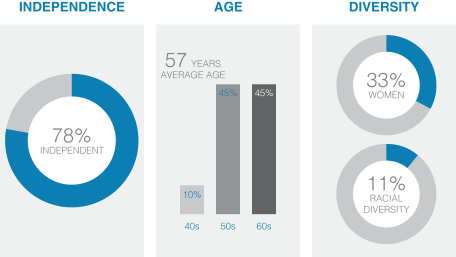

• Diversity of ages of directors (41-67 years old);

• Approximately 33% of CCOH’s directors are female and |

| iv Notice and Proxy Statement 2023

|

|

Table of Contents

| and targets, as well as environmental initiatives tailored to specific regions by specific business units. Select examples include:

• Up to 98% of Clear Channel Outdoor Americas’ (“CCOA”) digital billboards components are estimated as recyclable. CCOA has converted 99% of all metal halide and fluorescent fixtures in its billboards to more energy-efficient LED lighting.

• In 2022, Clear Channel United Kingdom purchased all electricity for use in its premises and street furniture from 100% renewable sources.

• Clear Channel Europe has agreed to contract with renewable energy providers in all new energy contracts (from 2021 onward).

• Clear Channel Europe has introduced hybrid and electric vehicles in key fleets.

• Clear Channel Europe has developed auto-dimming backlights to dim and turn off the backlights on displays to reduce power consumption in digital assets during quiet periods. |

preferences and to help guide and prioritize our efforts;

• Seeking to support efforts to increase social and racial justice and equality by providing free media space and charitable contributions and engaging in collaborations with charity partners;

• Helping local and national governments and nongovernmental organizations to make public safety announcements, including in response to COVID-19 and the war in Ukraine;

• Adopting our Supplier Code of Conduct and implementing contractual clauses used across our business, requiring key suppliers to operate at a high ethical standard;

• Establishing policies on nondiscriminatory compensation and hiring practices that prohibit discriminatory employee reward decisions based on an employee’s intersectionality (e.g., gender, race, class, caste, sexuality, religion, disability or physical appearance);

• Adopting a Global Human Rights Policy that details our position on human rights, with annual trainings required for all employees;

• Working to promote the health and safety of our employees, including our field workers, by developing safety programs and systems that are regularly inspected and independently audited; and

• Seeking to improve the mental health of our employees with mental health programs across our regions, including our Mental Health Allies program.

|

approximately 11% of CCOH’s directors are racially diverse;

• Annual Say-On-Pay voting;

• Focusing on data privacy and cybersecurity through impact assessments and cybersecurity programs and policies, auditing and annual cyber security awareness training, all overseen by our dedicated Privacy Office (including a European/UK Chief Data Protection Officer) and cybersecurity teams; and

• Robust internal governance program for employees, executives and directors, underpinning our Code of Business Conduct and Ethics with mandatory regular training, due diligence and risk management programs tailored to each division and a global anti-corruption and sanctions program, all supported by an independent whistleblowing hotline. |

|

Notice and Proxy Statement 2023 v

|

Table of Contents

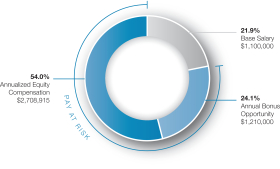

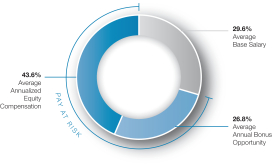

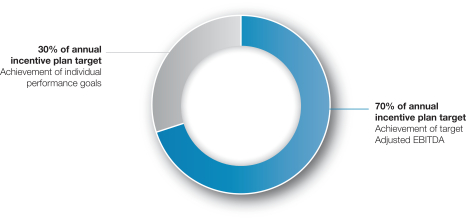

EXECUTIVE COMPENSATION HIGHLIGHTS

Our Compensation Committee, with support from our independent compensation consultant, periodically evaluates our compensation practices to ensure that they support the objectives of our business, align with market practices and provide incentive to deliver key financial metrics that are explicitly linked with stockholder value creation. Certain highlights for 2022 include:

| • | We continued our practice of annual incentive plan awards tied to Company, division and individual performance goals. |

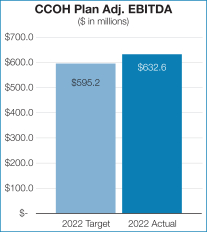

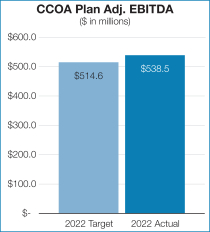

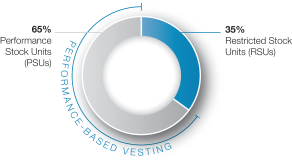

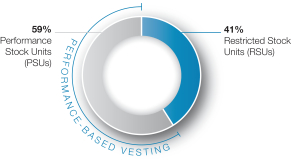

| • | Our long-term incentive (“LTI”) program provides for annual equity awards for our executive team members. The program varies by role and consisted of 38% restricted stock units (RSUs) and 62% performance stock units (PSUs) on average in the May 2022 grants. The RSUs are designed to promote retention, while the PSUs provide alignment to shareholders by tying payout to relative total shareholder return over a three-year period. |

| • | The compensation determinations for our named executive officers (NEOs) for 2022 reflect the strong overall performance of Clear Channel Outdoor and the contributions of our leaders to driving the year’s successes. Our NEOs earned payouts between 115% and 118% of their individual target opportunities as a result of strong business and individual performance. |

| • | In connection with his transition to Chief Executive Officer, Mr. Scott R. Wells received a base salary increase and a one-time grant of RSUs related to his senior leadership transition in early 2022. |

| • | The Company entered into amended and restated employment agreements with Mr. Jason A. Dilger and Ms. Lynn A. Feldman. In connection with these agreements, Mr. Dilger’s base salary was increased retroactive to October 1, 2021 and Ms. Feldman’s base salary was increased effective November 1, 2022. |

| vi Notice and Proxy Statement 2023

|

|

Table of Contents

Clear Channel Outdoor Holdings, Inc.

2023 Proxy Statement

This Proxy Statement contains information related to the Annual Meeting of Clear Channel Outdoor to be held on Wednesday, May 3, 2023, beginning at 9 a.m. Eastern Time, at meetnow.global/MTUQGHX, and at any postponements or adjournments thereof. On or about March 22, 2023, we will begin to mail to our stockholders either a notice containing instructions on how to access this Proxy Statement and our annual report online or a printed copy of these proxy materials. The Company will bear the costs of preparing and mailing the proxy materials and other costs of the proxy solicitation made by the Board.

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND THE ANNUAL MEETING

| Q: | WHY AM I RECEIVING THESE MATERIALS? |

| A: | Clear Channel Outdoor is making these proxy materials available to you via the Internet or, upon your request, has delivered printed versions of these proxy materials to you by mail in connection with Clear Channel Outdoor’s Annual Meeting, which will take place on May 3, 2023. The Board is soliciting proxies to be used at the Annual Meeting. You also are invited to attend the Annual Meeting webcast and are requested to vote on the proposals described in this Proxy Statement. |

| Q: | WHY DID I RECEIVE A NOTICE IN THE MAIL REGARDING THE INTERNET AVAILABILITY OF PROXY MATERIALS INSTEAD OF A FULL SET OF PHYSICAL PROXY MATERIALS? |

| A: | As permitted by U.S. Securities and Exchange Commission (“SEC”) rules, we are making this Proxy Statement and our annual report available to our stockholders electronically via the Internet. The Notice of Internet Availability of Proxy Materials contains instructions on how to access this Proxy Statement and our annual report and how to vote online. If you received a notice by mail, you will not receive a printed copy of the proxy materials in the mail. Instead, the notice instructs you on how to access and review all of the important information contained in the Proxy Statement and annual report via the Internet. The notice also instructs you on how you may submit your proxy via the Internet or by telephone. If you received a notice by mail and would like to receive a printed copy of our proxy materials, please follow the instructions for requesting such materials contained in the notice. |

| Q: | WHAT PROPOSALS WILL BE VOTED ON AT THE ANNUAL MEETING? |

| A: | There are four proposals scheduled to be voted on at the Annual Meeting: |

| • | the election of the nominees for director named in this Proxy Statement; |

| • | the approval of an advisory resolution on executive compensation; |

| • | the approval of an advisory vote on the frequency of future advisory votes on executive compensation; and |

| • | the ratification of the selection of Ernst & Young LLP as Clear Channel Outdoor’s independent registered public accounting firm for the year ending December 31, 2023. |

| Q: | WHICH OF MY SHARES MAY I VOTE? |

| A: | All shares of common stock owned by you as of the close of business on the Record Date may be voted by you. These shares include shares that are: (i) held directly in your name as the stockholder of record and (ii) held for you as the beneficial owner through a broker, bank or other nominee. As of the Record Date, there were 477,438,803 shares of common stock outstanding. |

| Q: | WHAT IS THE DIFFERENCE BETWEEN HOLDING SHARES AS A STOCKHOLDER OF RECORD AND AS A BENEFICIAL OWNER? |

| A: | Most stockholders of Clear Channel Outdoor hold their shares through a broker, bank or other nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially. |

|

Notice and Proxy Statement 2023 1

|

Table of Contents

Stockholder of Record: If your shares are registered directly in your name with Clear Channel Outdoor’s transfer agent, Computershare Trust Company, N.A. (“Computershare”), you are considered, with respect to those shares, the stockholder of record, and these proxy materials are being sent directly to you by Computershare on behalf of Clear Channel Outdoor. As the stockholder of record, you have the right to grant your voting proxy directly to Clear Channel Outdoor or to vote during the Annual Meeting.

Beneficial Owner: If your shares are held in a stock brokerage account or by a broker or other nominee, you are considered the beneficial owner of shares held in “street name”, and these proxy materials are being forwarded to you by your broker or nominee who is considered, with respect to those shares, the stockholder of record. As the beneficial owner, you have the right to direct your broker on how to vote and are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote these shares during the Annual Meeting, unless you obtain a legal proxy from your broker, bank or other nominee giving you the right to vote the shares and register for the meeting in accordance with the instructions set forth below.

| Q: | WHAT CONSTITUTES A QUORUM? |

| A: | The holders of a majority of the total voting power of Clear Channel Outdoor’s common stock entitled to vote and represented in person (virtually) or by proxy will constitute a quorum at the Annual Meeting. Votes “withheld”, abstentions and “broker non-votes” (as described below) are counted as present for purposes of establishing a quorum. |

| Q: | IF MY SHARES ARE HELD IN “STREET NAME” BY MY BROKER, WILL MY BROKER VOTE MY SHARES FOR ME? |

| A: | Under New York Stock Exchange (“NYSE”) rules, brokers have discretion to vote the shares of customers who fail to provide voting instructions on “routine matters”, but brokers may not vote such shares on “non-routine matters” without voting instructions. When a broker is not permitted to vote the shares of a customer who does not provide voting instructions, it is called a “broker non-vote”. If you do not provide your broker with voting instructions, your broker will not be able to vote your shares with respect to the election of directors, the advisory vote on executive compensation or the advisory vote on the frequency of future advisory votes on executive compensation. Your broker will send you directions on how you can instruct your broker to vote. Broker non-votes will be counted for purposes of establishing a quorum at the Annual Meeting and will have no effect on the vote on any of the proposals at the Annual Meeting. |

| Q: | HOW CAN I ATTEND THE ANNUAL MEETING? |

| A: | We are hosting the Annual Meeting by means of a live webcast to enable attendance by a large number of stockholders and to embrace the latest technology to provide ease of access, real-time communication and cost savings for us and our stockholders. Hosting a virtual meeting makes it easier for our stockholders to participate from any location around the world and provides those of our stockholders who would otherwise not be able to attend the meeting the opportunity to do so. You will not be able to attend the meeting in person. You are entitled to participate in the Annual Meeting only if you were a stockholder of record of Clear Channel Outdoor as of the close of business on the Record Date or if you hold a legal proxy from the record holder for the Annual Meeting. |

Stockholder of Record: You will be able to listen to the Annual Meeting, submit questions and vote by going to meetnow.global/MTUQGHX and logging in using your control number found on your Notice of Internet Availability of Proxy Materials or proxy card.

Beneficial Owner: If you wish to attend the Annual Meeting, you must register in advance. See “HOW DO I REGISTER TO ATTEND THE ANNUAL MEETING?” below.

We encourage you to access the meeting website prior to the start time to allow ample time for check in. The virtual Annual Meeting will begin promptly at 9 a.m. Eastern Time.

| Q: | HOW DO I REGISTER TO ATTEND THE ANNUAL MEETING? |

| A: | Stockholder of Record: You do not need to register. Follow the instructions on your Notice of Internet Availability of Proxy Materials or proxy card. See “HOW CAN I ATTEND THE ANNUAL MEETING?” above. |

| 2 Notice and Proxy Statement 2023

|

|

Table of Contents

Beneficial Owner: If you hold your shares through an intermediary, such as a bank or broker, you must register in advance to attend the Annual Meeting virtually on the Internet.

To register to attend the Annual Meeting online by webcast you must submit proof of your proxy power (legal proxy) reflecting your Clear Channel Outdoor holdings along with your name and email address to Computershare. Requests for registration must be labeled as “Legal Proxy” and be received no later than 5:00 p.m. Eastern Time on April 28, 2023. You will receive a confirmation of your registration by email after we receive your registration materials.

Requests for registration should be directed to us at the following:

By email: Forward the email from your broker, or attach an image of your legal proxy, to legalproxy@computershare.com

By mail:

Computershare

COMPANY Legal Proxy

P.O. Box 43001

Providence, RI 02940-3001

| Q: | HOW CAN I PARTICIPATE IN THE VIRTUAL ANNUAL MEETING? |

| A: | If you are a stockholder as of the Record Date and have logged in using your control number, you may submit a question at any point during the meeting (until the floor is closed to questions) by typing your question on the Q&A tab and clicking “Send”. Shareholder questions or comments are welcome, but we will only answer questions pertinent to Annual Meeting matters, subject to time constraints. Questions regarding personal matters and statements of advocacy are not pertinent to Annual Meeting matters and therefore will not be addressed. Questions or comments that are substantially similar may be grouped and answered together to avoid repetition. Rules of Conduct applicable to the Annual Meeting will be accessible on the virtual meeting website during the Annual Meeting. The audio broadcast of the Annual Meeting will be archived at https://edge.media-server.com/mmc/p/sgou94gj for at least one year. |

| Q: | WHAT IF I RUN INTO TECHNICAL ISSUES WHILE TRYING TO ACCESS THE ANNUAL MEETING? |

| A: | The virtual meeting platform is supported across browsers and devices running the most updated version of applicable software and plug-ins. Participants should give themselves plenty of time to log in and ensure that they have a strong internet connection and that they can hear streaming audio prior to the start of the Annual Meeting. |

If you encounter technical difficulties with the virtual meeting platform on the Annual Meeting day, please call the technical support number that will be posted on the Annual Meeting website. Technical support will be available starting at 8:45 a.m. Eastern Time and until the end of the Annual Meeting.

| Q: | HOW CAN I VOTE MY SHARES WITHOUT ATTENDING THE ANNUAL MEETING? |

| A: | If you are a stockholder of record, you may authorize a proxy to vote your shares. Specifically, you may authorize a proxy to vote: |

| • | By Internet: If you have Internet access, you may submit your proxy by going to www.envisionreports.com/cco and following the instructions on how to complete an electronic proxy card. You will need the control number included on your Notice of Internet Availability of Proxy Materials or your proxy card in order to authorize a proxy to vote by Internet. Internet voting is available until 11:59 p.m. Eastern Time on May 2, 2023. |

| • | By Telephone: If you have access to a touch-tone telephone, you may submit your proxy by calling the telephone number specified on your Notice of Internet Availability of Proxy Materials or your proxy card and by following the recorded instructions. You will need the control number included on your Notice of Internet Availability of Proxy Materials or your proxy card in order to authorize a proxy to vote by telephone. Telephone voting is available until 11:59 p.m. Eastern Time on May 2, 2023. |

| • | By Mail: You may authorize a proxy to vote by mail by requesting a proxy card from us, indicating your vote by completing, signing and dating the proxy card where indicated on the proxy card and by mailing or otherwise |

|

Notice and Proxy Statement 2023 3

|

Table of Contents

| returning the proxy card in the envelope that will be provided to you therewith. You should sign your name exactly as it appears on the proxy card. If you are signing in a representative capacity (for example, as guardian, executor, trustee, custodian, attorney or officer of a corporation), please indicate your name and title or capacity. |

If you hold your shares in street name, you may submit voting instructions to your broker, bank or other nominee. In most instances, you will be able to do this over the Internet, by telephone or by mail. Please refer to information from your broker, bank or other nominee on how to submit voting instructions.

| Q: | WHAT IF I RETURN MY PROXY CARD WITHOUT SPECIFYING MY VOTING CHOICES? |

| A: | If your proxy card is signed and returned without specifying choices, the shares will be voted as recommended by the Board. |

| Q: | WHAT IF I WITHHOLD MY VOTE, ABSTAIN FROM VOTING OR THERE ARE BROKER NON-VOTES ON A SPECIFIC PROPOSAL? |

| A: | If you withhold your vote on the election of directors, it will have no effect on the outcome of the vote on the election of directors. |

If you abstain from voting on the advisory vote on the frequency of future advisory votes on executive compensation, it will have no effect on the outcome of the vote on that proposal.

If you abstain from voting on (i) the approval of an advisory resolution on executive compensation or (ii) the ratification of the selection of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2023, it will have the same effect as a vote “against” these proposals.

Broker non-votes will have no effect on the vote on any of the proposals at the Annual Meeting.

Abstentions and broker non-votes are counted as present for purposes of determining a quorum.

| Q: | WHAT DOES IT MEAN IF I RECEIVE MORE THAN ONE NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS, PROXY CARD OR VOTING INSTRUCTION CARD? |

| A: | It means that your shares are registered differently or are in more than one account. Please provide voting instructions for all notices, proxy cards and voting instruction cards you receive. |

| Q: | WHAT ARE THE VOTING RECOMMENDATIONS OF THE BOARD OF CLEAR CHANNEL OUTDOOR? |

| A: | The Board recommends that you vote your shares “FOR”: |

| • | the nominees for director named in this Proxy Statement; |

| • | the approval of the advisory resolution on executive compensation; and |

| • | the ratification of the selection of Ernst & Young LLP as Clear Channel Outdoor’s independent registered public accounting firm for the year ending December 31, 2023. |

The Board also recommends that you vote “ONE YEAR” with respect to the advisory vote on the frequency of future advisory votes on executive compensation.

| Q: | WHAT VOTE IS REQUIRED TO ELECT THE DIRECTORS AND APPROVE EACH PROPOSAL? |

| A: | The directors will be elected by a plurality of the votes properly cast. This means that the director nominees receiving the highest number of “FOR” votes will be elected as directors. The approval of an advisory resolution on executive compensation and the ratification of the selection of Ernst & Young LLP as Clear Channel Outdoor’s independent registered public accounting firm for the year ending December 31, 2023 will require the affirmative vote of the holders of at least a majority of the total voting power of the voting stock present in person (virtually) or by proxy at the Annual Meeting and entitled to vote on the matter. With respect to the advisory vote on the frequency of future advisory votes on executive compensation, the Board will consider the frequency that receives the highest number of votes to be the frequency selected by our stockholders, regardless of whether that frequency receives a majority of the votes cast. |

| 4 Notice and Proxy Statement 2023

|

|

Table of Contents

| Q: | WHAT HAPPENS IF A NOMINEE FOR DIRECTOR IS UNABLE TO STAND FOR ELECTION DUE TO UNFORESEEN CIRCUMSTANCES? |

| A: | If you vote by proxy and unforeseen circumstances make it necessary for the Board to substitute another person for a nominee, the designated proxy will vote your shares for that other person. |

| Q: | WHERE CAN I FIND A LIST OF STOCKHOLDERS OF RECORD ENTITLED TO VOTE AT THE ANNUAL MEETING? |

| A: | A list of stockholders of record entitled to vote at the Annual Meeting will be accessible on the virtual meeting website during the Annual Meeting for those attending the Annual Meeting and, additionally, for ten days prior to the Annual Meeting, at our corporate offices at 4830 North Loop 1604W, Suite 111, San Antonio, Texas 78249. |

| Q: | MAY I CHANGE MY VOTE OR REVOKE MY PROXY? |

| A: | If you are a stockholder of record, you may change your vote or revoke your proxy at any time before your shares are voted at the Annual Meeting by (i) mailing a proxy card dated later than your last submitted proxy card, (ii) authorizing a new proxy to vote on a later date on the Internet or by telephone (it being understood that only your latest Internet or telephone proxy submitted prior to the Annual Meeting will be counted), (iii) notifying the Corporate Secretary of Clear Channel Outdoor in writing or (iv) voting during the Annual Meeting. If your shares are held beneficially in “street name”, you should follow the instructions provided by your broker, bank or other nominee to change your vote or revoke your proxy. |

| Q: | WHERE CAN I FIND THE VOTING RESULTS OF THE ANNUAL MEETING? |

| A: | Clear Channel Outdoor will announce preliminary voting results at the Annual Meeting and will then publish final results in a Current Report on Form 8-K, which we anticipate filing with the SEC by May 9, 2023. |

| Q: | MAY I ACCESS CLEAR CHANNEL OUTDOOR’S PROXY MATERIALS FROM THE INTERNET? |

| A: | Yes. These materials are available at www.envisionreports.com/cco. |

| Q: | WILL THE ANNUAL MEETING BE RECORDED? |

| A: | A replay of the meeting will be made available at www.envisionreports.com/cco. |

|

Notice and Proxy Statement 2023 5

|

Table of Contents

The Board of Directors and Corporate Governance

Our Board is responsible for overseeing the direction of Clear Channel Outdoor and for establishing broad corporate policies. In accordance with corporate legal principles, our Board is not involved in day-to-day operating activities of the Company. Members of the Board are kept informed of Clear Channel Outdoor’s business through discussions with the Company’s Chief Executive Officer, Chief Financial Officer and other executive officers, by reviewing analyses and reports sent to them, by receiving updates from Board committees and by otherwise participating in Board and committee meetings.

COMPOSITION OF THE BOARD OF DIRECTORS

Our Board is currently comprised of nine directors: W. Benjamin Moreland (our Chair), Scott R. Wells (our Chief Executive Officer), John Dionne, Lisa Hammitt, Andrew Hobson, Thomas C. King, Joe Marchese, Mary Teresa Rainey and Jinhy Yoon. Directors elected at this Annual Meeting will be elected for a one-year term expiring at our 2024 annual meeting of stockholders.

BOARD MEETINGS

In 2022, the Board held eight meetings and also acted by written consent. All of our incumbent directors attended more than 93% of the aggregate of all meetings of the Board and the committees of the Board on which they served during 2022.

STOCKHOLDER MEETING ATTENDANCE

Clear Channel Outdoor encourages, but does not require, its directors to attend the Annual Meeting of stockholders. All of our directors attended the annual meeting of stockholders in 2022.

INDEPENDENCE OF DIRECTORS

Our Board currently consists of nine directors, one of whom currently serves as our Chief Executive Officer. For a director to be independent, the Board must determine that such director does not have any direct or indirect material relationship with Clear Channel Outdoor. Pursuant to our governance guidelines (the “Governance Guidelines”), the Board has undertaken its annual review of director independence.

The Board has adopted the following standards for determining the independence of its members:

| 1. A director must not be, or have been within the last three years, an employee of Clear Channel Outdoor. In addition, a director’s immediate family member (“immediate family member” is defined to include a person’s spouse, parents, children, siblings, mother- and father-in-law, sons- and daughters-in-law and anyone (other than domestic employees) who shares such person’s home) must not be, or have been within the last three years, an executive officer of Clear Channel Outdoor.

|

||||

|

2. A director or immediate family member must not have received, during any twelve-month period within the last three years, more than $120,000 in direct compensation from Clear Channel Outdoor, other than director or committee fees and pension or other forms of deferred compensation for prior service (and no such compensation may be contingent in any way on continued service).

|

||||

|

3. A director must not be a current partner or employee of a firm that is Clear Channel Outdoor’s internal or external auditor. In addition, a director must not have an immediate family member who is (a) a current partner of such firm or (b) a current employee of such a firm and personally works on Clear Channel Outdoor’s audit. Finally, neither the director nor an immediate family member of the director may have been, within the last three years, a partner or employee of such a firm and personally worked on Clear Channel Outdoor’s audit within that time.

|

||||

|

4. A director or an immediate family member must not be, or have been within the last three years, employed as an executive officer of another company where any of Clear Channel Outdoor’s present executive officers at the same time serve or served on that company’s compensation committee.

|

| 6 Notice and Proxy Statement 2023

|

|

Table of Contents

|

5. A director must not be a current employee, and no director’s immediate family member may be a current executive officer, of a material relationship party (“material relationship party” is defined as any company that has made payments to, or received payments from, Clear Channel Outdoor for property or services in an amount that, in any of the last three fiscal years, exceeds the greater of $1,000,000 or 2% of such other company’s consolidated gross revenues).

|

||||

|

6. A director must not own, together with ownership interests of his or her family, ten percent (10%) or more of a material relationship party.

|

||||

|

7. A director or immediate family member must not be, or have been during the last three years, an executive officer of a charitable organization (or hold a similar position), to which Clear Channel Outdoor makes contributions in an amount that, in any of the last three fiscal years, exceeds the greater of $1,000,000 or 2% of such organization’s consolidated gross revenues.

|

||||

|

8. A director must be “independent” as that term is defined from time to time by the rules and regulations promulgated by the SEC, by the listing standards of the NYSE and, with respect to at least two members of the compensation committee, by the applicable provisions of, and rules promulgated under, the Internal Revenue Code of 1986, as amended (collectively, the “Applicable Rules”). For purposes of determining independence, the Board will consider relationships with Clear Channel Outdoor and any parent or subsidiary in a consolidated group with Clear Channel Outdoor or any other company relevant to an independence determination under the Applicable Rules.

|

The above independence standards conform to, or are more exacting than, the director independence requirements of the NYSE applicable to Clear Channel Outdoor. The above independence standards are set forth on Appendix A of the Governance Guidelines.

The Board has affirmatively determined that all current directors (other than Mr. Wells and Ms. Yoon) are independent under the listing standards of the NYSE, as well as Clear Channel Outdoor’s independence standards set forth above. In addition, the Board has determined that each member currently serving on the Compensation Committee and on the Audit Committee is independent under the heightened independence standards for compensation or audit committee members under the listing standards of the NYSE and the rules and regulations of the SEC, as applicable. In making these determinations, the Board reviewed information provided by the directors and by Clear Channel Outdoor with regard to the directors’ business and personal activities as they relate to Clear Channel Outdoor and its affiliates.

In the ordinary course of business during 2022, Clear Channel Outdoor entered into purchase and sale transactions for products and services and other ordinary course transactions with certain entities affiliated with members of the Board as described below, and the following transactions were considered by the Board in making their independence determinations with respect to Mses. Hammitt and Yoon and Messrs. Hobson, King, Marchese and Moreland:

| • | a subsidiary of a company for which Mses. Hammitt and Yoon serve as chairwoman and director, respectively, paid us approximately $48,206 during 2022 for outdoor advertising services; |

| • | a family member of Ms. Hammitt is employed by a company, which paid us approximately $47,482 during 2022 for outdoor advertising services; |

| • | a company for which Mr. Hobson serves as chairman of the board of directors paid us $12,845 during 2022 for outdoor advertising services; |

| • | a company for which Mr. King serves as a director paid us approximately $188,489 during 2022 for outdoor advertising services; |

| • | a company for which Mr. Marchese serves as a director paid us approximately $1,102,691 during 2022 for outdoor advertising services; |

| • | a client of a company for which Mr. Marchese serves as the chief executive officer paid us approximately $3,960 during 2022 for outdoor advertising services; |

| • | two charitable organizations with which Mr. Marchese is affiliated paid us approximately $3,221 and $90,000, respectively, during 2022 for outdoor advertising services; |

| • | a company for which Mr. Moreland serves as a director paid us approximately $97,099 during 2022 for ordinary course easements, and we paid that company approximately $2,400 for ordinary course site leases; and |

| • | a hospital system for which Mr. Moreland serves as a director paid us approximately $1,352,797 during 2022 for outdoor advertising services. |

|

Notice and Proxy Statement 2023 7

|

Table of Contents

All of the payments described above were for arms-length, ordinary course of business transactions, and we expect transactions of a similar nature to occur during 2023. The Board has concluded that such transactions or relationships do not impair the independence of Mses. Hammitt and Yoon and Messrs. Hobson, King, Marchese and Moreland.

The rules of the NYSE require that non-management or independent directors of a listed company meet periodically in executive sessions. In addition, the rules of the NYSE require listed companies to schedule an executive session including only independent directors at least once a year. Clear Channel Outdoor’s independent directors met separately in executive session at least one time during 2022. Mr. Moreland, the independent Chair of the Board, presides over all such executive sessions.

COMMITTEES OF THE BOARD

The Board has three standing committees: (i) the Audit Committee, (ii) the Compensation Committee and (iii) the Nominating and Corporate Governance Committee. Each committee consists solely of independent directors and is governed by a written charter. The committee charters are available on our website at www.investor.clearchannel.com.

The table below provides membership information for each committee of the Board as of March 7, 2023:

Board Committee Membership

| Director Name | Audit Committee |

Compensation Committee |

Nominating and Corporate Governance Committee |

||||||||||||

|

Scott R. Wells

|

|||||||||||||||

|

John Dionne

|

|

|

|||||||||||||

|

Lisa Hammitt

|

|

|

|||||||||||||

|

Andrew Hobson

|

|

||||||||||||||

|

Thomas C. King

|

|

||||||||||||||

|

Joe Marchese

|

|

|

|||||||||||||

|

W. Benjamin Moreland «

|

|||||||||||||||

|

Mary Teresa Rainey

|

|

|

|||||||||||||

|

Jinhy Yoon

|

|||||||||||||||

| Meetings Held in 2022

|

5

|

7

|

4

|

||||||||||||

« = Chair of the Board

= Committee Chair

= Committee Chair

= Committee member

= Committee member

The Audit Committee

The Audit Committee consists of Andrew Hobson, Mary Teresa Rainey and John Dionne, each of whom is independent as defined under the rules of the NYSE and Rule 10A-3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Mr. Hobson has been designated as an “audit committee financial expert”, as such term is defined in Item 407(d)(5) of Regulation S-K. The Audit Committee assists the Board in its oversight of the quality and integrity of the accounting, auditing and financial reporting practices of Clear Channel Outdoor. The Audit Committee’s primary responsibilities, which are discussed in detail within its charter, include the following:

| • | be responsible for the appointment, compensation, retention and oversight of the work of the independent registered public accounting firm and any other registered public accounting firm engaged for the purpose of preparing an audit report or to perform other audit, review or attest services and all fees and other terms of their engagement; |

| 8 Notice and Proxy Statement 2023

|

|

Table of Contents

| • | review and discuss reports regarding the independent registered public accounting firm’s independence; |

| • | review with the independent registered public accounting firm the annual audit scope and plan; |

| • | review with management, the director of internal audit and the independent registered public accounting firm the budget and staffing of the internal audit department; |

| • | review and discuss with management and the independent registered public accounting firm the annual and quarterly financial statements and the specific disclosures under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” prior to the filing of the Annual Report on Form 10-K and Quarterly Reports on Form 10-Q; |

| • | review with the independent registered public accounting firm the critical accounting policies and practices used; |

| • | review with management, the independent registered public accounting firm and the director of internal audit Clear Channel Outdoor’s internal accounting controls and any significant findings and recommendations; |

| • | discuss guidelines and policies with respect to risk assessment and risk management; |

| • | oversee Clear Channel Outdoor’s policies with respect to related party transactions; |

| • | prepare the Audit Committee report for inclusion in Clear Channel Outdoor’s annual proxy statement; |

| • | review information technology procedures and controls, including as they relate to data privacy and cyber-security; and |

| • | review with management and the Chief Legal Officer the status of legal and regulatory matters that may have a material impact on Clear Channel Outdoor’s financial statements and compliance policies. |

The full text of the Audit Committee’s charter can be found on our website at www.investor.clearchannel.com.

The Compensation Committee

The Compensation Committee consists of Thomas C. King, Lisa Hammitt and Joe Marchese, each of whom is independent under the rules of the NYSE and further qualifies as a non-employee director for purposes of Rule 16b-3 under the Exchange Act. The members of the Compensation Committee are not current or former employees of Clear Channel Outdoor, are not eligible to participate in any of Clear Channel Outdoor’s executive compensation programs, do not receive compensation that would impair their ability to make independent judgments about executive compensation and are not “affiliates” of the Company, as defined under Rule 10C-1 under the Exchange Act. The Compensation Committee administers Clear Channel Outdoor’s incentive-compensation plans and equity-based plans, determines compensation arrangements for all executive officers and makes recommendations to the Board concerning compensation for our directors. The Compensation Discussion and Analysis section of this Proxy Statement provides additional details regarding the basis on which the Compensation Committee determines executive compensation. The Compensation Committee’s primary responsibilities, which are discussed in detail within its charter, include the following:

| • | assist the Board in ensuring that a proper system of long-term and short-term compensation is in place to provide performance-oriented incentives to management and that compensation plans are appropriate and competitive and properly reflect the objectives and performance of management and Clear Channel Outdoor; |

| • | review and approve corporate goals and objectives relevant to the compensation of Clear Channel Outdoor’s executive officers, evaluate the performance of the executive officers in light of those goals and objectives and, either as a committee or together with the other independent directors (as directed by the Board), determine and approve the compensation level of the executive officers based on this evaluation; |

| • | review and adopt, and/or make recommendations to the Board with respect to, incentive-compensation plans for executive officers and equity-based plans; |

|

Notice and Proxy Statement 2023 9

|

Table of Contents

| • | review and discuss with management the Compensation Discussion and Analysis to be included in Clear Channel Outdoor’s annual proxy statement and determine whether to recommend to the Board the inclusion of the Compensation Discussion and Analysis in the annual Proxy Statement; |

| • | prepare the Compensation Committee report for inclusion in Clear Channel Outdoor’s annual proxy statement; |

| • | review and make recommendations about the Company’s strategies, policies and procedures with respect to human capital management; and |

| • | recommend to the Board the appropriate compensation for the non-employee members of the Board. |

The Compensation Committee has the ability, under its charter, to select and retain, in its sole discretion, at the expense of Clear Channel Outdoor, independent legal and financial counsel and other consultants necessary to assist the Compensation Committee. The Compensation Committee also has the authority to select and retain any compensation consultant to be used to survey the compensation practices in Clear Channel Outdoor’s industry and to provide advice so that Clear Channel Outdoor can maintain its competitive ability to recruit and retain highly qualified personnel. The Compensation Committee has the sole authority to approve related fees and retention terms for any of its counsel and consultants.

During 2022, the Compensation Committee engaged an independent compensation consultant, Willis Towers Watson (“WTW”), to provide executive compensation benchmarking data and incentive and retention compensation plan design advice. The Compensation Committee requested and evaluated responses from WTW addressing its independence in accordance with applicable NYSE rules and concluded that WTW’s work does not raise any conflict of interest or independence concerns.

The full text of the Compensation Committee’s charter can be found on our website at www.investor.clearchannel.com.

The Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee consists of Mary Teresa Rainey, Joe Marchese, Lisa Hammitt and John Dionne, each of whom is independent under the rules of the NYSE. The Nominating and Corporate Governance Committee’s primary responsibilities, which are discussed in detail within its charter, include the following:

| • | identify individuals qualified to become members of the Board, consistent with criteria approved by the Board; |

| • | recommend director nominees to the Board for the next annual meeting of stockholders; |

| • | oversee the organization of the Board to discharge the Board’s duties and responsibilities properly and efficiently; |

| • | develop and recommend corporate governance guidelines; |

| • | oversee the evaluation of the Board and management; and |

| • | oversee, review with management and report to the Board on the Company’s ESG policies and practices in order to manage risk, lay a foundation for sustainable growth and effectively communicate ESG initiatives to stakeholders. |

The full text of the Nominating and Corporate Governance Committee’s charter can be found on our website at www.investor.clearchannel.com.

DIRECTOR NOMINATING PROCEDURES

The Nominating and Corporate Governance Committee is responsible for identifying individuals qualified to become Board members, developing qualification standards and other criteria for selecting Board member nominees and reviewing background information for candidates for the Board, including those recommended by stockholders. The Nominating and Corporate Governance Committee believes that all Board members must, at a minimum, meet the criteria set forth in the Governance Guidelines, which specify, among other things, that the Board seeks members from

| 10 Notice and Proxy Statement 2023

|

|

Table of Contents

diverse professional backgrounds who combine a broad spectrum of experience and expertise with a reputation for integrity. While we do not have a formal policy on diversity, when considering the selection of director nominees, the Nominating and Corporate Governance Committee considers individuals with diverse viewpoints, accomplishments, cultural backgrounds, professional expertise and diversity in gender, ethnicity, race, skills and geographic representation that, when considered as a group, provide a sufficient mix of perspectives to allow the Board to best fulfill its responsibilities to and, advocate for the long-term interests of, our shareholders. Furthermore, our Board is committed to include qualified women and individuals from underrepresented minority groups in any pool for selection of new candidates for the Board in case the size of the Board were increased or as a result of a vacancy. The Board strives to nominate directors with a variety of complementary skills such that, as a group, the Board will possess the appropriate mix of experience, skills and expertise to oversee the Company’s businesses. Directors must: (i) have experience in positions with a high degree of responsibility; (ii) be leaders in the organizations with whom they are affiliated; (iii) have the time, energy, interest and willingness to serve as a member of the Board; and (iv) be selected based upon contributions they can make to the Board and management. Members of our Board play a critical role in guiding our strategic direction and overseeing our management. The Nominating and Corporate Governance Committee evaluates each individual in the context of the Board as a whole, with the objective of recommending a group that can best perpetuate the success of our business and represent stockholder interests through the exercise of sound judgment and using its diversity of experience. The Nominating and Corporate Governance Committee evaluates each incumbent director to determine whether she or he should be nominated to stand for reelection based on the types of criteria outlined above as well as the director’s contributions to the Board during their current term.

The Nominating and Corporate Governance Committee will consider as potential nominees individuals properly recommended by stockholders. Recommendations concerning individuals proposed for consideration should be addressed to the Board, c/o Corporate Secretary, Clear Channel Outdoor Holdings, Inc., 4830 North Loop 1604W, Suite 111, San Antonio, Texas 78249. Each recommendation should include a personal biography of the suggested nominee, an indication of the background or experience that qualifies the person for consideration and a statement that the person has agreed to serve if nominated and elected. The Board evaluates candidates recommended by stockholders in the same manner in which it evaluates other nominees. Stockholders who themselves wish to effectively nominate a person for election to the Board, as contrasted with recommending a potential nominee to the Board for its consideration, are required to comply with the advance notice and other requirements set forth in our By-laws.

BOARD LEADERSHIP STRUCTURE

The Board exercises its discretion in combining or separating the position of Chair of the Board and Chief Executive Officer as it deems appropriate in light of prevailing circumstances. Mr. Wells currently serves as our Chief Executive Officer, and Mr. Moreland currently serves as our independent Chair of the Board. The Chief Executive Officer is responsible for the strategic direction, day-to-day leadership and performance of the Company, while the Chair of the Board provides overall leadership to our Board. This leadership structure allows the Chief Executive Officer to focus on his operational responsibilities, while keeping a measure of independence between the oversight function of our Board and those operating decisions. Our Board believes that this leadership structure has historically provided an appropriate allocation of roles and responsibilities and has been in the best interests of stockholders and believes that it continues to be appropriate and in the best interests of stockholders at this time given Mr. Wells’ recent transition to the Chief Executive Officer role, effective as of January 1, 2022.

|

Notice and Proxy Statement 2023 11

|

Table of Contents

|

W. Benjamin Moreland

|

Mr. Moreland has been our independent Chair since May 2019. The Board views the independent Chair as a liaison between the Board and the Company’s Chief Executive Officer and other members of management and believes the powers and authority of the Chair strengthen the Board’s role in risk oversight. Mr. Moreland exercises effective leadership and sets the tone at the top. He leverages, from multiple leadership positions on boards of large public companies, his breadth of experience in oversight areas, including in financial and transactional matters, as well as his strategic insight to strengthen independent oversight of management.

Our independent Chair has power and authority to do the following:

• preside at all meetings of non-management directors when they meet in executive session without management participation;

• set agendas, priorities and procedures for meetings of non-management directors meeting in executive session without management participation;

• add agenda items to the established agenda for meetings of the Board and its committees;

• request access to the Company’s management, employees and its independent advisers for purposes of discharging his duties and responsibilities as a director; and

• retain independent outside financial, legal or other advisors at any time, at the expense of the Company, on behalf of the Board or any committee or subcommittee of the Board. |

In addition, at any time when the Chair might not be an independent director, the Board has created the office of the Presiding Director to serve as the lead non-management director of the Board. If required, the Presiding Director would be an “independent” director, as that term is defined from time to time by the listing standards of the NYSE and as determined by the Board in accordance with the Governance Guidelines. If the Chair of the Board is an independent director, then the Chair of the Board assumes the responsibilities of the Presiding Director that are set forth above. Throughout the year, we engage with our stockholders to discuss and receive feedback on various matters, including our governance structure.

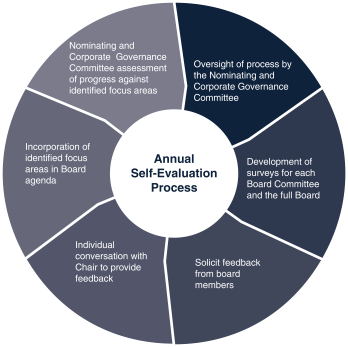

SELF-EVALUATION

Our Board conducts an annual self-evaluation process to determine whether the Board, its committees and the directors are functioning effectively. This includes survey materials as well as individual, private conversations between directors and the Chair of the Board, as needed, and a report to, and discussion of survey results with, the Nominating and Corporate Governance Committee and the full Board. The survey materials solicit feedback on organizational matters, business strategy, financial matters, board structure and meeting administration. The directors use the survey materials, discussions with the Chair of the Board, as needed, and discussions with the full Board to provide feedback, identify themes for the Board to consider, suggest specific action steps and review Board agendas. In addition, focus areas identified through the evaluation are incorporated into the Board’s and, as applicable, its committees’ agendas for the following year to monitor progress. The annual Board performance evaluation is also a primary determinant for Board tenure. Annually, the Nominating and Corporate Governance Committee reviews progress against focus areas identified in the self-evaluation. Each committee also conducts its own annual self-evaluation to assess the functioning of the committee and the effectiveness of the committee members, including the committee chair.

| 12 Notice and Proxy Statement 2023

|

|

Table of Contents

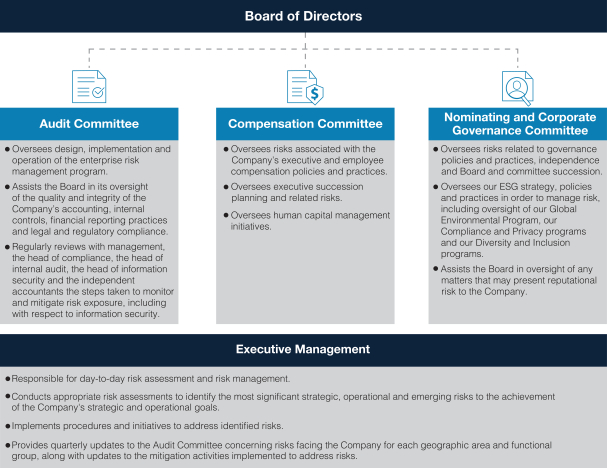

RISK MANAGEMENT

Our Board has overall responsibility for the oversight of our enterprise risk management process, which is guided by the COSO Enterprise Risk Management Framework three lines of defense model, including Operational Management as the First Line of Defense, Compliance and Information Security as the Second Line of Defense and Internal and External Audit as the Third Line of Defense. The Board sets the tone at the top as it relates to enterprise risk management and encourages management to promote a corporate culture that incorporates risk management into our corporate strategy and day-to-day operations.

Our risk management philosophy strives to:

| • | timely identify the material risks that we face; |

| • | communicate necessary information with respect to material risks to senior management and, as appropriate, to the Board or relevant Board committee; |

| • | implement appropriate and responsive risk management strategies consistent with our risk profile; and |

| • | integrate risk management into our decision-making. |

Our management conducts a formal risk assessment of the Company’s business, including probability and potential economic and reputational impact assessments, and develops mitigation actions and monitoring plans.

The Board has designated the Audit Committee to broadly oversee enterprise risk management in accordance with its charter. Under the oversight of the Audit Committee, and with the support of the Company’s compliance function and the Company’s internal and external audit functions, we operate an enterprise-wide risk management governance framework that sets standards and provides guidance for the identification, assessment, monitoring and control of the most significant risks facing the Company and that have the potential to affect stockholder value, our customers and colleagues, the communities in which we operate and the safety and soundness of the Company. The Audit Committee then reports to the Board quarterly regarding briefings provided by management and advisors, as well as the Audit Committee’s own analysis and conclusions regarding the adequacy of our risk management processes.

|

Notice and Proxy Statement 2023 13

|

Table of Contents

The Board also exercises its oversight of our enterprise risk management process with support from the Compensation Committee and the Nominating and Corporate Governance Committee, each of which has oversight responsibilities for risks that may fall within their areas of responsibility and expertise. For example, the Compensation Committee reviews human capital related risks, and the Nominating and Corporate Governance Committee regularly reviews ESG risks. The Board receives independent reports from each committee at its quarterly meetings.

The Board’s oversight of risk management requires close interaction between the full Board, each of its committees and executive management. The Company’s risk oversight framework and key areas of responsibility are illustrated below:

| 14 Notice and Proxy Statement 2023

|

|

Table of Contents

SUCCESSION PLANNING

At least annually, the Compensation Committee reviews the Company’s talent management and succession plan, including with respect to the Chief Executive Officer and other executive positions. This includes the review and evaluation of development plans for potential successors to the Chief Executive Officer role and other executive positions. As part of the Board’s ongoing succession planning processes, the Board, after recommendation from the Compensation Committee, identified Mr. Wells, our current Chief Executive Officer, as successor to Mr. Eccleshare. On July 27, 2021, the Board unanimously appointed Mr. Wells as our successor Chief Executive Officer and a director, effective January 1, 2022. Among the qualifications, skills and attributes that the Compensation Committee and Board considered to appoint Mr. Wells as our Chief Executive Officer were his proven and successful leadership of the Company’s Americas business and his deep knowledge of our business, strategic vision, leadership and moral integrity. Following Mr. Wells appointment and first year as the Company’s Chief Executive Officer, the Compensation Committee has continued its routine talent management and succession planning with Mr. Wells’ input.

Developing talent at all levels of the Company is a priority for us. We are focused on providing the Board with additional opportunities to interact with senior management, which gives management unique access to the Board and also facilitates a deeper understanding of the organization among the Board. The Company also offers various talent development programs throughout the organization focused on building leadership and management skills, career development and other areas.

CORPORATE GOVERNANCE

Our corporate governance practices are established and monitored by the Board. The Board, with assistance from the Nominating and Corporate Governance Committee, periodically assesses our governance practices in light of legal requirements and governance best practices.

Our primary governing documents include:

| • | Governance Guidelines |

| • | Board Committee Charters |

| ○ | Audit Committee Charter |

| ○ | Compensation Committee Charter |

| ○ | Nominating and Corporate Governance Committee Charter |

| • | Code of Business Conduct and Ethics |

These documents are available on our website at www.investor.clearchannel.com. We encourage our stockholders to read these documents, as we believe they illustrate our commitment to good governance practices. Certain key provisions of these documents are summarized below.

|

Notice and Proxy Statement 2023 15

|

Table of Contents

GOVERNANCE GUIDELINES

We operate under Governance Guidelines that set forth our corporate governance principles and practices on a variety of topics, including director qualifications, the responsibilities of the Board, independence requirements and the composition and functioning of the Board. Our Governance Guidelines are designed to maximize long-term stockholder value, align the interests of the Board and management with those of our stockholders and promote high ethical conduct among our directors. The Governance Guidelines include, but are not limited to, the following key practices to assist the Board in carrying out its responsibilities in connection with the business and affairs of Clear Channel Outdoor:

| 1. | Director Responsibilities

|

|

| The basic responsibility of a director is to exercise his or her business judgment and act in what she or he reasonably believes to be in the best interests of Clear Channel Outdoor and its stockholders. Directors are expected to attend Board meetings and meetings of committees on which they serve and to spend the time needed, and meet as frequently as necessary, to properly discharge their responsibilities. | ||

|

||

| 2. | Self-Evaluation Process

|

|

| The Board and each standing committee of the Board will conduct an annual self-evaluation to determine whether it and its committees are functioning effectively. The Nominating and Corporate Governance Committee is responsible for overseeing the self-evaluation process and for proposing any modification or alterations in Board or committee practices or procedures. | ||

|

||

| 3. | Executive Sessions of Non-Management Directors

|

|

| The non-management directors and/or the independent directors meet periodically in executive session without management participation. | ||

|

||

| 4. | Board Access to Senior Management

|

|

| Directors have complete access to Clear Channel Outdoor’s management, employees and its independent advisors for purposes of discharging their duties and responsibilities as directors and can initiate contact or meetings through the Chief Executive Officer or any other executive officer. | ||

|

||

| 5. | Board Access to Independent Advisors

|

|

| The Board and each Board committee have the power to retain independent legal, financial or other advisors as they may deem necessary, at our expense. | ||

|

||

| 6. | Board Tenure

|

|

| The Board believes that term limits on director service and a predetermined retirement age impose arbitrary restrictions on Board membership. Instead, the Board believes directors who, over a period of time, develop an insight into Clear Channel Outdoor and its operations provide an increasing contribution to Clear Channel Outdoor as a whole. The annual board performance evaluation is a primary determinant for Board tenure. | ||

|

||

| 7. | Directors Who Change Their Current Job Responsibilities

|

|

| A director who changes the nature of the job she or he held when she or he was elected to the Board shall promptly notify the Board of any such change. This does not mean that such director should necessarily leave the Board. There should, however, be an opportunity for the Board to review the continued appropriateness of Board membership under these new circumstances. | ||

|

||

| 8. | Service on Multiple Boards

|

|

| To enable the Board to assess a director’s effectiveness and any potential conflicts of interest, any director who serves on more than three other public company boards must advise the Chair in advance of accepting an invitation to serve as a member of another public company board. | ||

|

||

| 9. | Management Development and Succession Planning

|

|

| The Board or a committee of the Board will periodically consider management development and succession planning, including short-term succession planning for certain of Clear Channel Outdoor’s most senior management positions. |

| 16 Notice and Proxy Statement 2023

|

|

Table of Contents

BOARD COMMITTEE CHARTERS