DEF 14A: Definitive proxy statements

Published on March 29, 2024

Table of Contents

☐ |

Preliminary Proxy Statement |

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☒ |

Definitive Proxy Statement |

|

☐ |

Definitive Additional Materials |

|

☐ |

Soliciting Material Pursuant to §240.14a-12

|

|

☒ |

No fee required | |

☐ |

Fee paid previously with preliminary materials | |

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

|

|

Table of Contents

Table of Contents

|

|

A LETTER FROM OUR CEO AND THE INDEPENDENT CHAIR OF OUR BOARD

|

|

Dear Fellow Stockholders:

On behalf of the Board of Directors of Clear Channel Outdoor Holdings, Inc. (“Clear Channel Outdoor”), it is our pleasure to invite you to our annual meeting of stockholders (the “Annual Meeting”).

During the past year, we made notable progress in executing on our strategic plan, which is centered on taking a number of steps that we believe will strengthen our ability to organically grow Adjusted EBITDA and cash flow and improve our liquidity, in support of our goal to reduce leverage on our balance sheet.

In addition to our ongoing focus on maximizing our U.S. assets and expanding the universe of advertisers we serve through disciplined investments in our technology and digital transformation, we are also working to monetize our remaining international businesses, while simultaneously exploring avenues to reduce corporate expenses and optimize our deployment of capital. We believe that streamlining our organization toward a focus on our higher-margin markets in the U.S. will strengthen the operating leverage in our business and enhance our ability to deliver value for our stockholders.

We believe that the outlook for the out-of-home advertising industry is bright and that we are well-positioned to benefit as an innovation leader in our space. We have built a dynamic advertising platform with the scale, reach and flexibility to deliver highly-targeted, measurable campaigns that are simpler to buy across a greater pool of brands and agencies. With the support of our Board of Directors and dedicated team of employees, we remain focused on pursuing our vision and executing on our strategic plan in the year ahead.

Thank you for your continued support and confidence in Clear Channel Outdoor. We hope you will join us for our Annual Meeting webcast on May 16, 2024.

Sincerely,

|

|

|

|

| Scott R. Wells | W. Benjamin Moreland | |

| Chief Executive Officer and Director | Independent Chair of the Board of Directors |

|

|

Table of Contents

NOTICE OF

2024

ANNUAL

MEETING OF

STOCKHOLDERS

AND

PROXY

STATEMENT

Thursday, May 16, 2024

9:00 a.m. Eastern Time

CLEAR CHANNEL OUTDOOR HOLDINGS, INC.

4830 North Loop 1604W, Suite 111

San Antonio, Texas 78249

As a stockholder of Clear Channel Outdoor Holdings, Inc., you are hereby given notice that the Annual Meeting of Stockholders of Clear Channel Outdoor Holdings, Inc. will be held by means of a live webcast, at meetnow.global/M2KV5AT, on May 16, 2024 at 9:00 a.m. Eastern Time for the following purposes:

| 1. | to elect ten nominees to serve as directors for a one-year term; |

| 2. | to approve an advisory resolution on executive compensation; |

| 3. | to approve an amendment to our certificate of incorporation to provide for exculpation of certain officers as permitted by recent amendments to Delaware law; |

| 4. | to approve the adoption of our 2012 Third Amended and Restated Equity Incentive Plan to increase the number of shares authorized for issuance under the 2012 Second Amended and Restated Equity Incentive Plan by 36,700,000 shares and to eliminate the liberal share recycling provisions with respect to stock options and stock appreciation rights; |

| 5. | to ratify the selection of Ernst & Young LLP as the independent registered public accounting firm of Clear Channel Outdoor for the year ending December 31, 2024; and |

| 6. | to transact any other business that may properly come before the meeting or any adjournment or postponement thereof. |

Only stockholders of record at the close of business on March 18, 2024 are entitled to notice of, and to vote at, the Annual Meeting.

If you plan to attend the Annual Meeting, please follow the voting and registration instructions set forth in the accompanying proxy statement (the “Proxy Statement”).

Your attention is directed to the accompanying Proxy Statement. In addition, although mere participation in the Annual Meeting will not revoke your proxy, if you participate in the Annual Meeting webcast, you may revoke your proxy and vote during the meeting. To ensure that your shares are represented at the Annual Meeting, please submit your vote by Internet, telephone or mail, whether or not you plan to attend the Annual Meeting.

By Order of the Board of Directors:

Lynn A. Feldman

Executive Vice President, Chief Legal Officer and Corporate Secretary

San Antonio, Texas

March 29, 2024

|

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF

The Proxy Statement and Annual Report are available at:

|

Table of Contents

TABLE OF CONTENTS

| Proxy Statement Summary | 1 | |||

| The Board of Directors and Corporate Governance | 1 | |||

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 3 | ||||

| 6 | ||||

| 6 | ||||

| 7 |

| 8 | ||||

| 10 | ||||

| 10 | ||||

| 11 | ||||

| 12 | ||||

| 12 | ||||

| Stockholder and Interested Party Communication with the Board |

12 |

| 46 | ||||

| 47 | ||||

| 50 | ||||

| 52 | ||||

| 53 |

| 53 | ||||

| 53 | ||||

| 54 | ||||

| 62 | ||||

| 66 |

|

Notice and Proxy Statement 2024

|

Table of Contents

|

|

Proxy Statement Summary

This Proxy Statement contains information related to the 2024 Annual Meeting of Stockholders of Clear Channel Outdoor Holdings, Inc. and at any postponements or adjournments thereof. This summary highlights information you will find in this Proxy Statement. As it is only a summary, please review the complete Proxy Statement before you vote.

2024 Annual Meeting Information

|

|

|

|

|||

| Date and Time: Thursday, May 16, 2024 at 9:00 a.m. Eastern Time |

Location: meetnow.global/M2KV5AT |

Record Date: March 18, 2024 |

Proxy Mail Date: On or about April 4, 2024 |

HOW TO VOTE

|

By Internet: Visit the website listed on your proxy card. |

By Phone: Call the telephone number on your proxy card. |

By Mail: Sign, date and return your proxy card in the enclosed envelope.

|

During the Annual Meeting: Participate in the Annual Meeting webcast.

|

| Voting: | Each share of Clear Channel Outdoor common stock is entitled to one vote for each director nominee and one vote for each of the other proposals to be voted on at the Annual Meeting. | |

| Admission: | Admission to the Annual Meeting is limited to stockholders as of March 18, 2024 (the “Record Date”). If you plan to attend the Annual Meeting, please follow the registration instructions set forth in this Proxy Statement. | |

ANNUAL MEETING AGENDA AND VOTE RECOMMENDATIONS

| Matter

|

Board Vote Recommendation |

Page Reference (for more details) |

||||

| Proposal 1 | Election of Directors |

FOR

|

15 | |||

| Proposal 2 | Advisory Resolution on Executive Compensation |

FOR

|

73 | |||

| Proposal 3 |

Amendment to our Certificate of Incorporation to Provide for Exculpation of Certain Officers as Permitted by Recent Amendments to Delaware Law

|

FOR | 74 | |||

| Proposal 4 |

Adoption of our 2012 Third Amended and Restated Equity Incentive Plan to Increase the Number of Shares Authorized for Issuance Under the 2012 Second Amended and Restated Equity Incentive Plan by 36,700,000 Shares and to Eliminate the Liberal Share Recycling Provisions with respect to Stock Options and Stock Appreciation Rights

|

FOR | 76 | |||

| Proposal 5 |

Ratification of the selection of Ernst & Young LLP as the independent registered public accounting firm for the year ending December 31, 2024

|

FOR | 85 |

In this Proxy Statement, “we”, “our”, “us”, “CCOH”, “Clear Channel Outdoor” and the “Company” refer to Clear Channel Outdoor Holdings, Inc., and the “Annual Meeting” refers to the 2024 Annual Meeting of Stockholders. We will begin mailing this Proxy Statement and form of proxy card to stockholders on or about April 4, 2024.

Table of Contents

|

|

| ii Notice and Proxy Statement 2024

|

|

Table of Contents

DIRECTOR NOMINEES

Below is information about each of our director nominees, as of March 18, 2024:

| Name |

Age | Most Recent Experience(s) |

Independent Director |

Committee Memberships |

||||||||||

| John Dionne |

60 | Senior Advisor at Blackstone Group, L.P. | ✓ | AC, NCGC | ||||||||||

| Lisa Hammitt |

61 | Former Executive Vice President, Artificial Intelligence and Chief Technology Officer at Davidson Technologies | ✓ | CC, NCGC | ||||||||||

| Andrew Hobson |

62 | Partner and Chief Financial Officer at Innovatus Capital Partners, LLC | ✓ | AC | ||||||||||

| Thomas C. King |

63 | Operating Partner at Atlas Merchant Capital | ✓ | CC | ||||||||||

| Joe Marchese |

42 | Co-Founder and Executive Chairman of Human Ventures | ✓ | CC, NCGC | ||||||||||

| W. Benjamin Moreland « |

60 | Private investor and retired Chief Executive Officer at Crown Castle International Corp. | ✓ | — | ||||||||||

| Mary Teresa Rainey |

68 | Founder of Rainey, Kelly Campbell Roalfe/Y&R | ✓ | AC, NCGC | ||||||||||

| Scott R. Wells |

55 | Chief Executive Officer at Clear Channel Outdoor | — | |||||||||||

| Raymond T. (Ted) White |

58 | Co-Founder and Managing Director of Legion Partners Asset Management, LLC |

✓ | AC | ||||||||||

| Jinhy Yoon |

52 | Executive Vice President, Credit Research at PIMCO | — | |||||||||||

« = Chair of the Board

AC = Audit Committee

CC = Compensation Committee

NCGC = Nominating and Corporate Governance Committee

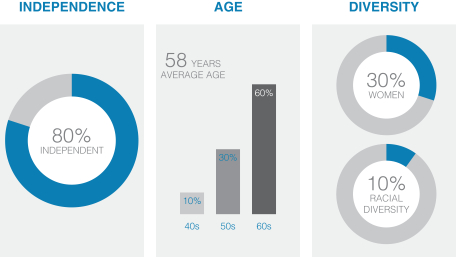

CORPORATE GOVERNANCE HIGHLIGHTS

The Board of Directors (the “Board”) of Clear Channel Outdoor believes that good governance is key to achieving long-term stockholder value and that the Company’s long-term success requires the Company’s commitment to a robust framework of guidelines and practices that serve the best interests of the Company and all of our stockholders. Below are some key highlights of our corporate governance framework:

| Board Practices

✓ 8 out of 10 of our directors are independent.

✓ The Board is led by an independent, non-executive Chair.

✓ All of our directors are elected annually.

✓ All members of our Audit, Compensation and Nominating and Corporate Governance Committees are independent as defined by the New York Stock Exchange (“NYSE”) listing standards and applicable U.S. Securities and Exchange Commission (“SEC”) rules.

✓ Each Board committee operates under a written charter that has been approved by the Board and is reviewed and, if necessary, amended annually.

✓ The Board conducts periodic executive sessions, where non-executive and independent directors meet without management.

✓ The Nominating and Corporate Governance Committee oversees an annual self-evaluation process for the Board and each standing committee of the Board and is responsible for proposing any modification or alterations to Board or committee practices or procedures. |

Compensation Practices

✓ Robust annual risk assessment of executive compensation programs, policies and practices.

✓ Clawback policy in place for senior executives in the case of an accounting restatement.

✓ Significant stock ownership requirements for senior executives and directors.

Stockholder Matters

✓ Robust stockholder engagement.

✓ Annual Say-on-Pay voting.

Other Governance Practices

✓ Our Code of Business Conduct and Ethics, which applies to all Clear Channel Outdoor employees, as well as our executive officers and our directors, reinforces our core values and helps drive our workplace culture of compliance with ethical standards, integrity and accountability.

✓ We have made a strong commitment to Corporate Social Responsibility and strengthening the Company’s Environmental, Social and Governance (“ESG”) program. For more details, please see “Corporate Social Responsibility and Environmental, Social and Governance” in this Proxy Statement and our 2023 ESG Report, which is available on our website at investor.clearchannel.com. |

|

|

Notice and Proxy Statement 2024 iii

|

Table of Contents

|

|

CORPORATE SOCIAL RESPONSIBILITY AND ENVIRONMENTAL, SOCIAL AND GOVERNANCE

Our Board and management team are committed to making a difference in the communities we serve. We are united across our business units by the common purpose of “creating a better world through our people-powered platform”. Together, we strive to improve the communities in which we operate through innovation, dedication and good governance.

ESG is integrated across Clear Channel Outdoor’s strategic and operational endeavors. The ultimate responsibility and oversight for Clear Channel Outdoor’s ESG initiatives lies with the Board’s Nominating and Corporate Governance Committee. In addition, the Board’s Audit Committee oversees risk, including climate-related, compliance, privacy and information security risks, and the Board’s Compensation Committee oversees our human capital management initiatives. On an operational level, Clear Channel Outdoor’s legal and compliance business functions report directly to the Board and its standing committees on ESG matters and compliance initiatives. Further, the Global Compliance Office coordinates regional ESG Programs with executive oversight, and senior leaders in divisional governance committees oversee local ESG programs across Clear Channel Outdoor.

Our ESG program reflects our divisional Values of Integrity (in Clear Channel Outdoor Americas) and Fairness (in Clear Channel Europe and Clear Channel Latin America), which (i) have ethics as the bottom line and (ii) require that our people seek opportunities to take ownership of challenges and provide ethical solutions.

In all of the regions in which we operate, ESG is part of our DNA: the corporate Clear Channel Outdoor mission is to connect brands and consumers by delivering innovative advertising insights and solutions while serving our communities. Similarly, the divisional Clear Channel Europe and Clear Channel Latin America mission is to create the future of media through data-driven digital innovations and infrastructure that are environmentally and socially conscious, as a Platform for Brands and a Platform for Good.

In November 2023, Clear Channel Outdoor published its 2023 ESG Report, which details how we strive to behave ethically and responsibly as a company, an employer and a business partner and how we endeavor to use our resources and products to drive meaningful change in the communities in which we operate. For more information on our ESG policies, practices, initiatives and accomplishments, please see our 2023 ESG Report, which is available at investor.clearchannel.com. None of our 2023 ESG Report, our websites or the information included therein is a part of, or incorporated by reference into, this Proxy Statement.

| iv Notice and Proxy Statement 2024

|

|

Table of Contents

|

|

EXECUTIVE COMPENSATION HIGHLIGHTS

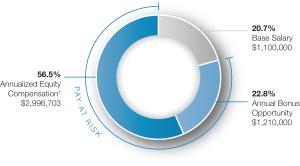

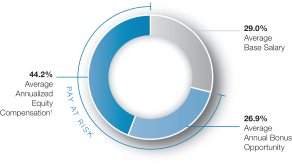

Our Compensation Committee, with support from our independent compensation consultant, periodically evaluates our compensation practices to ensure that they support the objectives of our business, align with market practices and provide incentives to deliver key financial metrics that are explicitly linked with stockholder value creation. Certain highlights for 2023 include:

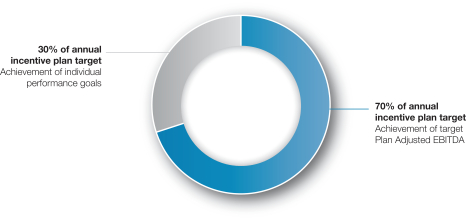

| • | We continued our practice of annual incentive plan awards tied to Company, division and individual performance goals. |

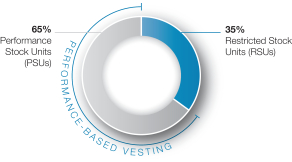

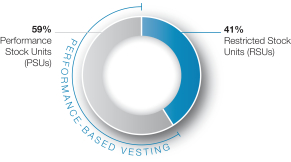

| • | Our long-term incentive (“LTI”) program provides for annual equity awards for our executive team members. The program favors performance-based LTI awards and while varied by role, the May 2023 grants averaged 40% restricted stock units (“RSUs”) and 60% performance stock units (“PSUs”) for our named executive officers (“NEOs”). The RSUs are designed to promote retention, while the PSUs provide alignment to stockholders by tying payout to relative total shareholder return over a three-year period. |

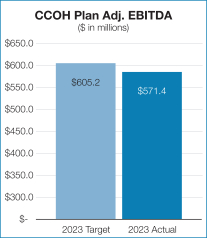

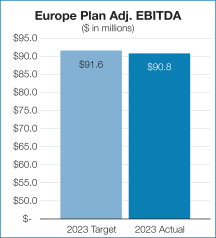

| • | The compensation determinations for our NEOs for 2023 reflect the overall performance of Clear Channel Outdoor and the contributions of our leaders to driving the year’s successes. The achievement of individual performance objectives along with slightly below target achievement of business performance objectives resulted in the NEOs earning annual incentive payouts between 80% and 100% of their individual target opportunities. |

| • | The Company entered into an amended and restated employment agreement with Mr. Brian D. Coleman on March 7, 2023. In connection with this agreement, his base salary was increased effective April 1, 2023. |

| • | On October 25, 2022, Mr. Justin Cochrane received a one-time cash award in recognition of his efforts related to the sale of our Europe-South businesses. 50% of that award was paid in 2023 and the remaining 50% will be paid in 2024, subject to his continued employment through the payment date. |

| • | The Compensation Committee adopted a Clawback Policy that complies with new clawback rules adopted by the NYSE. |

After fiscal year end, David Sailer was appointed Executive Vice President, Chief Financial Officer of the Company, effective as of March 1, 2024. Mr. Coleman departed his position as Executive Vice President, Chief Financial Officer as of March 1, 2024, upon which time he became a consultant to the Company in order to assist with transition matters.

|

Notice and Proxy Statement 2024 v

|

Table of Contents

THE BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Our Board is responsible for overseeing the direction of Clear Channel Outdoor and for establishing broad corporate policies. In accordance with corporate legal principles, our Board is not involved in day-to-day operating activities of the Company. Members of the Board are kept informed of Clear Channel Outdoor’s business through discussions with the Company’s Chief Executive Officer, Chief Financial Officer, Chief Legal Officer and other executive officers, by reviewing analyses and reports sent to them, by receiving updates from Board committees and by otherwise participating in Board and committee meetings.

COMPOSITION OF THE BOARD OF DIRECTORS

Our Board is currently comprised of ten directors: W. Benjamin Moreland (our Chair), Scott R. Wells (our Chief Executive Officer), John Dionne, Lisa Hammitt, Andrew Hobson, Thomas C. King, Joe Marchese, Mary Teresa Rainey, Ted White and Jinhy Yoon. Directors elected at this Annual Meeting will be elected for a one-year term expiring at our 2025 annual meeting of stockholders.

BOARD MEETINGS

In 2023, the Board held nine meetings and also acted by written consent. All of our incumbent directors attended more than 89% of the aggregate of all meetings of the Board and the committees of the Board on which they served during 2023.

The rules of the NYSE require that non-management or independent directors of a listed company meet periodically in executive sessions. In addition, the rules of the NYSE require listed companies to schedule an executive session including only independent directors at least once a year. Clear Channel Outdoor’s independent directors met separately in executive session at least one time during 2023. Mr. Moreland, the independent Chair of the Board, presides over all such executive sessions.

STOCKHOLDER MEETING ATTENDANCE

Clear Channel Outdoor encourages, but does not require, its directors to attend the Annual Meeting of stockholders. All of our directors then in office attended the annual meeting of stockholders in 2023.

INDEPENDENCE OF DIRECTORS

Our Board currently consists of ten directors, one of whom currently serves as our Chief Executive Officer. For a director to be independent, the Board must determine that such director does not have any direct or indirect material relationship with Clear Channel Outdoor. Pursuant to our governance guidelines (the “Governance Guidelines”), the Board has undertaken its annual review of director independence.

The Board has adopted the following standards for determining the independence of its members:

| 1. A director must not be, or have been within the last three years, an employee of Clear Channel Outdoor. In addition, a director’s immediate family member (“immediate family member” is defined to include a person’s spouse, parents, children, siblings, mother- and father-in-law, sons- and daughters-in-law and anyone (other than domestic employees) who shares such person’s home) must not be, or have been within the last three years, an executive officer of Clear Channel Outdoor. |

||||

| 2. A director or immediate family member must not have received, during any twelve-month period within the last three years, more than $120,000 in direct compensation from Clear Channel Outdoor, other than director or committee fees and pension or other forms of deferred compensation for prior service (and no such compensation may be contingent in any way on continued service). |

||||

| 3. A director must not be a current partner or employee of a firm that is Clear Channel Outdoor’s internal or external auditor. In addition, a director must not have an immediate family member who is (a) a current partner of such firm or (b) a current employee of such a firm and personally works on Clear Channel Outdoor’s audit. Finally, neither the director nor an immediate family member of the director may have been, within the last three years, a partner or employee of such a firm and personally worked on Clear Channel Outdoor’s audit within that time. |

||||

|

Notice and Proxy Statement 2024 1

|

Table of Contents

| 4. A director or an immediate family member must not be, or have been within the last three years, employed as an executive officer of another company where any of Clear Channel Outdoor’s present executive officers at the same time serve or served on that company’s compensation committee. |

||||

| 5. A director must not be a current employee, and no director’s immediate family member may be a current executive officer, of a material relationship party (“material relationship party” is defined as any company that has made payments to, or received payments from, Clear Channel Outdoor for property or services in an amount that, in any of the last three fiscal years, exceeds the greater of $1,000,000 or 2% of such other company’s consolidated gross revenues). |

||||

| 6. A director must not own, together with ownership interests of his or her family, ten percent (10%) or more of a material relationship party. |

||||

| 7. A director or immediate family member must not be, or have been during the last three years, an executive officer of a charitable organization (or hold a similar position), to which Clear Channel Outdoor makes contributions in an amount that, in any of the last three fiscal years, exceeds the greater of $1,000,000 or 2% of such organization’s consolidated gross revenues. |

||||

| 8. A director must be “independent” as that term is defined from time to time by the rules and regulations promulgated by the SEC, by the listing standards of the NYSE and, with respect to at least two members of the compensation committee, by the applicable provisions of, and rules promulgated under, the Internal Revenue Code of 1986, as amended (collectively, the “Applicable Rules”). For purposes of determining independence, the Board will consider relationships with Clear Channel Outdoor and any parent or subsidiary in a consolidated group with Clear Channel Outdoor or any other company relevant to an independence determination under the Applicable Rules. |

||||

The above independence standards conform to, or are more exacting than, the director independence requirements of the NYSE applicable to Clear Channel Outdoor. The above independence standards are set forth on Appendix A of the Governance Guidelines.

The Board has affirmatively determined that all current directors (other than Mr. Wells and Ms. Yoon) are independent under the listing standards of the NYSE, as well as Clear Channel Outdoor’s independence standards set forth above. In addition, the Board has determined that each member currently serving on the Compensation Committee and on the Audit Committee is independent under the heightened independence standards for compensation or audit committee members under the listing standards of the NYSE and the rules and regulations of the SEC, as applicable. In making these determinations, the Board reviewed information provided by the directors and by Clear Channel Outdoor with regard to the directors’ business and personal activities as they relate to Clear Channel Outdoor and its affiliates.

In the ordinary course of business during 2023, Clear Channel Outdoor entered into purchase and sale transactions for products and services and other ordinary course transactions with (i) a subsidiary of a company where Mses. Hammitt and Yoon serve as chairwoman and director, respectively; (ii) entities where Mr. Moreland serves or served as a director; (iii) an entity where Mr. Marchese serves as director, an entity where Mr. Marchese serves as partner and the chairman, and charitable organizations affiliated with Mr. Marchese; (iv) a company that employs Mr. Dionne’s daughter in a non-executive capacity; and (v) a company that employs Mr. White’s son in a non-executive capacity. All of these transactions were for arms-length, ordinary course of business transactions, and we expect transactions of a similar nature to occur during 2024. These transactions were considered by the Board in making their independence determinations with respect to Mses. Hammitt and Yoon and Messrs. Dionne, Marchese, Moreland and White. The Board has concluded that such transactions or relationships do not impair the independence of Mses. Hammitt and Yoon and Messrs. Dionne, Marchese, Moreland and White.

With respect to Mr. White, the Board also considered that Mr. White is the Co-Founder and Managing Director of Legion Partners Asset Management, LLC and considered the relationships and transactions between Clear Channel Outdoor and Legion Partners Asset Management, LLC and its affiliates (collectively, “Legion Partners”), which are described under “Certain Relationships and Related Party Transactions.” In concluding that these relationships and transactions do not result in a “material relationship” between Clear Channel Outdoor and Legion Partners that would impede the exercise of independent judgment by Mr. White, the Board considered, among other things, that Legion Partners’ rights and obligations under the Cooperation Agreement arise directly as a result of Legion Partners’ stock

| 2 Notice and Proxy Statement 2024

|

|

Table of Contents

ownership, that the amount of certain expenses of Legion Partners that Clear Channel Outdoor agreed to reimburse is below the threshold set forth in the applicable NYSE and Board-adopted standards regarding independence and that such payment does not constitute the payment of a consulting, advisory or other compensatory fee for purposes of Rule 10A-3 of the Exchange Act.

COMMITTEES OF THE BOARD

The Board has three standing committees: (i) the Audit Committee, (ii) the Compensation Committee and (iii) the Nominating and Corporate Governance Committee. Each committee consists solely of independent directors and is governed by a written charter. The committee charters are available on our website at investor.clearchannel.com.

The table below provides membership information for each committee of the Board as of March 18, 2024:

Board Committee Membership

| Director Name | Audit Committee |

Compensation Committee |

Nominating and Corporate Governance Committee |

||||||||||||

|

John Dionne

|

Member

|

Member

|

|||||||||||||

|

Lisa Hammitt

|

Member

|

Member

|

|||||||||||||

|

Andrew Hobson

|

Chair

|

||||||||||||||

|

Thomas C. King

|

Chair

|

||||||||||||||

|

Joe Marchese

|

Member

|

Member

|

|||||||||||||

|

W. Benjamin Moreland, Chair of the Board

|

|||||||||||||||

|

Mary Teresa Rainey

|

Member

|

Chair

|

|||||||||||||

|

Scott R. Wells

|

|||||||||||||||

|

Ted White

|

Member

|

||||||||||||||

|

Jinhy Yoon

|

|||||||||||||||

| Meetings Held in 2023

|

4

|

5

|

4

|

||||||||||||

The Audit Committee

|

Andrew Hobson, Chair |

John Dionne |

The Audit Committee consists of Andrew Hobson (as Chair), John Dionne, Mary Teresa Rainey and Ted White, each of whom is independent as defined under the rules of the NYSE and Rule 10A-3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Mr. Hobson has been designated as an “audit committee financial expert”, as such term is defined in Item 407(d)(5) of Regulation S-K. The Audit Committee assists the Board in its oversight of the quality and integrity of the accounting, auditing and financial reporting practices of Clear Channel Outdoor. | ||

|

Mary Teresa Rainey |

Ted White |

The Audit Committee’s primary responsibilities, which are discussed in detail within its charter, include the following:

| • | be responsible for the appointment, compensation, retention and oversight of the work of the independent registered public accounting firm and any other registered public accounting firm engaged for the purpose |

|

Notice and Proxy Statement 2024 3

|

Table of Contents

| of preparing an audit report or to perform other audit, review or attest services and all fees and other terms of their engagement; |

| • | review and discuss reports regarding the independent registered public accounting firm’s independence; |

| • | review with the independent registered public accounting firm the annual audit scope and plan; |

| • | review with management, the director of internal audit and the independent registered public accounting firm the budget and staffing of the internal audit department; |

| • | review and discuss with management and the independent registered public accounting firm the annual and quarterly financial statements and the specific disclosures under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” prior to the filing of the Annual Report on Form 10-K and Quarterly Reports on Form 10-Q; |

| • | review with the independent registered public accounting firm the critical accounting policies and practices used; |

| • | review with management, the independent registered public accounting firm and the director of internal audit Clear Channel Outdoor’s internal accounting controls and any significant findings and recommendations; |

| • | discuss guidelines and policies with respect to risk assessment and risk management; |

| • | oversee Clear Channel Outdoor’s policies with respect to related party transactions; |

| • | prepare the Audit Committee report for inclusion in Clear Channel Outdoor’s annual proxy statement; |

| • | review information technology procedures and controls, including as they relate to data privacy and cyber-security; and |

| • | review with management and the Chief Legal Officer the status of legal and regulatory matters that may have a material impact on Clear Channel Outdoor’s financial statements and compliance policies. |

The full text of the Audit Committee’s charter can be found on our website at investor.clearchannel.com.

The Compensation Committee

|

Thomas C. King, Chair |

Lisa Hammitt |

The Compensation Committee consists of Thomas C. King (as Chair), Lisa Hammitt and Joe Marchese, each of whom is independent under the rules of the NYSE and further qualifies as a non-employee director for purposes of Rule 16b-3 under the Exchange Act. The members of the Compensation Committee are not current or former employees of Clear Channel Outdoor, are not eligible to participate in any of Clear Channel Outdoor’s executive compensation programs, do not receive compensation that would impair their ability to make independent judgments about executive compensation and are not “affiliates” of the Company, as defined under Rule 10C-1 under the Exchange Act. The Compensation Committee administers Clear Channel Outdoor’s incentive-compensation plans and equity-based plans, determines compensation arrangements for all executive officers and makes recommendations to the Board concerning compensation for our directors. The Compensation Discussion and Analysis section of this Proxy Statement provides additional details regarding the basis on which the Compensation Committee determines executive compensation. | ||

|

Joe Marchese |

||||

The Compensation Committee’s primary responsibilities, which are discussed in detail within its charter, include the following:

| • | assist the Board in ensuring that a proper system of long-term and short-term compensation is in place to provide performance-oriented incentives to management and that compensation plans are appropriate and competitive and properly reflect the objectives and performance of management and Clear Channel Outdoor; |

| 4 Notice and Proxy Statement 2024

|

|

Table of Contents

| • | review and approve corporate goals and objectives relevant to the compensation of Clear Channel Outdoor’s executive officers, evaluate the performance of the executive officers in light of those goals and objectives and, either as a committee or together with the other independent directors (as directed by the Board), determine and approve the compensation level of the executive officers based on this evaluation; |

| • | review and adopt, and/or make recommendations to the Board with respect to, incentive-compensation plans for executive officers and equity-based plans; |

| • | review and discuss with management the Compensation Discussion and Analysis to be included in Clear Channel Outdoor’s annual proxy statement and determine whether to recommend to the Board the inclusion of the Compensation Discussion and Analysis in the annual Proxy Statement; |

| • | prepare the Compensation Committee report for inclusion in Clear Channel Outdoor’s annual proxy statement; |

| • | review and make recommendations about the Company’s strategies, policies and procedures with respect to human capital management; and |

| • | recommend to the Board the appropriate compensation for the non-employee members of the Board. |

The Compensation Committee has the ability, under its charter, to select and retain, in its sole discretion, at the expense of Clear Channel Outdoor, independent legal and financial counsel and other consultants necessary to assist the Compensation Committee. The Compensation Committee also has the authority to select and retain any compensation consultant to be used to survey the compensation practices in Clear Channel Outdoor’s industry and to provide advice so that Clear Channel Outdoor can maintain its competitive ability to recruit and retain highly qualified personnel. The Compensation Committee has the sole authority to approve related fees and retention terms for any of its counsel and consultants.

During 2023, the Compensation Committee directly engaged an independent compensation consultant, Willis Towers Watson (“WTW”), to provide executive compensation benchmarking data and incentive and retention compensation plan design advice. The Compensation Committee requested and evaluated responses from WTW addressing its independence in accordance with applicable NYSE rules and concluded that WTW’s work does not raise any conflict of interest or independence concerns.

The full text of the Compensation Committee’s charter can be found on our website at investor.clearchannel.com.

The Nominating and Corporate Governance Committee

|

Mary Teresa Rainey, Chair |

John Dionne |

The Nominating and Corporate Governance Committee consists of Mary Teresa Rainey (as Chair), John Dionne, Lisa Hammitt and Joe Marchese, each of whom is independent under the rules of the NYSE. | ||

|

Lisa Hammitt |

Joe Marchese |

The Nominating and Corporate Governance Committee’s primary responsibilities, which are discussed in detail within its charter, include the following:

| • | identify individuals qualified to become members of the Board, consistent with criteria approved by the Board; |

| • | recommend director nominees to the Board for the next annual meeting of stockholders; |

| • | oversee the organization of the Board to discharge the Board’s duties and responsibilities properly and efficiently; |

|

Notice and Proxy Statement 2024 5

|

Table of Contents

| • | develop and recommend corporate governance guidelines; |

| • | oversee the evaluation of the Board and management; and |

| • | oversee, review with management and report to the Board on the Company’s ESG policies and practices in order to manage risk, lay a foundation for sustainable growth and effectively communicate ESG initiatives to stakeholders. |

The full text of the Nominating and Corporate Governance Committee’s charter can be found on our website at investor.clearchannel.com.

DIRECTOR NOMINATING PROCEDURES

The Nominating and Corporate Governance Committee is responsible for identifying individuals qualified to become Board members, developing qualification standards and other criteria for selecting Board member nominees and reviewing background information for candidates for the Board, including those recommended by stockholders. The Nominating and Corporate Governance Committee believes that all Board members must, at a minimum, meet the criteria set forth in the Governance Guidelines, which specify, among other things, that the Board seeks members from diverse professional backgrounds who combine a broad spectrum of experience and expertise with a reputation for integrity. While we do not have a formal policy on diversity, when considering the selection of director nominees, the Nominating and Corporate Governance Committee considers individuals with diverse viewpoints, accomplishments, cultural backgrounds, professional expertise and diversity in gender, ethnicity, race, skills and geographic representation that, when considered as a group, provide a sufficient mix of perspectives to allow the Board to best fulfill its responsibilities to and, advocate for the long-term interests of, our shareholders. Furthermore, our Board is committed to include qualified women and individuals from underrepresented minority groups in any pool for selection of new candidates for the Board in case the size of the Board were increased or as a result of a vacancy. The Board strives to nominate directors with a variety of complementary skills such that, as a group, the Board will possess the appropriate mix of experience, skills and expertise to oversee the Company’s businesses. Directors must: (i) have experience in positions with a high degree of responsibility; (ii) be leaders in the organizations with whom they are affiliated; (iii) have the time, energy, interest and willingness to serve as a member of the Board; and (iv) be selected based upon contributions they can make to the Board and management. Members of our Board play a critical role in guiding our strategic direction and overseeing our management. The Nominating and Corporate Governance Committee evaluates each individual in the context of the Board as a whole, with the objective of recommending a group that can best perpetuate the success of our business and represent stockholder interests through the exercise of sound judgment and using its diversity of experience. The Nominating and Corporate Governance Committee evaluates each incumbent director to determine whether she or he should be nominated to stand for reelection based on the types of criteria outlined above as well as the director’s contributions to the Board during their current term.

The Nominating and Corporate Governance Committee will consider as potential nominees individuals properly recommended by stockholders. Recommendations concerning individuals proposed for consideration should be addressed to the Board, c/o Corporate Secretary, Clear Channel Outdoor Holdings, Inc., 4830 North Loop 1604W, Suite 111, San Antonio, Texas 78249. Each recommendation should include a personal biography of the suggested nominee, an indication of the background or experience that qualifies the person for consideration and a statement that the person has agreed to serve if nominated and elected. The Board evaluates candidates recommended by stockholders in the same manner in which it evaluates other nominees. Stockholders who themselves wish to effectively nominate a person for election to the Board, as contrasted with recommending a potential nominee to the Board for its consideration, are required to comply with the advance notice and other requirements set forth in our By-laws and Rule 14a-19 of the Exchange Act (the universal proxy rules).

BOARD LEADERSHIP STRUCTURE

The Board exercises its discretion in combining or separating the position of Chair of the Board and Chief Executive Officer as it deems appropriate in light of prevailing circumstances. Mr. Wells currently serves as our Chief Executive Officer, and Mr. Moreland currently serves as the independent Chair of our Board. The Chief Executive Officer is responsible for the strategic direction, day-to-day leadership and performance of the Company, while the Chair of the Board provides overall leadership to our Board. This leadership structure allows the Chief Executive Officer to focus on his operational responsibilities, while keeping a measure of independence between the oversight function of our Board and those operating decisions. Our Board believes that this leadership structure has historically provided an appropriate

| 6 Notice and Proxy Statement 2024

|

|

Table of Contents

allocation of roles and responsibilities and has been in the best interests of stockholders and believes that it continues to be appropriate and in the best interests of stockholders at this time.

|

W. Benjamin Moreland

|

Mr. Moreland has been our independent Chair since May 2019. The Board views the independent Chair as a liaison between the Board and the Company’s Chief Executive Officer and other members of management and believes the powers and authority of the Chair strengthen the Board’s role in risk oversight. Mr. Moreland exercises effective leadership and sets the tone at the top. He leverages, from multiple leadership positions and positions on boards of large public companies, his breadth of experience in oversight areas, including in financial and transactional matters, as well as his strategic insight to strengthen independent oversight of management.

Our independent Chair has power and authority to do the following:

• preside at all meetings of non-management directors when they meet in executive session without management participation;

• set agendas, priorities and procedures for meetings of non-management directors meeting in executive session without management participation;

• add agenda items to the established agenda for meetings of the Board and its committees;

• request access to the Company’s management, employees and its independent advisers for purposes of discharging his duties and responsibilities as a director; and

• retain independent outside financial, legal or other advisors at any time, at the expense of the Company, on behalf of the Board or any committee or subcommittee of the Board. |

In addition, at any time when the Chair might not be an independent director, the Board has created the office of the Presiding Director to serve as the lead non-management director of the Board. If required, the Presiding Director would be an “independent” director, as that term is defined from time to time by the listing standards of the NYSE and as determined by the Board in accordance with the Governance Guidelines. If the Chair of the Board is an independent director, then the Chair of the Board assumes the responsibilities of the Presiding Director that are set forth above. Throughout the year, we engage with our stockholders to discuss and receive feedback on various matters, including our governance structure.

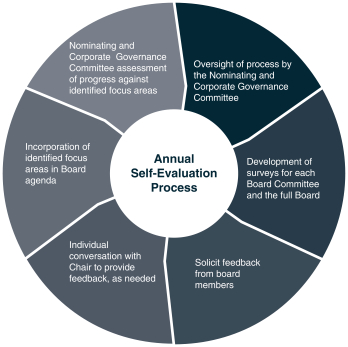

SELF-EVALUATION

Our Board conducts an annual self-evaluation process to determine whether the Board, its committees and the directors are functioning effectively. This includes survey materials as well as individual, private conversations between directors and the Chair of the Board, as needed, and a report to, and discussion of survey results with, the Nominating and Corporate Governance Committee and the full Board. The survey materials solicit feedback on organizational matters, business strategy, financial matters, board structure and meeting administration. The directors use the survey materials, discussions with the Chair of the Board, as needed, and discussions with the full Board to provide feedback, identify themes for the Board to consider, suggest specific action steps and review Board agendas. In addition, focus areas identified through the evaluation are incorporated into the Board’s and, as applicable, its committees’ agendas for the following year to monitor progress. The annual Board performance evaluation is also a primary determinant for Board tenure. Annually, the Nominating and Corporate Governance Committee reviews progress against focus areas identified in the self-evaluation. Each committee also conducts its own annual self-evaluation to assess the functioning of the committee and the effectiveness of the committee members, including the committee chair.

|

Notice and Proxy Statement 2024 7

|

Table of Contents

RISK MANAGEMENT

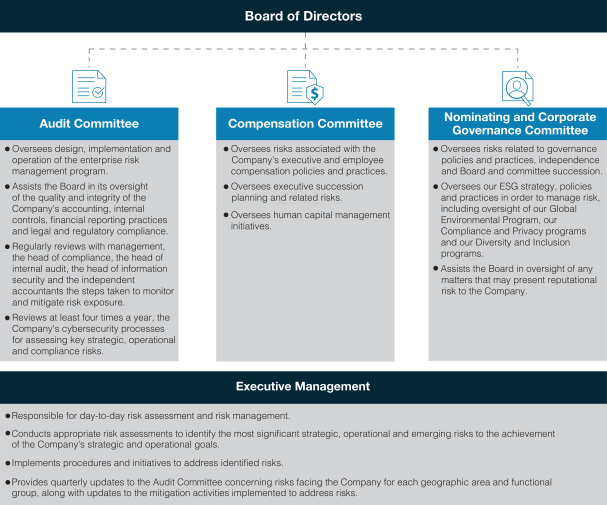

Our Board has overall responsibility for the oversight of our enterprise risk management process, which is guided by the COSO Enterprise Risk Management Framework three lines of defense model, including Operational Management as the First Line of Defense, Compliance and Information Security as the Second Line of Defense and Internal and External Audit as the Third Line of Defense. The Board sets the tone at the top as it relates to enterprise risk management and encourages management to promote a corporate culture that incorporates risk management into our corporate strategy and day-to-day operations.

Our risk management philosophy strives to:

| • | timely identify the material risks that we face; |

| • | communicate necessary information with respect to material risks to senior management and, as appropriate, to the Board or relevant Board committee; |

| • | implement appropriate and responsive risk management strategies consistent with our risk profile; and |

| • | integrate risk management into our decision-making. |

Our management conducts a formal risk assessment of the Company’s business, including probability and potential economic and reputational impact assessments, and develops mitigation actions and monitoring plans.

The Board has designated the Audit Committee to broadly oversee enterprise risk management in accordance with its charter. Under the oversight of the Audit Committee, and with the support of the Company’s compliance function and the Company’s internal and external audit functions, we operate an enterprise-wide risk management governance framework that sets standards and provides guidance for the identification, assessment, monitoring and control of the most significant risks facing the Company and that have the potential to affect stockholder value, our customers and colleagues, the communities in which we operate and the safety and soundness of the Company. The Audit Committee then reports to the Board quarterly regarding briefings provided by management and advisors, as well as the Audit Committee’s own analysis and conclusions regarding the adequacy of our risk management processes.

| 8 Notice and Proxy Statement 2024

|

|

Table of Contents

The Board also exercises its oversight of our enterprise risk management process with support from the Compensation Committee and the Nominating and Corporate Governance Committee, each of which has oversight responsibilities for risks that may fall within their areas of responsibility and expertise. For example, the Compensation Committee reviews human capital related risks, and the Nominating and Corporate Governance Committee regularly reviews ESG risks. The Board receives independent reports from each committee at its quarterly meetings.

The Board’s oversight of risk management requires close interaction between the full Board, each of its committees and executive management. The Company’s risk oversight framework and key areas of responsibility are illustrated below:

|

Notice and Proxy Statement 2024 9

|

Table of Contents

SUCCESSION PLANNING

At least annually, the Compensation Committee reviews the Company’s talent management and succession plan, including with respect to the Chief Executive Officer and other executive positions. This includes the review and evaluation of development plans for potential successors to the Chief Executive Officer role and other executive positions. As part of the Board’s ongoing succession planning processes, in December 2023, the Board, with the recommendation of the Compensation Committee, appointed David Sailer (formerly Executive Vice President, Chief Financial Officer of the Americas) to succeed Brian Coleman in the role of Executive Vice President, Chief Financial Officer of the Company, effective as of March 1, 2024.

Developing talent at all levels of the Company is a priority for us. We are focused on providing the Board with additional opportunities to interact with senior management, which gives management unique access to the Board and also facilitates a deeper understanding of the organization among the Board. The Company also offers various talent development programs throughout the organization focused on building leadership and management skills, career development and other areas.

CORPORATE GOVERNANCE

Our corporate governance practices are established and monitored by the Board. The Board, with assistance from the Nominating and Corporate Governance Committee, periodically assesses our governance practices in light of legal requirements and governance best practices.

Our primary governing documents include:

| • | Governance Guidelines |

| • | Board Committee Charters |

| ○ | Audit Committee Charter |

| ○ | Compensation Committee Charter |

| ○ | Nominating and Corporate Governance Committee Charter |

| • | Code of Business Conduct and Ethics |

These documents are available on our website at investor.clearchannel.com. We encourage our stockholders to read these documents, as we believe they illustrate our commitment to good governance practices. Certain key provisions of these documents are summarized below.

| 10 Notice and Proxy Statement 2024

|

|

Table of Contents

GOVERNANCE GUIDELINES

We operate under Governance Guidelines that set forth our corporate governance principles and practices on a variety of topics, including director qualifications, the responsibilities of the Board, independence requirements and the composition and functioning of the Board. Our Governance Guidelines are designed to maximize long-term stockholder value, align the interests of the Board and management with those of our stockholders and promote high ethical conduct among our directors. The Governance Guidelines include, but are not limited to, the following key practices to assist the Board in carrying out its responsibilities in connection with the business and affairs of Clear Channel Outdoor:

| 1. | Director Responsibilities

|

|

| The basic responsibility of a director is to exercise his or her business judgment and act in what she or he reasonably believes to be in the best interests of Clear Channel Outdoor and its stockholders. Directors are expected to attend Board meetings and meetings of committees on which they serve and to spend the time needed, and meet as frequently as necessary, to properly discharge their responsibilities. | ||

| 2. | Self-Evaluation Process

|

|

| The Board and each standing committee of the Board will conduct an annual self-evaluation to determine whether it and its committees are functioning effectively. The Nominating and Corporate Governance Committee is responsible for overseeing the self-evaluation process and for proposing any modification or alterations in Board or committee practices or procedures. | ||

| 3. | Executive Sessions of Non-Management Directors

|

|

| The non-management directors and/or the independent directors meet periodically in executive session without management participation. | ||

| 4. | Board Access to Senior Management

|

|

| Directors have complete access to Clear Channel Outdoor’s management, employees and its independent advisors for purposes of discharging their duties and responsibilities as directors and can initiate contact or meetings through the Chief Executive Officer or any other executive officer. | ||

| 5. | Board Access to Independent Advisors

|

|

| The Board and each Board committee have the power to retain independent legal, financial or other advisors as they may deem necessary, at our expense. | ||

| 6. | Board Tenure

|

|

| The Board believes that term limits on director service and a predetermined retirement age impose arbitrary restrictions on Board membership. Instead, the Board believes directors who, over a period of time, develop an insight into Clear Channel Outdoor and its operations provide an increasing contribution to Clear Channel Outdoor as a whole. The annual board performance evaluation is a primary determinant for Board tenure. | ||

| 7. | Directors Who Change Their Current Job Responsibilities

|

|

| A director who changes the nature of the job she or he held when she or he was elected to the Board shall promptly notify the Board of any such change. This does not mean that such director should necessarily leave the Board. There should, however, be an opportunity for the Board to review the continued appropriateness of Board membership under these new circumstances. | ||

| 8. | Service on Multiple Boards

|

|

| To enable the Board to assess a director’s effectiveness and any potential conflicts of interest, any director who serves on more than three other public company boards must advise the Chair in advance of accepting an invitation to serve as a member of another public company board. | ||

| 9. | Management Development and Succession Planning

|

|

| The Board or a committee of the Board will periodically consider management development and succession planning, including short-term succession planning for certain of Clear Channel Outdoor’s most senior management positions. |

|

Notice and Proxy Statement 2024 11

|

Table of Contents

BOARD COMMITTEE CHARTERS

Each standing committee of the Board operates under a written charter that has been adopted by the Board. We have three standing committees: the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee. Each committee charter sets forth the purpose, responsibilities of the respective committee and discusses matters such as committee membership requirements, number of meetings and the setting of meeting agendas. The charters are assessed at least every year, or more frequently as the applicable committee may determine, and are updated as needed. More information on the Board’s standing committees, their respective roles and responsibilities and their charters can be found under “The Board of Directors and Corporate Governance—Committees of the Board” above.

CODE OF BUSINESS CONDUCT AND ETHICS

Our Code of Business Conduct and Ethics (the “Code”) applies to our officers, directors, employees (including our principal executive officer, principal financial officer and principal accounting officer), interns, contractors and agents throughout our corporate structure. Our Code constitutes a “code of ethics”, as defined by Item 406(b) of Regulation S-K. Our Code is available on our website at investor.clearchannel.com. We intend to satisfy the disclosure requirements of Item 5.05 of Form 8-K regarding any amendment to, or waiver from, a provision of the Code that applies to our principal executive officer, principal financial officer or principal accounting officer and relates to any element of the definition of code of ethics set forth in Item 406(b) of Regulation S-K by posting such information on our website at investor.clearchannel.com.

STOCKHOLDER AND INTERESTED PARTY COMMUNICATION WITH THE BOARD

Stockholders and other interested parties may contact an individual director, the Chair of the Board, the Board as a group or a specified Board committee or group, including the non-management directors as a group, by sending regular mail to the following address:

Board of Directors

c/o Corporate Secretary

Clear Channel Outdoor Holdings, Inc.

4830 North Loop 1604W, Suite 111

San Antonio, Texas 78249

| 12 Notice and Proxy Statement 2024

|

|

Table of Contents

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Except as otherwise stated, the table below sets forth information concerning the beneficial ownership of Clear Channel Outdoor’s common stock as of March 18, 2024 for: (1) each director currently serving on our Board, all of whom are nominees for director; (2) each of our named executive officers; (3) our directors and executive officers as a group; and (4) each person known to Clear Channel Outdoor to beneficially own more than 5% of any class of Clear Channel Outdoor’s outstanding shares of common stock. At the close of business on March 18, 2024, there were 483,720,129 shares of Clear Channel Outdoor’s common stock outstanding. Except as otherwise noted, each stockholder has sole voting and investment power with respect to the shares beneficially owned.

Each share of Clear Channel Outdoor common stock is entitled to one vote on matters submitted to a vote of the stockholders. Each share of our common stock is entitled to share equally on a per-share basis in any dividends and distributions by us.

| Name and Address of Beneficial Owner(a) |

Number of Shares of Common Stock |

Percent of Common Stock(b) |

||||||

| Holders of More than 5%: |

||||||||

| PIMCO(c) |

104,796,992 | 21.7 | % | |||||

| Ares Management(d) |

55,829,046 | 11.5 | % | |||||

| The Vanguard Group(e) |

36,323,087 | 7.5 | % | |||||

| Arturo R. Moreno(f) |

32,924,370 | 6.8 | % | |||||

| BlackRock, Inc.(g) |

27,671,438 | 5.7 | % | |||||

| Legion Partners(h) |

25,948,728 | 5.4 | % | |||||

| Named Executive Officers, Executive Officers and Directors: |

|

|||||||

| Scott R. Wells(i) |

2,722,250 | * | ||||||

| Brian D. Coleman(j) |

1,326,178 | * | ||||||

| Lynn A. Feldman(k) |

873,825 | * | ||||||

| Justin Cochrane(l) |

608,967 | * | ||||||

| Jason A. Dilger(m) |

333,390 | * | ||||||

| John Dionne(n) |

382,300 | * | ||||||

| Lisa Hammitt(o) |

253,265 | * | ||||||

| Andrew Hobson(p) |

521,472 | * | ||||||

| Thomas King(q) |

511,271 | * | ||||||

| Joe Marchese(r) |

520,791 | * | ||||||

| W. Benjamin Moreland(s) |

1,390,821 | * | ||||||

| Mary Teresa Rainey(t) |

321,472 | * | ||||||

| Ted White (u) |

25,948,728 | 5.4 | % | |||||

| Jinhy Yoon |

— | — | ||||||

| All directors and executive officers as a group (14 individuals)(v) |

34,869,497 | 7.2 | % | |||||

| * | Means less than 1%. |

| (a) | Unless otherwise indicated, the address for all beneficial owners is c/o Clear Channel Outdoor Holdings, Inc., 4830 North Loop 1604W, Suite 111, San Antonio, Texas 78249. |

| (b) | Percentage of ownership calculated in accordance with Rule 13d-3(d)(1) under the Exchange Act. |

| (c) | As reported on a Schedule 13D/A filed on July 14, 2023, Pacific Investment Management Company LLC (“PIMCO”) has sole voting and investment power with respect to all the shares reported above. The address of the principal business office of PIMCO is 650 Newport Center Drive, Newport Beach, California 92660. |

|

Notice and Proxy Statement 2024 13

|

Table of Contents

| (d) | As reported on a Form 4 filed on February 2, 2023, the shares of Clear Channel Outdoor’s common stock reflected above may be deemed to be beneficially owned by one or more of the following persons: ASSF IV AIV B Holdings III, L.P., ASSF IV AIV B, L.P., ASSF Operating Manager IV, L.P., ASOF Holdings I, L.P., ASOF II Holdings I, L.P., ASOF II A (DE) Holdings I, L.P., ASOF Investment Management LLC, ACOF VI Holdings, L.P., ACOF Investment Management LLC, Ares Management LLC, Ares Management Holdings L.P., Ares Holdco LLC, Ares Management Corporation, Ares Voting LLC, Ares Management GP LLC and Ares Partners Holdco LLC. The business address of each reporting person is c/o Ares Management LLC, 2000 Avenue of the Stars, 12th Floor, Los Angeles, California 90067. |

| (e) | As reported on a Schedule 13G/A filed on February 13, 2024, The Vanguard Group, Inc. has shared voting power with respect to 223,607 shares, sole dispositive power with respect to 35,826,576 shares and shared dispositive power with respect to 496,511 shares. The business address of each reporting person is 100 Vanguard Blvd., Malvern, Pennsylvania 19355. |

| (f) | As reported on a Schedule 13D/A filed on December 6, 2023, Mr. Arturo Moreno has sole voting and investment power with respect to 32,924,370 shares of Clear Channel Outdoor’s common stock. The business address of the reporting person is 4455 E. Camelback Road, Suite C140, Phoenix, Arizona 85018. |

| (g) | As reported on a Schedule 13G/A filed January 29, 2024, Blackrock, Inc. has sole voting power with respect to 26,967,630 shares, sole dispositive power with respect to 27,671,438 shares, and the following subsidiaries are reported as having acquired the securities reported in the Schedule 13G/A BlackRock Advisors, LLC, Aperio Group, LLC, BlackRock (Netherlands) B.V., BlackRock Institutional Trust Company, National Association, BlackRock Asset Management Ireland Limited, BlackRock Financial Management, Inc., BlackRock Japan Co., Ltd., BlackRock Asset Management Schweiz AG, BlackRock Investment Management, LLC, BlackRock Investment Management (UK) Limited, BlackRock Asset Management Canada Limited, BlackRock (Luxembourg) S.A., BlackRock Investment Management (Australia) Limited, BlackRock Fund Advisors and BlackRock Fund Managers Ltd. The business address of each reporting person is BlackRock, Inc., 50 Hudson Yards, New York, New York 10001. |

| (h) | As reported on a Form 4 filed on February 20, 2024, the following persons have shared voting and investment power with respect to the following number of shares of common stock of Clear Channel Outdoor: Legion Partners, L.P. I, with respect to 21,869,019 shares, Legion Partners, L.P. II, with respect to 1,943,844 shares, Legion Partners Special Opportunities, L.P. XVI, with respect to 2,122,933 shares, Legion Partners, LLC, with respect to 25,935,796 shares, Legion Partners Asset Management, LLC, with respect to 25,947,828 shares (which includes 12,032 unvested RSUs that will vest within 60 days of March 18, 2024), and Legion Partners Holdings, LLC, Christopher S. Kiper and Ted White, with respect to 25,948,728 shares (which includes 12,032 unvested RSUs that will vest within 60 days of March 18, 2024). The business address of the reporting persons is 12121 Wilshire Blvd, Suite 1240, Los Angeles, California 90025. |

| (i) | Represents 1,843,243 shares of common stock, vested stock options representing 402,018 shares of common stock and 476,989 unvested RSUs that will vest within 60 days of March 18, 2024. Excludes 367,647 unvested performance units that could vest within 60 days of March 18, 2024, assuming they are earned at target payout. |

| (j) | Represents 1,020,094 shares of common stock and 306,084 unvested RSUs that will vest within 60 days of March 18, 2024. Excludes 291,666 unvested performance units that could vest within 60 days of March 18, 2024, assuming they are earned at target payout. |

| (k) | Represents 657,916 shares of common stock, vested stock options representing 11,043 shares of common stock and 204,866 unvested RSUs that will vest within 60 days of March 18, 2024. Excludes 225,490 unvested performance units that could vest within 60 days of March 18, 2024, assuming they are earned at target payout. |

| (l) | Represents 449,227 shares of common stock, vested stock options representing 9,549 shares of common stock and 150,191 unvested RSUs that will vest within 60 days of March 18, 2024. Excludes 88,235 unvested performance units that could vest within 60 days of March 18, 2024, assuming they are earned at target payout. |

| (m) | Represents 240,845 shares of common stock, vested stock options representing 9,632 shares of common stock and 82,913 unvested RSUs that will vest within 60 days of March 18, 2024. Excludes 75,490 unvested performance units that could vest within 60 days of March 18, 2024, assuming they are earned at target payout. |

| (n) | Represents 369,266 shares of common stock and 13,034 unvested RSUs that will vest within 60 days of March 18, 2024. |

| (o) | Represents 253,265 shares of common stock held by Ms. Hammitt as of March 18, 2024. |

| (p) | Represents 521,472 shares of common stock held by Mr. Hobson as of March 18, 2024. |

| (q) | Represents 498,571 shares of common stock and 12,700 unvested RSUs that will vest within 60 days of March 18, 2024. |

| (r) | Represents 508,425 shares of common stock and 12,366 unvested RSUs that will vest within 60 days of March 18, 2024. |

| (s) | Represents 1,374,110 shares of common stock and 16,711 unvested RSUs that will vest within 60 days of March 18, 2024. |

| (t) | Represents 321,472 shares of common stock held by Ms. Rainey as of March 18, 2024. |

| (u) | Mr. White is the Co-Founder and a Managing Director of Legion Partners Asset Management, LLC and has shared voting and investment power with respect to the shares of common stock reported by Legion Partners as set forth in footnote (h) above. |

| (v) | As of March 18, 2024, includes common stock beneficially owned by all of our directors and executive officers as a group (which group excludes Brian Coleman who ceased being an executive officer on March 1, 2024 and includes David Sailer who became an executive officer on such date) as follows: (1) 7,389,330 shares of common stock held by such persons (excluding shares beneficially owned by Ted White); (2) 25,948,728 shares beneficially owned by Ted White as set forth in footnotes (h) and (u) above; (3) vested stock options representing 456,252 shares of common stock; and (4) 1,075,187 RSUs that will vest within 60 days after March 18, 2024 (excluding RSUs beneficially owned by Ted White). Excludes 835,293 unvested performance units that could vest within 60 days of March 18, 2024 assuming they are earned at target payout. |

| 14 Notice and Proxy Statement 2024

|

|

Table of Contents

PROPOSAL 1: ELECTION OF DIRECTORS

The Board has nominated the persons listed below as nominees for election as directors at the Annual Meeting. All nominees are currently directors and are standing for re-election, except for Mr. White who was appointed to the Board on January 31, 2024 and is submitted to election by our stockholders for the first time at the Annual Meeting. Pursuant to our Certificate of Incorporation, each director will be elected for a one-year term annually. Accordingly, the directors elected at the Annual Meeting will serve a one-year term until the annual meeting of stockholders in 2025 or until her or his successor shall have been elected and qualified, subject to earlier death, resignation or removal. The directors are to be elected by a plurality of the votes cast at the Annual Meeting. Each nominee has indicated a willingness to serve as director if elected. Should any nominee become unavailable for election or be unable to serve for good cause, discretionary authority is conferred on the proxies to vote for a substitute. Management has no reason to believe that any nominee will be unable or unwilling to serve if elected.

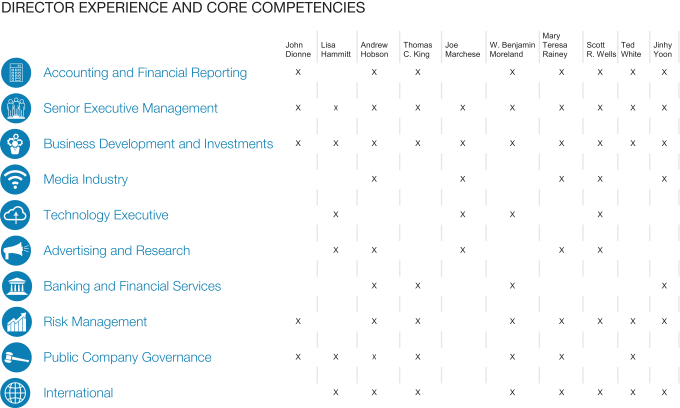

Our directors, all of whom are director nominees, are from diverse professional backgrounds and possess the relevant combination of experience, skills and qualifications that contribute to a well-functioning board that is equipped to oversee the Company’s business and represent stockholder interests through sound judgment and utilizing the group’s varied experience. The diversity of characteristics, expertise, skills and experiences that the Nominating and Corporate Governance Committee and the Board seek in the composition of the Board, as well as the individual experiences, skills and characteristics of our Board members, are highlighted in the following charts and director qualifications matrix.

|

Notice and Proxy Statement 2024 15

|

Table of Contents

| 16 Notice and Proxy Statement 2024

|

|

Table of Contents

The following information, which is as of March 18, 2024, is furnished with respect to each of the nominees for election at the Annual Meeting.

The Board recommends that you vote “FOR” all director nominees. Properly submitted proxies will be so voted unless stockholders specify otherwise.

|

Director

Age: 60

Board Committees: • Audit • Nominating and |

John Dionne

Mr. Dionne has served as Senior Advisor to the Blackstone Group L.P. (NYSE: BX), an investment firm, since July 2013 and as a Senior Lecturer in the Finance Unit at the Harvard Business School since January 2014. He previously served as a director of Caesars Entertainment Corporation (NASDAQ: CZR), a large casino-entertainment company, from October 2017 to July 2020, and currently serves as a director of Cengage Learning Holdings II, Inc. Until he retired from his position as a Senior Managing Director of Blackstone, Mr. Dionne was most recently Global Head of its Private Equity Business Development and Investor Relations Groups and served as a member of Blackstone’s Private Equity and Valuation Committees. Mr. Dionne originally joined Blackstone in 2004 as the Founder and Chief Investment Officer of the Blackstone Distressed Securities Fund. Mr. Dionne began his career with PricewaterhouseCoopers.

Qualifications and Expertise Provided to Our Board

• Extensive financial experience, including overall leadership of global fundraising efforts of over $25 billion for private equity investment vehicles at Blackstone Group L.P., and management of Blackstone Distressed Securities Firm with peak assets under management of over $2 billion, which provide valuable insights to the Company. • Previously was a Chartered Financial Analyst and Certified Public Accountant. • Significant experience as a director of companies and not-for-profit institutions.

Education

• B.S. Magna Cum Laude in Accounting, Economics and Finance, The University of Scranton • M.B.A., academic honors, Harvard Business School |

|

|

Notice and Proxy Statement 2024 17

|

Table of Contents

|

Director

Age: 61

Board Committees: • Compensation • Nominating and |

Lisa Hammitt

Ms. Hammitt has served as Chairwoman of the board of directors of Intelsat, S.A., a multinational satellite services provider headquartered in Luxembourg, since March 2022. Previously, Ms. Hammitt served as the Executive Vice President, Artificial Intelligence and Chief Technology Officer at Davidson Technologies from September 2020 to December 2022. Prior to joining Davidson Technologies, Ms. Hammitt served as the Global Vice President, Data and Artificial Intelligence at VISA Inc. (NYSE: V), a leading global credit card processing and data services company, from December 2017 to June 2020. Ms. Hammitt served as the Chief Executive Officer and Founder of Beseeq, Inc., an artificial intelligence-driven advertising start-up, from September 2016 to December 2017. Ms. Hammitt served as Vice President of Cloud Marketplace and SaaS at IBM Corporation (NYSE: IBM), a multinational computer hardware, software and service company, from June 2015 to August 2016. Prior to IBM, Ms. Hammitt was a Vice President of Business Operations for Salesforce Community Cloud, an online brand platform of Salesforce, Inc. (NYSE: CRM), a leading SaaS services company, from August 2012 to May 2015. Before Salesforce, she headed mergers and acquisitions in Information Management and Cloud Computing at IBM and HP Inc. (NYSE: HPQ). Ms. Hammitt currently serves as a member of the boards of QuSecure, Auterion and Archetype AI. Ms. Hammitt also holds an advisor seat at Brighton Park Capital, an investment firm specializing in software, information services and technology-enabled services.

Qualifications and Expertise Provided to Our Board

• Broad experience and knowledge base in artificial intelligence and advertising. • Track record of developing $100 million+ businesses. • Broad executive experience in various roles at multinational companies.

Education

• B.A. in French and B.A. in Economics, University of California, Berkely • Graduate Coursework in Artificial Intelligence, Stanford University • Executive Education, Harvard Business School |

| 18 Notice and Proxy Statement 2024

|

|

Table of Contents

|

Director

Age: 62

Board Committees: • Audit

|

Andrew Hobson

Mr. Hobson has served as Partner and Chief Financial Officer at Innovatus Capital Partners, LLC, a private investment firm, since January 2016. From 1994 to 2015, Mr. Hobson served in various roles at Univision Communications Inc. (now known as TelevisaUnivision, Inc.), a television and radio broadcasting company, including Senior Executive Vice President and Chief Financial Officer from October 2007 through February 2015, during which time he was responsible for all financial aspects of the company. Prior to his employment at Univision, Mr. Hobson served as a Principal at Chartwell Partners LLC from 1990 to 1994. Mr. Hobson has served as chairman of the board of directors of Cumulus Media, Inc. (NASDAQ: CMLS), a prominent audio-first media and entertainment company, since June 2018.

Qualifications and Expertise Provided to Our Board

• Extensive experience in the media industry. • Deep experience in finance and accounting, including leading and structuring transactions in capital structures across varying economic cycles, and overseeing financial reporting, tax, capital allocation, financial and strategic planning. • Strong experience and service as a public company board member, including as chairman. • 30-year career building and leading teams of finance executives and raising billions in debt and equity financing.

Education

• B.S.E in Finance and B.S.E in Accounting, magna cum laude, University of Pennsylvania, The Wharton School |

|

|

Notice and Proxy Statement 2024 19

|

Table of Contents

|

Director

Age: 63

Board Committees: • Compensation

|

Thomas C. King