EX-99.4

Published on February 4, 2019

Exhibit 99.4

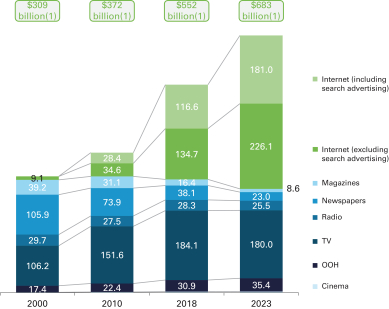

Headwinds Facing Other Media. Because we do not use content to attract audiences, we are not subject to the same headwinds as many other media. According to data published by Magna Global, since the emergence of the internet in the late 1990s, online advertising has gained market share from traditional content-based mediums. Initially, online advertising gained market share mostly from newspapers and magazines, but more recently it has also gained market share from television in some markets, as the internet has begun to provide alternative sources of content. We believe the outdoor advertising market is relatively distinct because it does not rely on content, such as news, television shows or editorials, to attract an audience and then interrupt that content with advertising messages. The following chart illustrates the evolution of global media revenue between 2000 and 2018 and its forecast through 2023. As evidenced by the chart, throughout the internet-driven transformation of the advertising ecosystem, the strengths of outdoor advertising have kept it relatively immune to the fragmentation of audiences.

| (1) | Total global media market size in the U.S.. |

Source: Magna Global January 2019 Advertising Revenue Forecasts.

We also anticipate that, while the proliferation of content and distribution models will continue to fragment content-based media audiences, outdoor advertisings distinct model will remain relatively immune to this trend. According to Magna Global, outdoor advertisings compounded annual growth rate is expected to be 2.8% between 2018 and 2023.

Outdoor advertisings share of the advertising market varies by country based on a number of factors, including regulation, sophistication, sociocultural aspects and historic media buying trends. Historically, outdoor advertising has had a larger market share in Western Europe (approximately 8% of the media mix, excluding search advertising, according to Magna Global) than in the United States (approximately 5%, excluding search advertising, according to Magna Global). We believe this is the result of the more urban nature of the outdoor advertising market in Europe.

1

We identified a material weakness in our internal control over financial reporting as of December 31, 2017 and are currently in the process of evaluating the effectiveness of such control as of December 31, 2018

We had a material weakness as of December 31, 2017 resulting from a failure to maintain effective internal control over financial reporting or effective disclosure controls and procedures, both of which are requirements of the Exchange Act, as of that date. The material weakness related to our failure to detect the misappropriation of funds by an employee of Clear Media Limited, an indirect, non-wholly-owned subsidiary of ours whose ordinary shares are listed on the Hong Kong Stock Exchange. Although we concluded that the amount misappropriated was not material to our financial statements, it is possible that the internal controls in place on that date would not have detected a larger misappropriation that would have been material to our financial statements. We have implemented additional controls to remediate the material weakness.

Our management and our independent registered public accounting firm are in the process of assessing whether our internal control over financial reporting and effective disclosure controls and procedures were effective as of December 31, 2018. Because this process is ongoing, there can be no assurance that our management and our independent public accounting firm will determine that we have effectively remediated our previous material weakness. In addition, despite our efforts, we may identify additional related or unrelated material weaknesses or significant deficiencies in the future. If our internal control over financial reporting or our disclosure controls and procedures are not effective, we may not be able to accurately report our financial results, prevent fraud or file our periodic reports in a timely manner, which may cause investors to lose confidence in our reported financial information and may lead to a decline in our stock price.

2