EX-99.1

Published on July 21, 2020

Exhibit 99.1

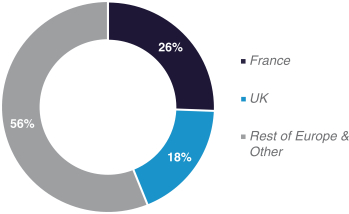

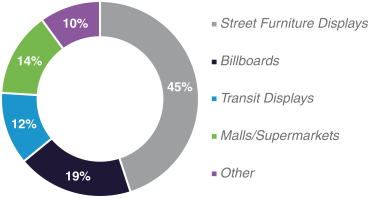

The charts below summarize the breakdown of our revenue by geography and product offering for the year ended December 31, 2019. For a description of the major markets in which we operate, see BusinessOur Major Markets.

Revenue Breakdown By Country (2019)

Revenue by Product Offering (2019)

1

Impact of the COVID-19 Pandemic

On March 11, 2020, the COVID-19 outbreak was characterized as a pandemic by the World Health Organization. In an effort to slow the pandemic, governments around the world placed significant restrictions on travel and closed businesses, resulting in unprecedented nationwide lock-downs. Our business, along with the global economy, has been adversely affected by these developments, which have resulted in a significant reduction in time spent out of the home by consumers, reductions in consumer spending, large declines in GDP, volatile economic conditions, and business disruptions across markets globally. The full magnitude and duration of the pandemic and the resulting downturn and their impact on our business is difficult to predict.

To better ensure the health, safety and wellbeing of our employees and their families during this extraordinary time, we initially transitioned a significant portion of our employees to work from home in Italy in early March, and expanded this directive globally by the end of March. We believe these teams were able to make the shift to a remote work environment relatively seamlessly. Our advertising inventory has been used to facilitate messages of support to medical teams, first responders, delivery professionals, food service workers, and many other key workers in all parts of the world. In addition, we have provided support to governments in helping remind citizens to observe restrictions and how to stay safe.

Markets in Europe have experienced dramatic declines in customer demand as a result of COVID-19. The downward impact across some European markets started to be felt in early March, corresponding with governments issuing advice on lockdowns in markets such as Italy, France and Spain. That downward impact continued across all European markets for the majority of the second quarter. In France, our largest market, the lockdown was announced mid-March and resulted in a sharp downturn in advertising spend at the end of the first quarter. In the U.K., our second largest market, the country entered full lockdown in the last week of March.

As a result, since March, there has been a significant decline in our customers near-term demand as they have deferred buying decisions and reduced marketing spend. The impact of COVID-19 and the protocols

2

implemented around the world significantly affected the behavior and movement of consumers and our customers target audiences. Transit was the hardest hit with many people avoiding public transport for health and safety reasons. The scale and speed with which near-term demand declined, and the number of requests we received to defer or cancel contracts, has been unprecedented. We have taken, and will continue to take, steps to ensure the continuity of our platform and operations to serve our customers as local conditions permit.

In May, as new daily cases continued to fall in Europe, European countries started to gradually reopen their businesses and lift restrictions, helping mobility recover toward pre-COVID-19 levels. Following the continued return to normalized traffic levels, we are experiencing not only an uptick in bookings but also a shift in behavior from our customers, with lead time from booking to display now shorter than normal. With our high proportion of roadside advertising, we believe we are well positioned to capture the recovery in walking and driving and the resulting audience exposure to our assets.

It is unclear when an economic recovery could start and what a recovery will look like as countries emerge from this unprecedented shutdown of the global economy. In light of the rapidly-evolving impact of the COVID-19 pandemic, the magnitude and duration of its impact on our results of operations and overall financial performance will not be known until future periods. We anticipate significant adverse effects throughout our business during the remainder of the year. This is largely due to customers deferring buying decisions and reducing marketing spend.

We have taken a highly disciplined approach in managing the use of our cash through this period. We have implemented extensive cost saving initiatives, including reductions in operating costs and capital expenditures. We have taken steps that we believe will most effectively support our advertising partners to take quick advantage of renewed opportunities for connection with their customers as the pandemic restrictions begin to relax. Sales teams have been in active discussions with customers to develop advertising plans as restrictions are lifted. Importantly, we believe technology investments made before the pandemic, specifically in expanding our digital footprint, will serve to position our businesses to meet our customers needs. We believe that the depth of our digital inventory provides the flexibility to quickly accelerate advertising campaigns and most effectively target audiences at the right time for our advertisers. However, a second wave of the virus may result in changes or delays in our customers advertising plans, causing further adverse effects on our results.

Recent Developments

Our unaudited interim financial statements for the three months ended June 30, 2020 are unavailable at this time because our financial closing procedures are not yet complete. However, our results will be adversely impacted by the COVID-19 pandemic.

Our preliminary estimated range of revenue for the three months ended June 30, 2020 is expected to be between $100 million and $115 million. In addition, we expect our Adjusted EBITDA for the three months ended June 30, 2020 to be substantially negative and we do not expect to achieve positive Adjusted EBITDA for the year ended December 31, 2020.

These estimates may differ from actual results. Actual results remain subject to the completion of our quarter-end closing process, which includes a final review by our management. During the course of the preparation of the financial statements and related notes and our final review, additional items that require material adjustments to the preliminary revenue estimate presented above may be identified. Therefore, you should not place undue reliance upon these preliminary financial results. See the sections titled Risk Factors and Forward-Looking Statements for additional information regarding factors that could result in differences between the preliminary estimate of our revenue and the actual revenue we will report for the three months ended June 30, 2020.

3

The preliminary revenue estimate for the three months ended June 30, 2020 presented above has been prepared by, and is the responsibility of, management. Ernst & Young LLP, our independent auditors, has not audited, reviewed, compiled or performed any procedures with respect to such preliminary information. Accordingly, Ernst & Young LLP does not express an opinion or any other form of assurance with respect thereto.

4

SUMMARY HISTORICAL CONSOLIDATED FINANCIAL DATA

The following table sets forth summary historical consolidated financial data as of the dates and for the periods indicated. The summary historical consolidated financial data for the years ended December 31, 2019, 2018 and 2017, and as of December 31, 2019 and 2018, are derived from our audited consolidated financial statements, which are included elsewhere in this offering circular. The summary historical consolidated financial data for the three months ended March 31, 2020 and 2019 and as of March 31, 2020, are derived from our unaudited consolidated financial statements, which are included elsewhere in this offering circular. The summary historical consolidated financial data as of December 31, 2017 and March 31, 2019 are derived from our audited and unaudited consolidated financial statements, respectively, which are not included in this offering circular. In the opinion of management, the interim financial data reflects all adjustments (consisting only of normal and recurring adjustments) necessary for a fair presentation of the results for the interim periods. The summary historical financial information for the twelve months ended March 31, 2020, is not presented in accordance with GAAP and is derived by adding the historical financial information for the unaudited three months ended March 31, 2020 to the historical financial information for the year ended December 31, 2019 and subtracting the historical financial information for the unaudited three months ended March 31, 2019. The summary historical financial information for the twelve months ended March 31, 2020 has been included in this offering circular in order to provide investors with information for the latest practicable twelve-month period. Historical results are not necessarily indicative of the results to be expected for future periods and the interim results are not necessarily indicative of the results that may be expected for the full year.

The summary historical consolidated financial and other data should be read in conjunction with Risk Factors, Offering Circular SummaryImpact of COVID-19 Pandemic, Managements Discussion and Analysis of Financial Condition and Results of Operations, and our consolidated financial statements and the related notes thereto included elsewhere in this offering circular. The amounts in the tables may not sum due to rounding.

| (U.S. dollars in thousands) |

Three Months Ended March 31, |

Years Ended December 31, |

Twelve Months Ended March 31, |

|||||||||||||||||||||

| 2020 | 2019 | 2019 | 2018 | 2017 | 2020 | |||||||||||||||||||

| (unaudited) | (unaudited) | (unaudited) | ||||||||||||||||||||||

| Results of Operations Data: |

||||||||||||||||||||||||

| Revenue (1) |

$ | 211,690 | $ | 243,896 | $ | 1,111,770 | $ | 1,173,616 | $ | 1,079,257 | $ | 1,079,564 | ||||||||||||

| Operating expenses: |

||||||||||||||||||||||||

| Direct operating expenses |

173,596 | 173,908 | 742,377 | 778,344 | 733,180 | 742,065 | ||||||||||||||||||

| Selling, general and administrative expenses |

53,131 | 55,205 | 235,822 | 257,125 | 233,823 | 233,748 | ||||||||||||||||||

| Corporate expenses |

8,694 | 8,425 | 28,285 | 35,736 | 49,907 | 28,554 | ||||||||||||||||||

| Depreciation and amortization |

20,356 | 19,017 | 80,642 | 83,480 | 75,867 | 81,981 | ||||||||||||||||||

| Impairment charges |

| | | | 4,159 | | ||||||||||||||||||

| Other operating income (expense)net |

(2,340 | ) | (377 | ) | 2,744 | 3,436 | 7,115 | 781 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Operating income (loss) |

(46,427 | ) | (13,036 | ) | 27,388 | 22,367 | (10,564 | ) | (6,003 | ) | ||||||||||||||

| Interest expensenet |

2,583 | 12,238 | 36,878 | 48,566 | 38,934 | 27,223 | ||||||||||||||||||

| Loss on extinguishment of debt |

| | 10,961 | | | 10,961 | ||||||||||||||||||

| Other income (expense)net |

(17,456 | ) | (2,646 | ) | 170 | (9,366 | ) | (3,081 | ) | (14,640 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

5

| (U.S. dollars in thousands) |

Three Months Ended March 31, |

Years Ended December 31, |

Twelve Months Ended March 31, |

|||||||||||||||||||||

| 2020 | 2019 | 2019 | 2018 | 2017 | 2020 | |||||||||||||||||||

| (unaudited) | (unaudited) | (unaudited) | ||||||||||||||||||||||

| Net income (loss) from continuing operations before income taxes |

(66,466 | ) | (27,920 | ) | (20,281 | ) | (35,565 | ) | (52,579 | ) | (58,827 | ) | ||||||||||||

| Income tax expense |

7,441 | 877 | 63,717 | 4,483 | 6,496 | 70,281 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Consolidated net loss |

(73,907 | ) | (28,797 | ) | (83,998 | ) | (40,048 | ) | (59,075 | ) | (129,108 | ) | ||||||||||||

| Less amount attributable to noncontrolling interest |

3 | 1 | 2 | 92 | 51 | 4 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net loss attributable to the Company |

(73,910 | ) | (28,798 | ) | (84,000 | ) | (40,140 | ) | (59,126 | ) | (129,112 | ) | ||||||||||||

| Other comprehensive income (loss), net of tax |

1,610 | 6,557 | 26,069 | 41,582 | (60,925 | ) | 21,122 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Comprehensive income (loss) |

(72,300 | ) | (22,241 | ) | (57,931 | ) | 1,442 | (120,051 | ) | (107,990 | ) | |||||||||||||

| Less amount attributable to noncontrolling interest |

(6 | ) | (15 | ) | (29 | ) | (28 | ) | 78 | (20 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Comprehensive income (loss) attributable to the Company |

$ | (72,294 | ) | $ | (22,226 | ) | $ | (57,902 | ) | $ | 1,470 | $ | (120,129 | ) | $ | (107,970 | ) | |||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Cash Flow Data: |

||||||||||||||||||||||||

| Capital expenditures |

$ | 10,096 | $ | 11,934 | $ | 85,800 | $ | 63,967 | $ | 87,586 | $ | 83,962 | ||||||||||||

| Net cash provided by (used for) operating activities |

19,233 | 19,541 | 71,135 | 88,692 | 41,433 | 70,827 | ||||||||||||||||||

| Net cash provided by (used for) investing activities |

(9,758 | ) | (11,974 | ) | (75,494 | ) | (62,259 | ) | (90,349 | ) | (73,278 | ) | ||||||||||||

| Net cash provided by (used for) financing activities |

(285 | ) | (6,284 | ) | 6,784 | (15,793 | ) | (868 | ) | 12,783 | ||||||||||||||

| Other Financial Data: |

||||||||||||||||||||||||

| Adjusted EBITDA (1) |

(21,072 | ) | 9,601 | 123,369 | 119,849 | 75,326 | 92,696 | |||||||||||||||||

| Other Adjusted Financial Data: |

||||||||||||||||||||||||

| Ratio of senior debt to Adjusted EBITDA after giving effect to the notes offered hereby (1)(2) |

3.24x | |||||||||||||||||||||||

| First lien leverage ratio after giving effect to the notes offered |

3.24x | |||||||||||||||||||||||

| Secured leverage ratio after giving effect to the notes offered |

3.24x | |||||||||||||||||||||||

| Selected Balance Sheet Data (at end of period): |

||||||||||||||||||||||||

| Cash and cash equivalents |

$ | 43,262 | $ | 31,572 | $ | 34,498 | $ | 28,227 | $ | 21,250 | ||||||||||||||

| Current assets |

337,565 | 356,539 | 407,695 | 401,125 | 398,543 | |||||||||||||||||||

| Property, plant and equipmentnet |

280,540 | 280,629 | 295,638 | 290,803 | 310,128 | |||||||||||||||||||

| Total assets |

1,500,469 | 1,799,385 | 1,592,380 | 1,248,508 | 1,277,574 | |||||||||||||||||||

| Current liabilities |

563,411 | 578,277 | 587,445 | 420,112 | 398,693 | |||||||||||||||||||

| Related party notes payable (3) |

300,684 | 1,041,849 | 301,965 | 1,047,802 | 1,079,899 | |||||||||||||||||||

| Shareholders equity (deficit) |

162,935 | (711,959 | ) | 236,610 | (703,717 | ) | (707,369 | ) | ||||||||||||||||

6

| (1) | We define Adjusted EBITDA as consolidated net loss, plus: income tax expense, net; all non-operating expenses (income), including other (income) expense, net, loss on extinguishment of debt, and interest expense, net; other operating (income) expense, net; impairment charges; depreciation and amortization; non-cash compensation expenses; and restructuring and other costs included within operating expenses. Restructuring and other costs include costs associated with cost savings initiatives such as severance, consulting and termination costs, and other special costs. Adjusted EBITDA is a non-GAAP financial measure. Generally, a non-GAAP financial measure is a numerical measure of a companys performance, financial position or cash flows that either excludes or includes amounts that are not normally included or excluded in the most directly comparable measure calculated and presented in accordance with GAAP. Adjusted EBITDA does not represent and should not be considered as alternatives to net income or cash flow from operations, as determined under GAAP. We believe that Adjusted EBITDA provides investors with helpful information with respect to our operations. We present Adjusted EBITDA to provide additional information with respect to our ability to meet our future debt service, capital expenditures and working capital requirements. |

The following table summarizes the calculation of our historical Adjusted EBITDA and provides a reconciliation to our consolidated net income (loss) for the periods indicated:

| (U.S. dollars in thousands) |

Three Months Ended March 31, |

Years Ended December 31, |

Twelve Months Ended March 31 |

|||||||||||||||||||||

| 2020 | 2019 | 2019 | 2018 | 2017 | 2020 | |||||||||||||||||||

| (unaudited) | (unaudited) | (unaudited) | ||||||||||||||||||||||

| Consolidated net loss |

$ | (73,907 | ) | $ | (28,797 | ) | $ | (83,998 | ) | $ | (40,048 | ) | $ | (59,075 | ) | $ | (129,108 | ) | ||||||

| Interest expense, net |

2,583 | 12,238 | 36,878 | 48,566 | 38,934 | 27,223 | ||||||||||||||||||

| Income tax expense |

7,441 | 877 | 63,717 | 4,483 | 6,496 | 70,281 | ||||||||||||||||||

| Depreciation and amortization |

20,356 | 19,017 | 80,642 | 83,480 | 75,867 | 81,981 | ||||||||||||||||||

| Other (income) expense, net |

17,456 | 2,646 | (170 | ) | 9,366 | 3,081 | 14,640 | |||||||||||||||||

| Loss on extinguishment of debt |

| | 10,961 | | | 10,961 | ||||||||||||||||||

| Other operating (income) expense, net |

2,340 | 377 | (2,744 | ) | (3,436 | ) | (7,115 | ) | (781 | ) | ||||||||||||||

| Impairment charges |

| | | | 4,159 | | ||||||||||||||||||

| Share-based compensation |

574 | 230 | 1,736 | 2,658 | 2,227 | 2,080 | ||||||||||||||||||

| Restructuring and other costs |

2,085 | 3,013 | 16,347 | 14,780 | 10,752 | 15,419 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Adjusted EBITDA |

$ | (21,072 | ) | $ | 9,601 | $ | 123,369 | $ | 119,849 | $ | 75,326 | $ | 92,696 | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| (2) | Our ratio of senior debt to Adjusted EBITDA is calculated by dividing the aggregate principal amount of our senior indebtedness to our Adjusted EBITDA for the trailing twelve month period. Our first lien leverage ratio is calculated by dividing the aggregate principal amount of our indebtedness that is secured by liens on the Collateral ranking pari passu with the liens securing the notes to our Adjusted EBITDA for the trailing twelve month period. Our secured leverage ratio is calculated by dividing the aggregate principal amount of our indebtedness that is secured by liens on the Collateral to our Adjusted EBITDA for the trailing twelve month period. For purposes of all three ratios, the aggregate principal amount of our indebtedness is calculated net of up to $50 million in unrestricted cash, and does not reflect indebtedness outstanding under the related party notes payable (including the French Intercompany Notes, which will not be subordinated to the notes offered hereby). See Description of the Notes for further information regarding such ratios, and footnote (3) below and Certain Relationships and Related Party TransactionsRelated Party Notes Payable for further information regarding the related party notes payable. |

7

| (3) | In connection with this offering, and immediately prior to the closing, certain wholly-owned subsidiaries of the Issuer that are borrowers under related party notes payable to subsidiaries of Parent will capitalize interest payments due under the related party notes payable and extend the maturity date of the related party notes payable to , 2025, and certain of these related party notes payable will be subordinated to the notes offered hereby. The French Intercompany Notes will not be subordinated, but payments made under these obligations are offset in full by corresponding cash contributions to the Issuers other subsidiaries, such that any payments do not have any net impact on the amount of cash available to the Issuer and its subsidiaries taken as a whole. Of the $300.7 million outstanding as of March 31, 2020, $221.8 million would have been subordinated to the notes offered hereby and $78.9 million outstanding under the French Intercompany Notes would not have been subordinated. |

8

MANAGEMENTS DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

You should read the following discussion of our results of operations and financial condition together with the information included under Offering Circular SummarySummary Historical Consolidated Financial Data and the consolidated financial statements and related notes included elsewhere in this offering circular. This discussion contains forward-looking statements and involves numerous risks and uncertainties, including, but not limited to, those described under Forward-Looking Statements and Risk Factors. Actual results may differ materially from those contained in any forward-looking statements.

Managements discussion and analysis of our financial condition and results of operations (MD&A) should be read in conjunction with the audited consolidated financial statements and related notes included elsewhere in this document. In this MD&A, references to (i) we, us and our are to Clear Channel International B.V. together with its consolidated subsidiaries, (ii) Issuer are to Clear Channel International B.V. without any of its subsidiaries, (iii) Parent and CCOH are to Clear Channel Outdoor Holdings, Inc., our indirect parent company, and (iv) iHeartCommunications are to iHeartCommunications, Inc., the indirect parent of Parent until the Separation on May 1, 2019. Certain prior period amounts included herein have been reclassified to conform to the current period presentation.

This discussion contains forward-looking statements that are subject to risks and uncertainties, and actual results may differ materially from those contained in any forward-looking statements.

Overview

Separation from iHeartCommunications

Prior to May 1, 2019, Parent was indirectly owned by iHeartCommunications and its parent company, iHeartMedia through Clear Channel Holdings, Inc. (CCH), a wholly-owned subsidiary of iHeartCommunications. Historically, Parents relationship with iHeartCommunications was governed by several agreements (the Intercompany Agreements) related to corporate, employee, tax and other services provided by iHeartCommunications to CCOH and its subsidiaries, including us. Certain of these costs, as applicable, were allocated to us from Parent, as further described in Results of Operations below.

On March 14, 2018, iHeartMedia and certain of its subsidiaries filed voluntary petitions for relief under Chapter 11 of the U.S. Bankruptcy Code. There were no material effects on our financial statements related to the iHeart Chapter 11 Cases as none of our subsidiaries or operations were guarantors of iHeartCommunications debt, nor were there any cross-default provisions that affected us as a result of iHeartCommunications default on its debt. On May 1, 2019 (the Effective Date), iHeartMedia emerged from bankruptcy, and CCH, CCOH and its subsidiaries, including the Company, were separated from, and ceased to be controlled by, iHeartMedia (the Separation). CCOH then merged with and into CCH (the Merger), with CCH surviving the Merger, becoming the successor to CCOH and changing its name to Clear Channel Outdoor Holdings, Inc.

In connection with the Separation, the Intercompany Agreements with iHeartCommunications were terminated, and Parent entered into a Transition Services Agreement (TSA) with iHeartCommunications for one year from the Effective Date (subject to certain rights of the Company to extend up to one additional year). Parent may terminate the TSA with respect to all or any individual service, in whole or in part, upon 30 days prior written notice, provided that any co-dependent services must be terminated concurrently.

Description of Our Business

Our revenue is derived from selling advertising space on the displays we own or operate in key markets in Europe and Singapore, consisting primarily of digital and traditional street furniture displays, billboards, transit displays and retail displays.

9

We own the majority of our advertising displays, which typically are located on sites that we either lease or own or for which we have acquired permanent easements. The significant expenses associated with our operations include site lease expenses, as well as maintenance and installation expenses. Our site lease expenses include lease payments for use of the land under our displays, as well as any revenue-sharing arrangements or minimum guaranteed amounts payable under our long-term display contracts. Our maintenance and installation expenses include costs for transporting and changing the advertising copy on our displays; related labor costs; vinyl costs, which vary according to the complexity of the advertising copy and the quantity of displays; electricity costs and costs cleaning and maintaining our displays.

Macroeconomic Indicators, Seasonality and Recent Developments

Advertising revenue is correlated to changes in gross domestic product (GDP) as advertising spending has historically trended in line with GDP within each market. Additionally, our results are impacted by the economic conditions in the markets in which we have operations and fluctuations in foreign currency exchange rates.

We typically experience our lowest financial performance in the first quarter of the calendar year, which has historically resulted in a loss from operations in that period. This is generally offset during the remainder of the year, as we typically experience our strongest performance in the second and fourth quarters of the calendar year.

In December 2019, it was first reported that there had been an outbreak of COVID-19 in China, which subsequently spread to most countries around the globe. In March 2020, the World Health Organization characterized the COVID-19 outbreak as a pandemic, which is still ongoing. In an effort to slow the outbreak, governments around the world placed significant restrictions on travel and closed businesses, resulting in unprecedented nationwide lock-downs. Although most lock-downs have been or are in the process of being lifted, our business, along with the global economy, has been adversely affected by these developments. Since the onset of the crisis in March, we have experienced a sharp decline in bookings and received an unprecedented level of requests to defer or cancel current contracts as customers seek to conserve cash during the economic downturn. The extent to which COVID-19 will ultimately impact our results will depend on future developments, which are highly uncertain, but the curtailed customer demand we have experienced and are continuing to experience could materially adversely impact our business, results of operations and overall financial performance in future periods.

We are closely monitoring the spread of COVID-19 and its impact on our global business, and we have implemented specific actions to strengthen our financial position and support the continuity of our platform and operations. We believe that the combination of these initiatives and cash available to us will improve our liquidity position and provide us with additional flexibility during the economic downturn; however, given the quickly evolving economic environment, continuing downward pressure we are currently seeing, and the uncertainty around how long the economic downturn and its impact on our business will last, we are unable to accurately forecast future results.

Results of Operations

Revenue and expenses excluding the impact of movements in foreign exchange rates in this MD&A are presented because management believes that viewing certain financial results without the impact of fluctuations in foreign currency rates facilitates period-to-period comparisons of business performance and provides useful information. Revenue and expenses excluding the impact of movements in foreign exchange rates are calculated by converting the current periods revenue and expenses in local currency to U.S. dollars using average foreign exchange rates for the prior period.

Three months ended March 31, 2020 Compared to Three Months Ended March 31, 2019

Due to seasonality and uncertainty surrounding COVID-19, the results for the interim period are not indicative of expected results for the full year.

10

The comparison of our historical results of operations for the three months ended March 31, 2020 to the three months ended March 31, 2019 is as follows:

| (in thousands) | Three Months Ended March 31, |

% Change |

||||||||||

| 2020 | 2019 | |||||||||||

| Revenue |

$ | 211,690 | $ | 243,896 | (13.2 | )% | ||||||

| Operating expenses: |

||||||||||||

| Direct operating expenses (excludes depreciation and amortization) |

173,596 | 173,908 | (0.2 | )% | ||||||||

| Selling, general and administrative expenses (excludes depreciation and amortization) |

53,131 | 55,205 | (3.8 | )% | ||||||||

| Corporate expenses (excludes depreciation and amortization) |

8,694 | 8,425 | 3.2 | % | ||||||||

| Depreciation and amortization |

20,356 | 19,017 | 7.0 | % | ||||||||

| Other operating expense, net |

(2,340 | ) | (377 | ) | ||||||||

|

|

|

|

|

|||||||||

| Operating loss |

(46,427 | ) | (13,036 | ) | ||||||||

| Interest expense, net |

2,583 | 12,238 | ||||||||||

| Other expense, net |

(17,456 | ) | (2,646 | ) | ||||||||

|

|

|

|

|

|||||||||

| Net loss before income taxes |

(66,466 | ) | (27,920 | ) | ||||||||

| Income tax expense |

7,441 | 877 | ||||||||||

|

|

|

|

|

|||||||||

| Consolidated net loss |

(73,907 | ) | (28,797 | ) | ||||||||

| Less amount attributable to noncontrolling interest |

3 | 1 | ||||||||||

|

|

|

|

|

|||||||||

| Net loss attributable to the Company |

$ | (73,910 | ) | $ | (28,798 | ) | ||||||

|

|

|

|

|

|||||||||

Revenue

Revenue decreased $32.2 million, or 13.2%, during the three months ended March 31, 2020 compared to the same period of 2019. Excluding the $6.3 million impact of movements in foreign exchange rates, revenue decreased $25.9 million, or 10.6%. Revenue, particularly in France, Spain, Italy and Switzerland, was adversely affected by COVID-19 as governments locked down countries experiencing concentrated outbreaks of the virus, resulting in reduced customer demand and the loss of advertising campaigns. The non-renewal of certain contracts in Spain and Switzerland also contributed to the overall decrease in revenue, which was partially offset by a new contract in France and higher revenue from digital display expansion in the U.K. Digital revenue increased $0.2 million, or 0.3%, to $64.2 million for the three months ended March 31, 2020. Excluding the $2.0 million impact of movements in foreign exchange rates, digital revenue increased $2.2 million, or 3.4%.

Direct Operating Expenses

Direct operating expenses decreased $0.3 million, or 0.2%, during the three months ended March 31, 2020 compared to the same period of 2019. Excluding the $5.0 million impact of movements in foreign exchange rates, direct operating expenses increased $4.7 million, or 2.7%. The largest drivers of this increase were higher fixed site lease expense related to the new contract in France and higher variable expenses in the U.K. resulting from higher revenue. These increases were partially offset by lower direct operating expenses in Spain and Switzerland related to the non-renewal of certain contracts.

Selling, General and Administrative (SG&A) Expenses

SG&A expenses decreased $2.1 million, or 3.8%, during the three months ended March 31, 2020 compared to the same period of 2019. Excluding the $1.6 million impact of movements in foreign exchange rates, SG&A expenses decreased $0.5 million, or 0.8%.

11

Corporate Expenses

Corporate expenses increased $0.3 million, or 3.2%, during the three months ended March 31, 2020 compared to the same period of 2019. Severance costs associated with cost-savings initiatives were largely offset by an increase in Stewardship Fees charged to the Parent, which are recorded as a reduction of corporate expenses.

Depreciation and Amortization

Depreciation and amortization increased $1.3 million, or 7.0%, during the three months ended March 31, 2020 compared to the same period of 2019. Excluding the $0.5 million impact of movements in foreign exchange rates, depreciation and amortization increased $1.8 million, or 9.9%. This is primarily due to asset acquisitions, partially offset by assets becoming fully depreciated or fully amortized.

Other Operating Expense, Net

Other operating expense, net, of $2.3 million and $0.4 million for the three months ended March 31, 2020 and 2019, respectively, primarily relates to net losses on the disposal of assets.

Interest Expense, Net

Interest expense, net, decreased $9.7 million during the three months ended March 31, 2020 compared to the same period of 2019 as a result of the redemption of the Senior Notes in September 2019.

Other Expense, Net

Other expense, net, increased $14.8 million during the three months ended March 31, 2020 compared to the same period of 2019 primarily due to increases in net foreign exchange losses recognized in connection with intercompany notes denominated in various currencies.

Income Tax Expense

The effective tax rates for the three months ended March 31, 2020 and 2019 were (11.2)% and (3.1)%, respectively. The effective rates were primarily impacted by the valuation allowances recorded against deferred tax assets due to uncertainty regarding our ability to realize those assets in future periods. Specifically, we recorded an $8.6 million valuation allowance at March 31, 2020 based on significant negative evidence for the forecasted realizability of deferred tax assets in Italy due, in part, to the negative effects of COVID-19. In addition, current period losses in certain jurisdictions did not result in tax benefits due to the inability to deduct those losses for tax purposes.

12

Year Ended December 31, 2019 Compared to Year Ended December 31, 2018

The comparison of our results of operations for the years ended December 31, 2019 and 2018 is as follows:

| (U.S. dollars in thousands) | Years Ended December 31, | % Change |

||||||||||

| 2019 | 2018 | |||||||||||

| Revenue |

$ | 1,111,770 | 1,173,616 | (5.3 | )% | |||||||

| Operating expenses: |

||||||||||||

| Direct operating expenses (excludes depreciation and amortization) |

742,377 | 778,344 | (4.6 | )% | ||||||||

| Selling, general and administrative expenses (excludes depreciation and amortization) |

235,822 | 257,125 | (8.3 | )% | ||||||||

| Corporate expenses (excludes depreciation and amortization) |

28,285 | 35,736 | (20.9 | )% | ||||||||

| Depreciation and amortization |

80,642 | 83,480 | (3.4 | )% | ||||||||

| Other operating income, net |

2,744 | 3,436 | (20.1 | )% | ||||||||

|

|

|

|

|

|||||||||

| Operating income |

27,388 | 22,367 | 22.4 | % | ||||||||

| Interest expense, net |

36,878 | 48,566 | ||||||||||

| Loss on extinguishment of debt |

10,961 | | ||||||||||

| Other income (expense), net |

170 | (9,366 | ) | |||||||||

|

|

|

|

|

|||||||||

| Net loss before income taxes |

(20,281 | ) | (35,565 | ) | ||||||||

| Income tax expense |

63,717 | 4,483 | ||||||||||

|

|

|

|

|

|||||||||

| Consolidated net loss |

(83,998 | ) | (40,048 | ) | ||||||||

| Less amount attributable to noncontrolling interest |

2 | 92 | ||||||||||

|

|

|

|

|

|||||||||

| Net loss attributable to the Company |

$ | (84,000 | ) | (40,140 | ) | |||||||

|

|

|

|

|

|||||||||

Revenue

Revenue decreased $61.8 million, or 5.3%, during 2019 compared to 2018. Excluding the $57.5 million impact from movements in foreign exchange rates, revenues decreased $4.3 million, or 0.4%, during 2019 compared to 2018. The effects of non-renewal of contracts in certain countries, including Italy and Spain, were partially offset by increases in revenue from digital display expansion in various markets, particularly in the U.K., and new contracts in France. Digital revenue increased 5.9% to $323.2 million during 2019 as compared to $305.1 million during 2018. Excluding the $16.0 million impact of movements in foreign exchange rates, digital revenue increased $34.1 million, or 11.2%, in 2019 compared to 2018.

Direct Operating Expenses

Direct operating expenses decreased $36.0 million, or 4.6%, during 2019 compared to 2018. Excluding the $39.0 million impact from movements in foreign exchange rates, direct operating expenses increased $3.0 million, or 0.4%, during 2019 compared to 2018. This increase was primarily driven by higher site lease expenses in countries experiencing revenue growth, particularly in the U.K., and in countries with new contracts, particularly in France, partially offset by lower direct operating expenses, including site lease, labor and material expenses, related to the non-renewal of contracts in Italy and Spain.

Selling, General and Administrative (SG&A) Expenses

SG&A expenses decreased $21.3 million, or 8.3%, during 2019 compared to 2018. Excluding the $12.4 million impact from movements in foreign exchange rates, SG&A expenses decreased $8.9 million, or 3.6%, during 2019 compared to 2018. This decrease was primarily driven by lower spending on restructuring and other cost initiatives, partially offset by higher marketing and employee compensation expenses in the U.K., primarily due to its favorable operating performance, and higher consulting fees in France.

13

Corporate Expenses

Corporate expenses decreased $7.5 million, or 20.9%, during 2019 compared to 2018. This was primarily driven by an increase in Stewardship Fees charged to Parent, which are recorded as a reduction of corporate expenses, partially offset by smaller increases in management fees allocated to us by Parent and in other corporate expenses, largely related to the investigation in Italy. Refer to Notes 7 and 10 to the Consolidated Financial Statements for additional information.

Depreciation and Amortization

Depreciation and amortization decreased $2.8 million, or 3.4%, during 2019 compared to 2018. Excluding the $4.1 million impact from movements in foreign exchange rates, depreciation and amortization increased $1.3 million. The increase is primarily due to asset acquisitions, partially offset by assets becoming fully depreciated or fully amortized.

Other Operating Income, Net

Other operating income, net, of $2.7 million and $3.4 million for 2019 and 2018, respectively, related to net gains on the disposal of assets.

Interest Expense, Net

Interest expense, net, decreased $11.7 million during 2019 compared to 2018 as a result of the redemption of the Senior Notes in September 2019.

Loss on Extinguishment of Debt

We recognized a loss on extinguishment of debt of $11.0 million in 2019 as a result of the redemption of the Senior Notes in September 2019.

Other Income (Expense), Net

Other income, net, of $0.2 million for 2019 was driven by foreign exchange gains of $1.4 million offset by loss on sale of investments.

Other expense, net, of $9.4 million for 2018 related primarily to foreign exchange losses of $8.8 million, largely recognized in connection with intercompany notes denominated in various currencies.

Income Tax Expense

In 2019, the effective tax rate of (314)% was impacted primarily by the valuation allowance recorded against deferred tax assets in certain jurisdictions due to uncertainty regarding the Companys ability to realize those assets in future periods.

In 2018, the effective tax rate of (13)% was impacted primarily by certain nondeductible interest and other intercompany charges and the inability to benefit from losses in certain jurisdictions.

Refer to Note 11 to our Consolidated Financial Statements for additional information.

2018 Compared to 2017

For a comparison of our historical results of operations for the year ended December 31, 2018 to the year ended December 31, 2017, refer to Exhibit 99.2 of CCOHs Current Report on Form 8-K filed with the SEC on March 5, 2019.

14

Liquidity and Capital Resources

Cash Flows

Three months ended March 31, 2020 and three months ended March 31, 2019

The following discussion highlights our cash flow activities during the three months ended March 31, 2020 and 2019:

| (in thousands) | Three Months Ended March 31, |

|||||||

| 2020 | 2019 | |||||||

| Net cash provided by (used for): |

||||||||

| Operating activities |

$ | 19,233 | $ | 19,541 | ||||

| Investing activities |

$ | (9,758 | ) | $ | (11,974 | ) | ||

| Financing activities |

$ | (285 | ) | $ | (6,284 | ) | ||

Operating Activities

During the three months ended March 31, 2020, net loss as adjusted for non-cash and non-operating items, most notably depreciation and amortization, foreign exchange transaction loss and deferred taxes, resulted in $24.6 million of net cash outflows from operating activities. This was more than offset by $43.8 million of net cash inflows related to changes in working capital balances. A decrease in accounts receivable, driven by collections exceeding sales due to a combination of normal seasonality of the business and the adverse impact of COVID-19, and an increase in accounts payable, driven by the timing of invoice payments, were partially offset by a decrease in accrued expenses, driven by payment of the 2019 bonus to employees and lower sales commissions and VAT accruals related to lower revenue.

During the three months ended March 31, 2019, net loss as adjusted for non-cash and non-operating items, most notably depreciation and amortization and non-cash capitalized interest expense, resulted in $3.2 million of net cash inflows from operating activities. Additionally, changes in working capital balances resulted in $16.4 million of net cash inflows. A decrease in accounts receivable, driven by normal seasonality of the business, and an increase in deferred revenue, driven by the invoicing of annual campaigns, were partially offset by an increase in prepaid expenses and other current assets and decreases in accounts payable and accrued expenses, driven primarily by the timing of payments.

Investing Activities

Net cash used for investing activities primarily reflects our capital expenditures of $10.1 million and $11.9 million during the three months ended March 31, 2020 and 2019, respectively, which primarily related to constructing and sustaining our street furniture and other out-of-home advertising displays, including digital boards.

Financing Activities

Net cash used for financing activities during the three months ended March 31, 2019 primarily reflects repayments on related-party notes payable of $5.4 million, whereas no payments were made on related-party notes payable during the three months ended March 31, 2020. In addition, net cash used for financing activities reflects net transfers to related parties of $0.3 million and $0.8 million during the three months ended March 31, 2020 and 2019, respectively.

15

Years ended December 31, 2019, 2018 and 2017

The following discussion highlights our cash flow activities during the years ended December 31, 2019, 2018 and 2017:

| (U.S. dollars in thousands) | Years Ended December 31, | |||||||||||

| 2019 | 2018 | 2017 | ||||||||||

| Net cash provided by (used for): |

||||||||||||

| Operating activities |

$ | 71,135 | $ | 88,692 | $ | 41,433 | ||||||

| Investing activities |

$ | (75,494 | ) | $ | (62,259 | ) | $ | (90,349 | ) | |||

| Financing activities |

$ | 6,784 | $ | (15,793 | ) | $ | (868 | ) | ||||

Operating Activities

During 2019, net loss as adjusted for non-cash and non-operating items, most notably depreciation and amortization, deferred taxes, non-cash capitalized interest expense and loss on extinguishment of debt, resulted in $92.6 million of net cash inflows from operating activities. This was partially offset by $21.5 million of net cash outflows related to changes in working capital balances, particularly accounts payable, which decreased due to the timing of payments. Cash paid for interest was $24.3 million in 2019, a decrease of $8.5 million compared to 2018 due to the redemption of the Senior Notes in September 2019.

During 2018, net loss as adjusted for non-cash and non-operating items, most notably depreciation and amortization, non-cash capitalized interest expense and foreign exchange transaction loss, resulted in $91.7 million of net cash inflows from operating activities. This was partially offset by $3.0 million of net cash outflows related to changes in working capital balances, where an increase in accounts receivable was partially offset by increases in accounts payable and accrued expenses, driven primarily by the timing of payments. Cash paid for interest was $32.8 million in 2018, an increase of $6.6 million compared to 2017 due to the issuance of $150.0 million of Senior Notes in August 2017.

During 2017, net loss as adjusted for non-cash and non-operating items, most notably depreciation and amortization and non-cash capitalized interest expense, resulted in $60.7 million of net cash inflows from operating activities. This was partially offset by $19.3 million of net cash outflows related to changes in working capital balances, particularly a decrease in accrued expenses, which were affected by the timing of payments, and an increase in accounts receivable, which was impacted by slower collections. Cash paid for interest was $26.3 million in 2017.

Investing Activities

Net cash used for investing activities primarily reflects our capital expenditures of $85.8 million, $64.0 million and $87.6 million in 2019, 2018 and 2017, respectively, which primarily related to constructing and sustaining our street furniture and other out-of-home advertising displays, including digital boards.

Financing Activities

Net cash provided by financing activities during 2019 reflects borrowings on related-party notes payable, which were primarily used to redeem the outstanding Senior Notes in September 2019. This transaction is described in further detail within this MD&A below.

Net cash used for financing activities during 2018 primarily reflects net repayments of related-party notes payable of $14.8 million.

Net cash used for financing activities during 2017 primarily reflects net transfers to related parties of $152.0 million offset by proceeds from the issuance of $150.0 million of Senior Notes in August 2017.

16

Anticipated Cash Requirements

Sources of Capital and Liquidity

Our primary sources of liquidity are cash on hand and cash flow from operations. At March 31, 2020, we had $43.3 million of cash on our balance sheet. It is CCOHs policy to permanently reinvest the earnings of its non-U.S. subsidiaries as these earnings are generally redeployed in those jurisdictions for operating needs and continued functioning of their businesses. However, if any excess cash held by us and our subsidiaries is needed to fund operations in the U.S., CCOH has the ability to cause us to make distributions and repatriate available funds, subject to any limitations under applicable law and restrictions in our debt agreements, including the indenture governing the notes. CCOH does not have a legal obligation to do so but has the intent and ability to provide funds to us to the extent they are needed in order for us to meet our obligations as they become due.

We also have notes receivable from other wholly-owned subsidiaries of CCOH. In 2019, we reorganized our holding and financing structure and restructured our related party notes, consolidating some of our borrowing and lending activity in order to simplify intercompany funding arrangements. At March 31, 2020, we had four unsecured notes receivable from related parties, including Clear Channel Worldwide Holdings, Clear Channel Espectaculos S.L. and Clear Channel KNR Netherlands Antilles, with a total outstanding balance of $83.6 million. These notes are unsecured and bear interest at floating rates of 3.40% to 3.65% plus three-month LIBOR. As the result of an amendment, some of these notes will bear interest at 2.25% plus three-month USD LIBOR effective January 1, 2020. The note agreements allow for the provision of payment-in-kind interest, and interest is capitalized quarterly into the notes rather than paid in cash. Although the notes are repayable on demand, we have a history that supports our intent to hold these notes long-term.

Certain of our subsidiaries are the primary borrowers under various credit and overdraft facilities with European banks. As of March 31, 2020, there was $2.4 million outstanding under these facilities and there was approximately $5.3 million available for borrowings.

Uses of Capital and Liquidity

Our primary uses of liquidity are for working capital used to fund the operations of our business, capital expenditures and other funding requirements.

Prior to September 2019, we had $375.0 million aggregate principal amount outstanding of 8.75% Senior Notes, which was scheduled to mature on December 15, 2020 and bore interest at a rate of 8.75% per annum, payable semi-annually in arrears on June 15 and December 15 of each year. In September 2019, we redeemed all of the outstanding Senior Notes at a price of 102.187% of the principal amount thereof, plus accrued and unpaid interest to the redemption date, with funds provided by the Parent, thereby releasing us from our remaining obligations under the Senior Notes Indenture. During 2019, we paid $23.6 million of cash interest on this debt.

We have notes payable to other wholly-owned subsidiaries of CCOH. In 2019, we reorganized our holding and financing structure and restructured our related party notes, consolidating some of our borrowing and lending activity in order to simplify intercompany funding arrangements. As a result, at March 31, 2020, we had three unsecured related party notes payable to Clear Channel Worldwide Holdings with a total outstanding balance of $300.7 million. These notes are unsecured and bear interest at floating rates of 2.25% plus three-month USD LIBOR and 3.40% to 3.65% plus three-month EUR LIBOR. The note agreements allow for the provision of payment-in-kind interest, and interest is capitalized quarterly into the notes rather than paid out in cash. Although the notes are repayable on demand, the counterparties have represented to us that, consistent with the past, they will not require payment in the next 12 months.

The primary driver of our capital expenditure requirements is the construction of new advertising structures, including the continued deployment of digital displays in accordance with our long-term strategy to digitize our network as an alternative to traditional methods of displaying our clients advertisements. Additionally, we have

17

commitments relating to required purchases of property, plant, and equipment under certain street furniture contracts, and certain of our contracts contain penalties for not fulfilling our commitments related to its obligations to build bus stops, kiosks and other public amenities or advertising structures. At March 31, 2020, we had future capital expenditure commitments of $46.3 million, including $21.1 million committed for the remainder of 2020. As described below, in light of the rapidly-evolving impact of COVID-19 and the uncertainty around the related economic downturn, we are actively identifying opportunities to significantly reduce annual capital expenditures for 2020, including largely deferring discretionary growth capital expenditures, deferring sustaining capital expenditures to the extent possible, and exploring deferral options with respect to committed capital expenditures.

We also have future cash obligations under non-cancelable operating leases and other non-cancelable contracts. These costs, which are included in our direct operating expenses, have historically been satisfied by cash flows from operations. At March 31, 2020, we had future maturities of operating lease liabilities of $645.5 million, including $178.6 million maturing over the remainder of 2020, and future minimum payments under non-lease non-cancelable contracts of $772.8 million, including $130.8 million to be paid over the remainder of 2020. As described below, we are continuing discussions with landlords to align fixed site lease expenses with revenue during the economic downturn and have begun to see some success in this effort.

Trends and Uncertainties

Beginning in March 2020, we began seeing weakness in certain European markets affected by COVID-19. In light of the uncertainty presented by the unprecedented pandemic, future results are difficult to forecast. In response, we have implemented specific actions to strengthen our financial position and support the continuity of our platform and operations. These initiatives include negotiations with landlords to align fixed site lease expenses with revenue during the economic downturn; savings from lower variable compensation expense, temporary salary reductions, reduced hours for hourly employees, hiring freezes and furloughs; reducing discretionary expenses; deferring discretionary capital expenditures; and exploring options to defer our committed capital expenditures. Additionally, CCOH increased its cash on hand by selling its interest in Clear Media and by drawing $150 million on its Revolving Credit Facility. As previously described, CCOH has the intent and ability to provide funds to us to the extent they are needed in order for us to meet our obligations as they become due.

We believe that cash on hand, cash flows from operations, the initiatives that we are actively pursuing, and funding from CCOH will enable us to meet our working capital, capital expenditure and other funding requirements for at least the next 12 months. We believe our long-term plans, which include promoting outdoor media spending, capitalizing on our diverse geographic and product opportunities, and the continued deployment of digital displays, will enable us to continue generating cash flows from operations sufficient to meet our funding requirements in the long term. However, our anticipated results are subject to significant uncertainty and may be affected by events beyond our control, including prevailing economic, financial and industry conditions. Our ability to meet our funding requirements depends on the impacts from these uncertainties including the impacts related to the COVID-19 pandemic, our future operating performance, our cash flow from operations and our ability to manage our liquidity and obtain supplemental liquidity, if necessary. Additional factors may emerge as a result of the COVID-19 pandemic that could cause our expectations to change. If we are unable to generate sufficient cash through our operations or obtain sources of supplemental liquidity, we could face substantial liquidity problems, which could have a material adverse effect on our financial condition and on our ability to meet our obligations. We may take further cost-cutting measures beyond those discussed above to generate short-term liquidity in the event of an unanticipated need for cash. In addition, we regularly consider, and enter into discussions with lenders related to, potential financing alternatives, which may include supplemental liquidity through issuances of secured or unsecured debt.

We frequently evaluate strategic opportunities both within and outside our existing lines of business, and we expect from time to time to dispose of certain businesses and may pursue acquisitions. These dispositions or

18

acquisitions could be material. Specifically, as we continue to focus on operational efficiencies that drive greater margin and cash flow, CCOH will continue to review and consider opportunities to unlock shareholder value, which may include, among other things, potential asset or operational divestitures intended to deleverage and increase free cash flow.

Market Risk

We are exposed to market risks arising from changes in market rates and prices, including movements in foreign currency exchange rates and inflation.

Foreign Currency Exchange Rate Risk

We have operations in countries throughout Europe and in Singapore. Operations in these countries are measured in their local currencies, and our consolidated financial statements are presented in U.S. dollars. As a result, our financial results could be affected by factors such as changes in foreign currency exchange rates or weak economic conditions in the foreign markets in which we have operations. Changes in economic or political conditions in any of the foreign countries in which we operate, including Brexit, could result in exchange rate movement, new currency or exchange controls or other currency restrictions being imposed.

We estimate a 10% increase in the value of the U.S. dollar relative to foreign currencies would have decreased our net loss for the three months ended March 31, 2020 by $7.4 million, and a 10% decrease in the value of the U.S. dollar relative to foreign currencies would have increased our net loss for the three months ended March 31, 2020 by a corresponding amount. This analysis does not consider the implications that such currency fluctuations could have on the overall economic activity that could exist in such an environment in the U.S. or the foreign countries or on the results of operations of these foreign entities.

Inflation

Inflation is a factor in the economies in which we do business, and we continue to seek ways to mitigate its effect. Inflation has affected our performance in terms of higher costs for wages, salaries and equipment. Although the exact impact of inflation is indeterminable, we believe we have offset these higher costs by increasing the effective advertising rates of most of our outdoor display faces.

Critical Accounting Estimates

The preparation of our financial statements in conformity with U.S. GAAP requires management to make estimates, judgments and assumptions that affect the reported amounts of assets and liabilities, and disclosure of contingent assets and liabilities, at the date of the financial statements and the reported amount of expenses during the reporting period. On an ongoing basis, we evaluate our estimates that are based on historical experience and on various other assumptions that are believed to be reasonable under the circumstances. The result of these evaluations forms the basis for making judgments about the carrying values of assets and liabilities and the reported amount of revenue and expenses that are not readily apparent from other sources. Because future events and their effects cannot be determined with certainty, actual results could differ from our assumptions and estimates, and such difference could be material. Our significant accounting policies are discussed in the notes to our consolidated financial statements. Management believes that certain accounting estimates are the most critical to aid in fully understanding and evaluating our reported financial results, and they require managements most difficult, subjective or complex judgments, resulting from the need to make estimates about the effect of matters that are inherently uncertain. These critical accounting estimates, managements judgments and assumptions, and the effect if actual results differ from these assumptions are described in the consolidated financial statements for the year ended December 31, 2019 included in this offering circular.

In March 2020, COVID-19 was categorized as a pandemic by the World Health Organization. While the duration and severity of the effects of COVID-19 are currently unknown, we anticipate significant adverse

19

effects on our results of operations throughout our business as more customers defer advertising buying decisions and reduce marketing spend. As such, we have updated certain of our estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amount of expenses during the reporting period, as described below. There continues to be a high level of uncertainty in estimating our expected economic and operational impacts relative to COVID-19 as it is an evolving situation. As expected impacts from COVID-19 are revised, our estimates and assumptions may change, and we may experience further potential impacts to our financial statements in future periods.

Allowance for Doubtful Accounts

We evaluate the collectability of our accounts receivable based on a combination of factors. In circumstances where we are aware of a specific customers inability to meet its financial obligations, we record a specific reserve to reduce the amounts recorded to what we believe will be collected. For all other customers, we recognize reserves for bad debt based on historical experience for each business unit, adjusted for relative improvements or deteriorations in the agings and changes in current economic conditions.

Leases

The most significant estimates used by management in accounting for leases and the impact of these estimates are as follows:

Lease term. Lease term includes the noncancelable period of the lease together with all of the following: periods covered by an option to extend the lease if the lessee is reasonably certain to exercise that option, periods covered by an option to terminate the lease if the lessee is reasonably certain not to exercise that option, and periods covered by an option to extend (or not to terminate) the lease in which exercise of the option is controlled by the lessor. When calculating our lease liability for contracts in which we are the lessee, we generally exclude renewal periods from the lease term as we do not consider exercise of such options to be reasonably certain for most of our leases. Therefore, unless exercise of a renewal option is considered reasonably certain, the optional terms and payments are not included within the lease liability. The expected lease term is used in determining whether the lease is accounted for as an operating lease or a finance lease. A lease is considered a finance lease if the lease term is for a major part of the remaining economic life of the underlying asset. The expected lease term is also used in determining the depreciable life of the asset. An increase in the expected lease term will increase the probability that a lease may be considered a finance lease and will generally result in higher interest and depreciation expense for a leased property recorded on our balance sheet.

Incremental borrowing rate. We use the incremental borrowing rate (IBR) to determine the present value of lease payments at the commencement of a lease. The IBR, as defined in ASC Topic 842, is the rate of interest that a lessee would have to pay to borrow on a collateralized basis over a similar term at an amount equal to the lease payments in a similar economic environment. We also use the IBR in determining whether the lease is accounted for as an operating lease or a finance lease. An increase in the IBR decreases the net present value of the minimum lease payments and reduces the probability that a lease will be considered a finance lease.

Fair market value of leased asset. The fair market value of leased property is generally estimated based on comparable market data as provided by third-party sources. Fair market value is used in determining whether the lease is accounted for as an operating lease or a finance lease. A higher fair market value as compared to the present value of lease payments reduces the likelihood that a lease will be considered a finance lease.

Long-lived Assets

Long-lived assets, including property, plant and equipment and intangibles assets, are reported at historical cost less accumulated depreciation and amortization. We estimate the useful lives for various types of advertising structures and other long-lived assets based on our historical experience and our plans regarding how we intend

20

to use those assets. Advertising structures have different lives depending on their nature, with large format bulletins generally having longer depreciable lives and posters and other displays having shorter depreciable lives. Street furniture and transit displays are depreciated over their estimated useful lives or appropriate contractual periods, whichever is shorter. Our experience indicates that the estimated useful lives applied to our portfolio of assets have been reasonable, and we do not expect significant changes to the estimated useful lives of our long-lived assets in the future. When we determine that structures or other long-lived assets will be disposed of prior to the end of their useful lives, we estimate the revised useful lives and depreciate the assets over the revised period. We also review long-lived assets for impairment when events and circumstances indicate that depreciable and amortizable long-lived assets might be impaired and the undiscounted cash flows estimated to be generated by those assets are less than the carrying amounts of those assets. When specific assets are determined to be unrecoverable, the cost basis of the asset is reduced to reflect the current fair market value.

We use various assumptions in determining the remaining useful lives of assets to be disposed of prior to the end of their useful lives and in determining the current fair market value of long-lived assets that are determined to be unrecoverable. Estimated useful lives and fair values are sensitive to factors including contractual commitments, regulatory requirements, future expected cash flows, industry growth rates and discount rates, as well as future salvage values. Our impairment loss calculations require management to apply judgment in estimating future cash flows, including forecasting useful lives of the assets and selecting the discount rate that reflects the risk inherent in future cash flows.

Goodwill

Goodwill represents the excess of the purchase price over the fair value of identifiable net assets acquired in business combinations. We test goodwill at interim dates if events or changes in circumstances indicate that goodwill might be impaired. The fair value of our reporting unit is used to apply value to the net assets of each reporting unit. To the extent that the carrying amount of net assets would exceed the fair value, an impairment charge is recorded. The discounted cash flow approach that we use for valuing goodwill as part of the impairment testing approach involves estimating future cash flows expected to be generated from the related assets, discounted to their present value using a risk-adjusted discount rate. Terminal values are also estimated and discounted to their present value.

As described in Note 5 to our unaudited consolidated financial statements included elsewhere in this offering circular, historically, we treated each country in which we operate as a separate reporting unit for purposes of our annual goodwill impairment test; however, due to a change in the way the business is managed, we had only one reporting unit as of January 1, 2020. Corresponding with this change in our reporting units, we tested goodwill for impairment immediately before and after this change utilizing a discount rate of approximately 8.5% to 9.0% for each of our reporting units, and an estimated perpetual growth rate of 3.0%. This testing did not identify impairment.

Additionally, due to the expected impacts from COVID-19, we tested our goodwill for impairment as of March 31, 2020 in accordance with ASC 350-20-35; however, this did not result in any impairment of goodwill during the three months ended March 31, 2020. In determining the fair value of our reporting unit, we used the following assumptions:

| | Expected cash flows underlying our business plans for the periods 2020 through 2024, which are based on detailed, multi-year forecasts performed by each of our operating segments and reflect the advertising outlook across our businesses; |

| | Cash flows beyond 2024 are projected to grow at a perpetual growth rate, which we estimated at 3.0%; and |

| | In order to risk adjust the cash flow projections in determining fair value, we utilized a discount rate of 9.5%. |

21

Based on our assessment using the assumptions described above, a hypothetical 10% reduction in the estimated fair value in each of our reporting units would not result in a material impairment condition.

Tax Provisions

Our estimates of income taxes and the significant items giving rise to the deferred tax assets and liabilities are shown in the notes to our consolidated financial statements and reflect our assessment of actual future taxes to be paid on items reflected in the financial statements, giving consideration to both timing and probability of these estimates. Actual income taxes could vary from these estimates due to future changes in income tax law or results from the final review of our tax returns by foreign tax authorities.

We use our best and most informed judgment to determine whether it is more likely than not that our deferred tax assets will be realized. Deferred tax assets are reduced by valuation allowances if we believe it is more likely than not that some portion or the entire asset will not be realized.

We also use our best and most informed judgment to determine whether it is more likely than not that we will sustain positions that we have taken on tax returns and, if so, the amount of benefit to initially recognize within our financial statements. We regularly review our uncertain tax positions and adjust our unrecognized tax benefits (UTBs) in light of changes in facts and circumstances, such as changes in tax law, interactions with taxing authorities and developments in case law. These adjustments to our UTBs may affect our income tax expense, and settlement of uncertain tax positions may require use of our cash.

Litigation Accruals

We are currently involved in certain legal proceedings. Based on current assumptions, we have accrued an estimate of the probable costs for the resolution of those claims for which the occurrence of loss is probable and the amount can be reasonably estimated. Managements estimates have been developed in consultation with counsel and are based upon an analysis of potential results, assuming a combination of litigation and settlement strategies. Future results of operations could be materially affected by changes in these assumptions or the effectiveness of our strategies related to these proceedings. Additionally, due to the inherent uncertainty of litigation, there can be no assurance that the resolution of any particular claim or proceeding would not have a material adverse effect on our financial condition or results of operations.

Asset Retirement Obligations

ASC Subtopic 410-20 requires us to estimate our obligation to dismantle and remove our advertising structures from leased land or property and to restore the site to its original condition upon the termination or non-renewal of a lease or contract. An estimate of third-party cost information is used with respect to the dismantling of the structures and the restoration of the site, and the retirement period is estimated for each obligation based on contract terms. The interest rate used to calculate the present value of such costs over the retirement period is based on an estimated risk-adjusted credit rate for the same period.

22

CLEAR CHANNEL INTERNATIONAL B.V. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

| (In thousands) | March 31, 2020 (unaudited) |

December 31, 2019 |

||||||

| CURRENT ASSETS | ||||||||

| Cash and cash equivalents |

$ | 43,262 | $ | 34,498 | ||||

| Accounts receivable |

244,502 | 322,839 | ||||||

| Less: Allowance for credit losses |

(8,254 | ) | (6,507 | ) | ||||

|

|

|

|

|

|||||

| Accounts receivable, net |

236,248 | 316,332 | ||||||

| Prepaid expenses |

27,082 | 29,366 | ||||||

| Other current assets |

30,973 | 27,499 | ||||||

|

|

|

|

|

|||||

| Total Current Assets |

337,565 | 407,695 | ||||||

| NON-CURRENT ASSETS | ||||||||

| Property, plant and equipment, net |

280,540 | 295,638 | ||||||

| Intangible assets, net |

12,107 | 12,642 | ||||||

| Goodwill |

180,518 | 185,641 | ||||||

| Operating lease right-of-use assets |

572,122 | 566,597 | ||||||

| Related party notes receivable |

83,602 | 84,897 | ||||||

| Other assets |

34,015 | 39,270 | ||||||

|

|

|

|

|

|||||

| Total Assets |

$ | 1,500,469 | $ | 1,592,380 | ||||

|

|

|

|

|

|||||

| CURRENT LIABILITIES | ||||||||

| Accounts payable |

$ | 89,673 | $ | 56,507 | ||||

| Accrued expenses |

229,336 | 286,889 | ||||||

| Current operating lease liabilities |

204,615 | 211,617 | ||||||

| Deferred revenue |

39,787 | 32,432 | ||||||

|

|

|

|

|

|||||

| Total Current Liabilities |

563,411 | 587,445 | ||||||

| NON-CURRENT LIABILITIES | ||||||||

| Related party notes payable |

300,684 | 301,965 | ||||||

| Non-current operating lease liabilities |

378,779 | 372,105 | ||||||

| Other long-term liabilities |

94,660 | 94,255 | ||||||

|

|

|

|

|

|||||

| Total Liabilities |

1,337,534 | 1,355,770 | ||||||

|

|

|

|

|

|||||

| Commitments and contingencies (Note 8) |

||||||||

| SHAREHOLDERS EQUITY | ||||||||

| Noncontrolling interest |

331 | 334 | ||||||

| Parent Companys net investment |

(279,074 | ) | (204,136 | ) | ||||

| Accumulated other comprehensive income |

441,678 | 440,412 | ||||||

|

|

|

|

|

|||||

| Total Shareholders Equity |

162,935 | 236,610 | ||||||

|

|

|

|

|

|||||

| Total Liabilities and Shareholders Equity |

$ | 1,500,469 | $ | 1,592,380 | ||||

|

|

|

|

|

|||||

See Notes to Consolidated Financial Statements

F-2

CLEAR CHANNEL INTERNATIONAL B.V. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

(UNAUDITED)

| (In thousands) | Three Months Ended March 31, | |||||||

| 2020 | 2019 | |||||||

| Revenue |

$ | 211,690 | 243,896 | |||||

| Operating expenses: |

||||||||

| Direct operating expenses (excludes depreciation and amortization) |

173,596 | 173,908 | ||||||

| Selling, general and administrative expenses (excludes depreciation and amortization) |

53,131 | 55,205 | ||||||

| Corporate expenses (excludes depreciation and amortization) |

8,694 | 8,425 | ||||||

| Depreciation and amortization |

20,356 | 19,017 | ||||||

| Other operating expense, net |

(2,340 | ) | (377 | ) | ||||

|

|

|

|

|

|||||

| Operating loss |

(46,427 | ) | (13,036 | ) | ||||

| Interest expense, net |

2,583 | 12,238 | ||||||

| Other expense, net |

(17,456 | ) | (2,646 | ) | ||||

|

|

|

|

|

|||||

| Net loss before income taxes |

(66,466 | ) | (27,920 | ) | ||||

| Income tax expense |

7,441 | 877 | ||||||

|

|

|

|

|

|||||

| Consolidated net loss |

(73,907 | ) | (28,797 | ) | ||||

| Less amount attributable to noncontrolling interest |

3 | 1 | ||||||

|

|

|

|

|

|||||

| Net loss attributable to the Company |

$ | (73,910 | ) | $ | (28,798 | ) | ||

|

|

|

|

|

|||||

| Other comprehensive income: |

||||||||

| Foreign currency translation adjustments |

1,610 | 6,557 | ||||||

|

|

|

|

|

|||||

| Other comprehensive income |

1,610 | 6,557 | ||||||

|

|

|

|

|

|||||

| Comprehensive loss |

(72,300 | ) | (22,241 | ) | ||||

| Less amount attributable to noncontrolling interest |

(6 | ) | (15 | ) | ||||

|

|

|

|

|

|||||

| Comprehensive loss attributable to the Company |