EX-99.2

Published on September 8, 2022

Exhibit 99.2 Clear Channel Outdoor Investor Day 2022 September 8, 2022

Safe harbor statement Forward-Looking Statements Certain statements in this presentation constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of Clear Channel Outdoor Holdings, Inc. and its subsidiaries (the “Company”) to be materially different from any future results, performance, achievements, guidance, goals and/or targets expressed or implied by such forward-looking statements. The words “guidance,” “believe,” “expect,” “anticipate,” “estimate,” “forecast,” “goals,” “targets” and similar words and expressions are intended to identify such forward-looking statements. In addition, any statements that refer to expectations or other characterizations of future events or circumstances, such as statements about our guidance, outlook, long-term forecast, goals or targets, our business plans and strategies, our expectations about certain markets, strategic review processes and our liquidity, are forward-looking statements. These statements are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, some of which are beyond our control and are difficult to predict. Various risks that could cause future results to differ from those expressed by the forward-looking statements included in this presentation include, but are not limited to: risks associated with weak or uncertain global economic conditions and their impact on the level of expenditures on advertising; heightened levels of economic inflation and rising interest rates; fluctuations in operating costs; supply chain shortages; our ability to achieve expected financial results and growth targets; the war in Ukraine and the associated global effects thereof; the continued impact of the COVID-19 pandemic on our operations and on general economic conditions; our ability to service our debt obligations and to fund our operations and capital expenditures; the impact of our substantial indebtedness, including the effect of our leverage on our financial position and earnings; industry conditions, including competition; our ability to obtain and renew key contracts with municipalities, transit authorities and private landlords; technological changes and innovations; shifts in population and other demographics; changes in labor conditions and management; regulations and consumer concerns regarding privacy and data protection; a breach of our information security systems and measures; legislative or regulatory requirements; restrictions on out-of-home advertising of certain products; the impact of the continued strategic review of our European business and assets, including a possible sale of all or a part thereof; our ability to execute restructuring plans; the impact of future dispositions, acquisitions and other strategic transactions; third-party claims of intellectual property infringement, misappropriation or other violation against us or our suppliers; the risk that indemnities from iHeartMedia will not be sufficient to insure us against the full amount of certain liabilities; risks of doing business in foreign countries; fluctuations in exchange rates and currency values; the volatility of our stock price; the effect of analyst or credit ratings downgrades; our ability to continue to comply with the applicable listing standards of the New York Stock Exchange; the ability of our subsidiaries to dividend or distribute funds to us in order for us to repay our debts; the restrictions contained in the agreements governing our indebtedness limiting our flexibility in operating our business; the phasing out of LIBOR; our dependence on our management team and other key individuals; continued scrutiny and changing expectations from investors, lenders, customers, government regulators and other stakeholders; and certain other factors set forth in our other filings with the U.S. Securities and Exchange Commission (the “SEC”). You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date stated, or if no date is stated, as of the date of this presentation. Other key risks are described in the section entitled “Item 1A. Risk Factors” of the Company’s reports filed with the SEC, including the Company’s Annual Report on Form 10-K for the year ended December 31, 2021. The Company does not undertake any obligation to publicly update or revise any forward-looking statements because of new information, future events or otherwise. Non-GAAP Financial Information This presentation includes information that does not conform to U.S. generally accepted accounting principles (“GAAP”), including Adjusted EBITDA, Adjusted Corporate expenses, Funds From Operations (“FFO”) and Adjusted Funds From Operations (“AFFO”). The Company presents Adjusted EBITDA, Adjusted Corporate expenses, FFO and AFFO because the Company believes these non-GAAP measures help investors better understand the Company’s operating performance as compared to other out-of-home advertisers, and these metrics are widely used by such companies in practice. Please refer to the Appendix located at the end of this presentation for a reconciliation of non-GAAP financial measures to their most directly comparable GAAP financial measure. 2

Clear Channel Outdoor Investor Day 2022 September 8, 2022

European business update ▪ Prior to COVID, European business historically able to provide for its own cash needs ▪ European business currently and prospectively expected to fund its cash needs with operating cash flows and existing cash balances ▪ Divestiture alternatives via the European strategic review ongoing ▪ Divestiture activity under consideration, if executed, expected to further improve Adjusted EBITDA margins 4

Objectives for today 5

Today’s agenda & speakers Scott Wells Brian Coleman Clear Channel Overview Chief Executive Officer Chief Financial Officer Scott Wells The Marketplace: Opportunity & Vision Forward Why Advertisers Are Choosing Out of Home & Clear Channel Bob McCuin Customer Case for Technology Solutions & Innovation Erika Goldberg Bob McCuin Erika Goldberg Fundamental Role of Data & Clear Channel’s RADAR Solutions Chief Revenue Officer Chief of Business Operations Dan Levi Programmatic as a Driver of Growth Cathy Muldowney Financial Overview Brian Coleman Q&A Dan Levi Cathy Muldowney SVP of Programmatic Sales Chief Marketing Officer 6

Digital transformation 7

CCOA growth potential Highly advantaged position in growing advertising medium Technology & digital investment Attractive operating cash flow generation Attractive operating cash flow generation Experienced, proven leadership team 8

Out of Home: a growing, defensible ad medium 9

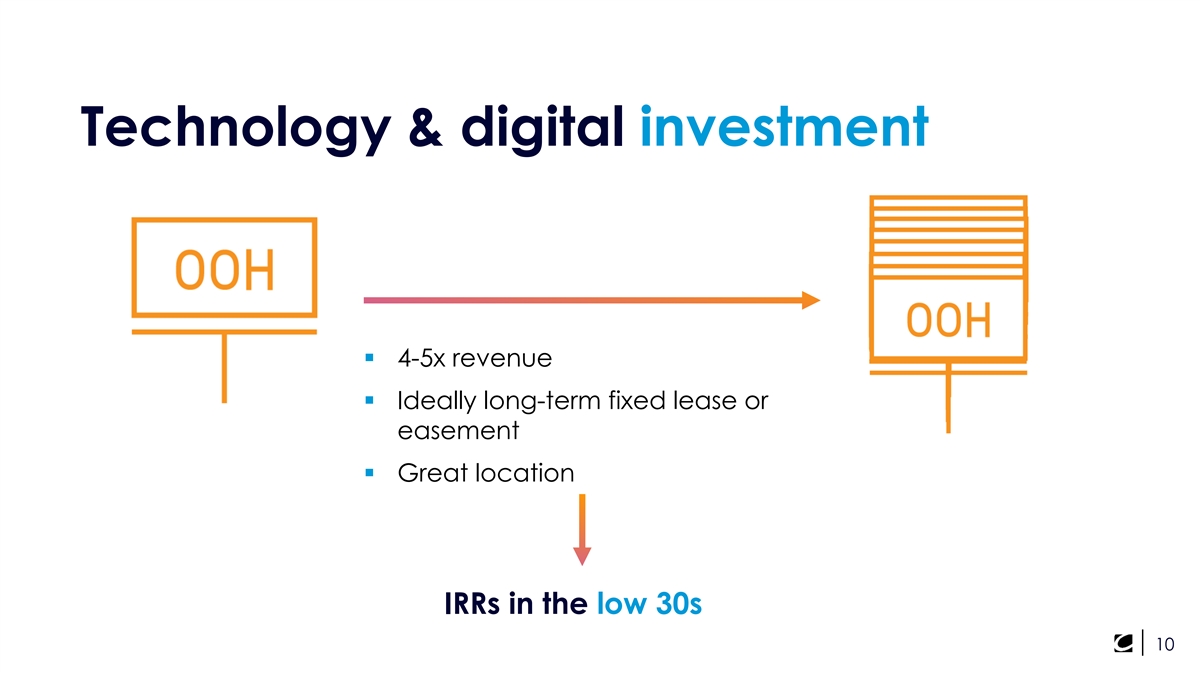

Technology & digital investment ▪ 4-5x revenue ▪ Ideally long-term fixed lease or easement ▪ Great location IRRs in the low 30s 10

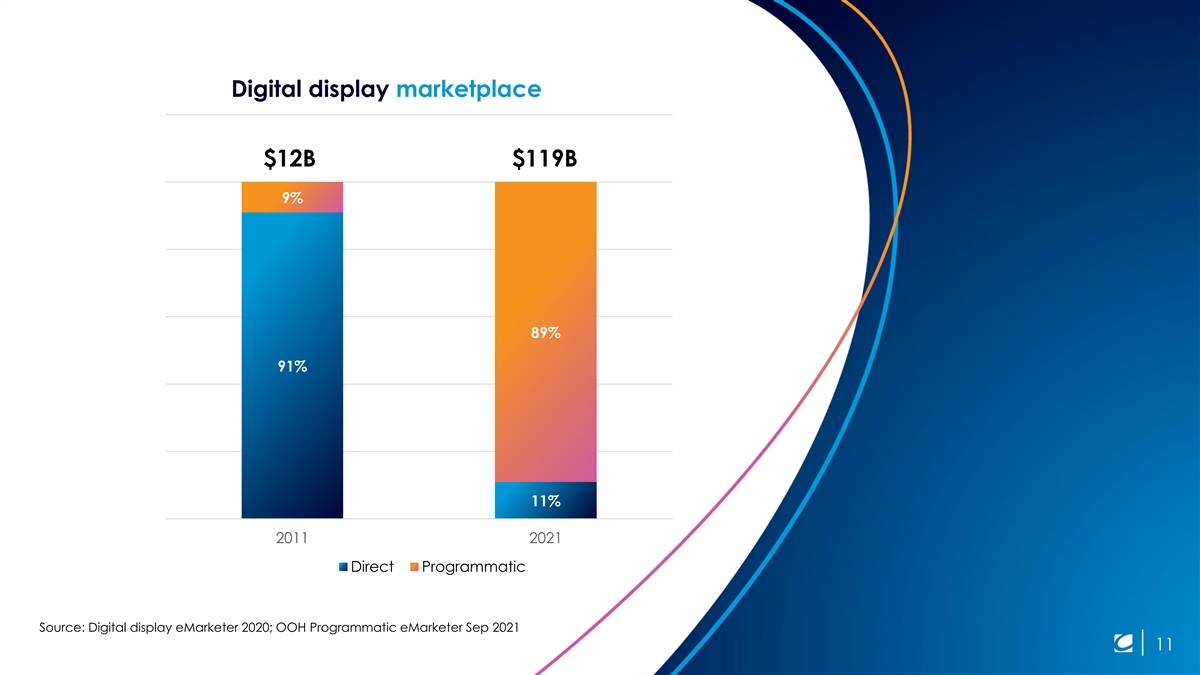

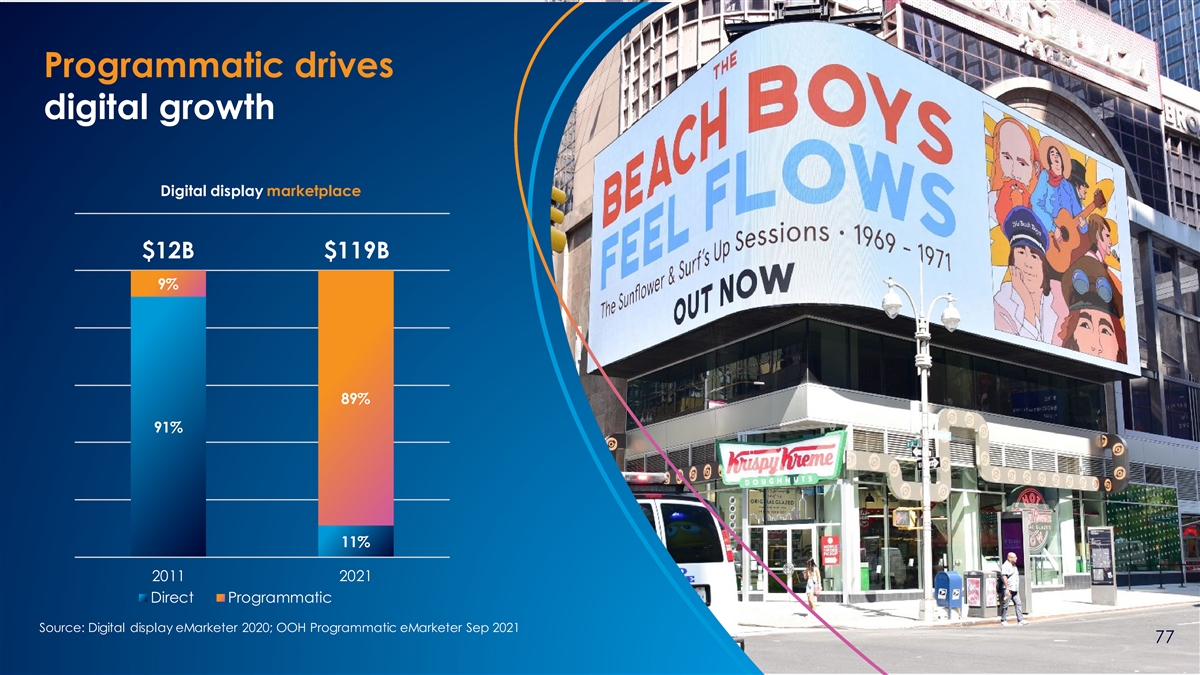

Digital display marketplace $12B $119B 9% 89% 91% 11% 2011 2021 Direct Programmatic Source: Digital display eMarketer 2020; OOH Programmatic eMarketer Sep 2021 11

Digital transformation Operating Operating Customer centricity cash flow cash flow Executional excellence 12

Scott Wells Brian Coleman Lynn Feldman Chief Executive Officer EVP, Chief Financial Officer EVP, General Counsel & Experienced, proven Corp. Secretary leadership ▪ Deep expertise in real estate, operations and media sales Erika Goldberg Gene Leehan Bob McCuin EVP, Chief of Business EVP, Senior Regional EVP, Chief Revenue Officer Operations President ▪ Extensive experience in Out of Home, competitive and complementary media ▪ Leaders in applied technology, digital transformation and change management Dan Levi Bryan Parker Christian Aaselund EVP, Real Estate and EVP, Chief Technology EVP, Chief Marketing Officer Public Affairs Officer Kim Heintz David Sailer Wade Rifkin EVP, Chief Human EVP, Chief Financial EVP/GM, Programmatic Resources Officer Officer, Americas

Jason Dilger Michelle Costa Kenetta Bailey SVP, Chief EVP, Regional President, SVP, Marketing Accounting Officer South Central Experienced, proven leadership ▪ Deep expertise in real estate, operations and Jasper Johnson Jack Jessen Morten Gotterup EVP, Regional President, Clear Channel Regional President, media sales President, Southeast Airports Northeast ▪ Extensive experience in Out of Home, competitive and complementary media ▪ Leaders in applied technology, digital transformation and change management Cathy Muldowney Sal Llach Greg McGrath SVP, Programmatic SVP, Deputy General Counsel, Regional President, SoCal Sales and Assistant Secretary Scott Wadsworth Diane Veres Bob Schmitt Regional President, SVP, Corporate Regional President, NorCal Southwest & Midwest Operations and Procurement

What’s great about Out of Home? 15

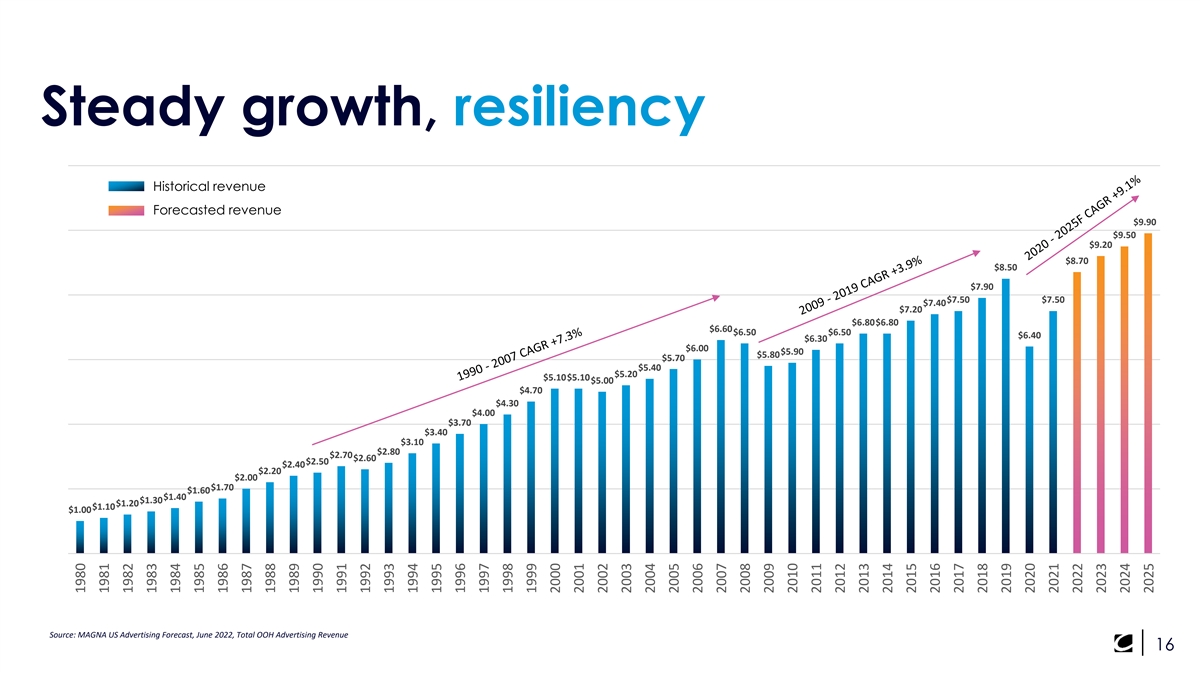

Steady growth, resiliency Historical revenue Forecasted revenue $9.90 $9.50 $9.20 $8.70 $8.50 $7.90 $7.50 $7.50 $7.40 $7.20 $6.80 $6.80 $6.60 $6.50 $6.50 $6.40 $6.30 $6.00 $5.90 $5.80 $5.70 $5.40 $5.20 $5.10 $5.10 $5.00 $4.70 $4.30 $4.00 $3.70 $3.40 $3.10 $2.80 $2.70 $2.60 $2.50 $2.40 $2.20 $2.00 $1.70 $1.60 $1.40 $1.30 $1.20 $1.10 $1.00 Source: MAGNA US Advertising Forecast, June 2022, Total OOH Advertising Revenue 16 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025

Creative impact 17

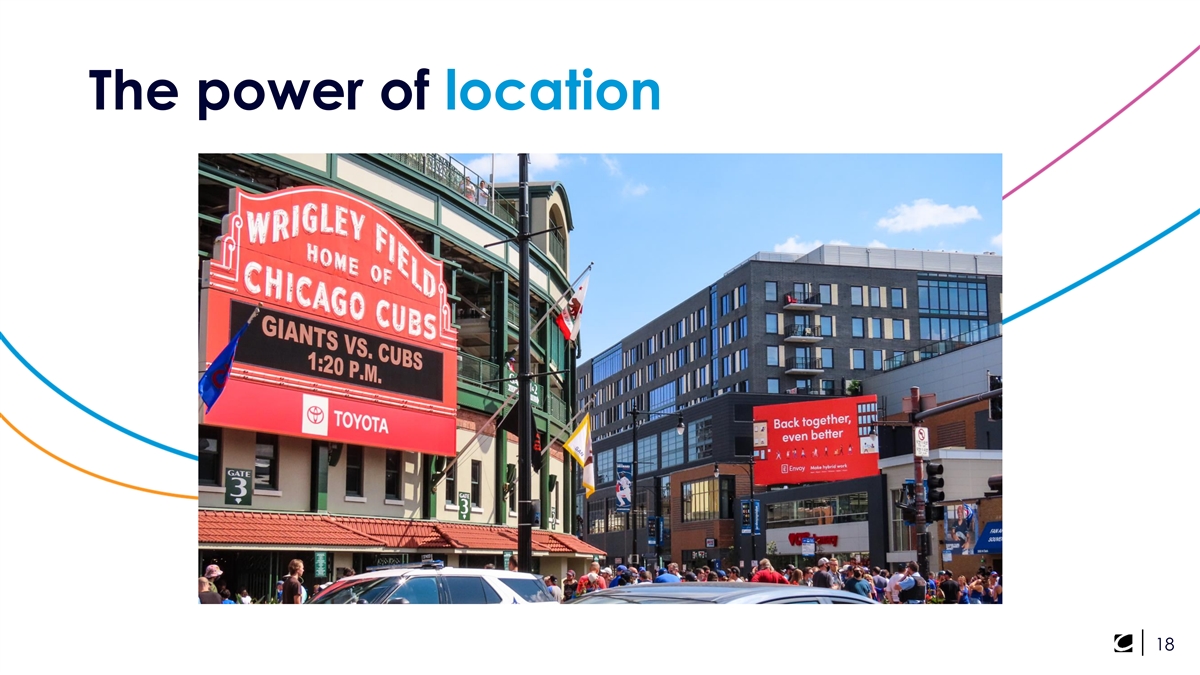

The power of location 18

Local impact, national scale 19

Good corporate citizens 20

Creating demand Increase Fight for maximum Bring more percentage spent share of marketers on OOH OOH budgets to OOH 21

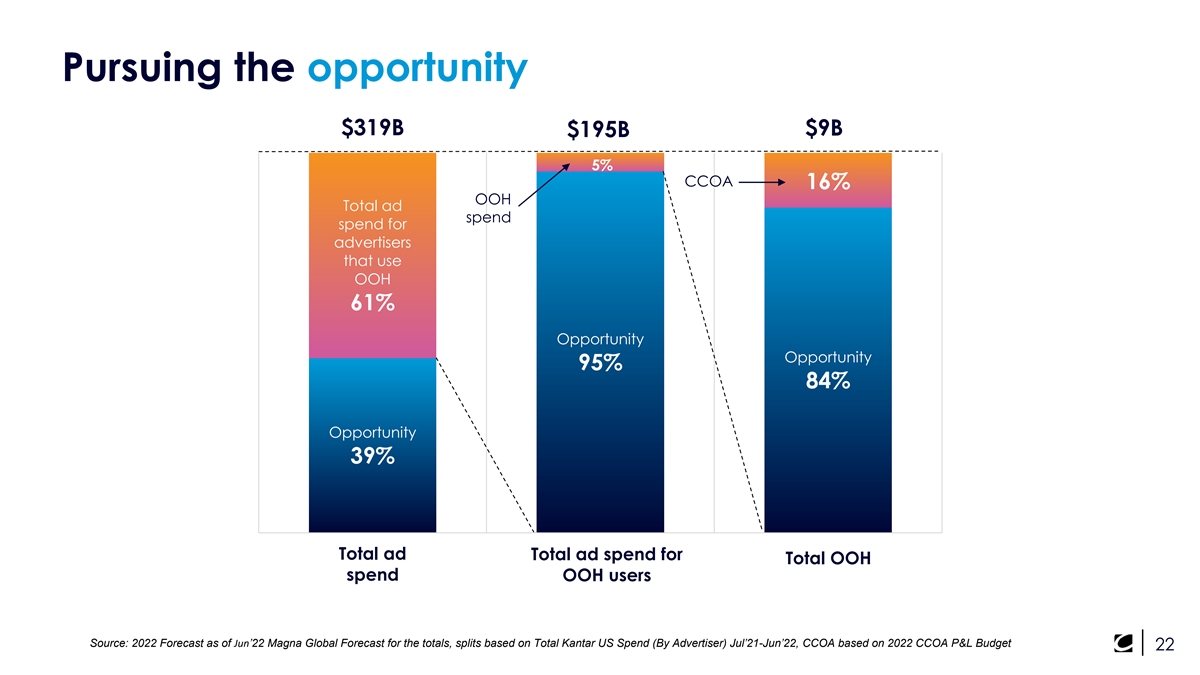

Pursuing the opportunity $319B $9B $195B 5% CCOA 16% OOH Total ad 5% spend spend for advertisers that use OOH 61% Opportunity Opportunity 95% 84% Opportunity 39% Total ad Total ad spend for Total OOH spend OOH users Source: 2022 Forecast as of Jun’22 Magna Global Forecast for the totals, splits based on Total Kantar US Spend (By Advertiser) Jul’21-Jun’22, CCOA based on 2022 CCOA P&L Budget 22

Why advertisers are choosing Out of Home & Clear Channel Bob McCuin Chief Revenue Officer 23

Evolving sales channels 24

The marketplace opportunity National Small Current sweet spot budgets budgets Current sales force ▪ Local sellers ▪ National sales group Agency partnerships Customer Solutions Team Programmatic 25

Developing the plant-based meat category 26

Client-direct success 27

The marketplace opportunity National Small Current sweet spot budgets budgets Current sales force ▪ Local sellers ▪ National sales group Inside sales Agency partnerships Self service Customer Solutions Team Programmatic 28

Mobile Consumer society attitudes 5 key trends OOH strengths Measurable Marketers’ impact needs 29

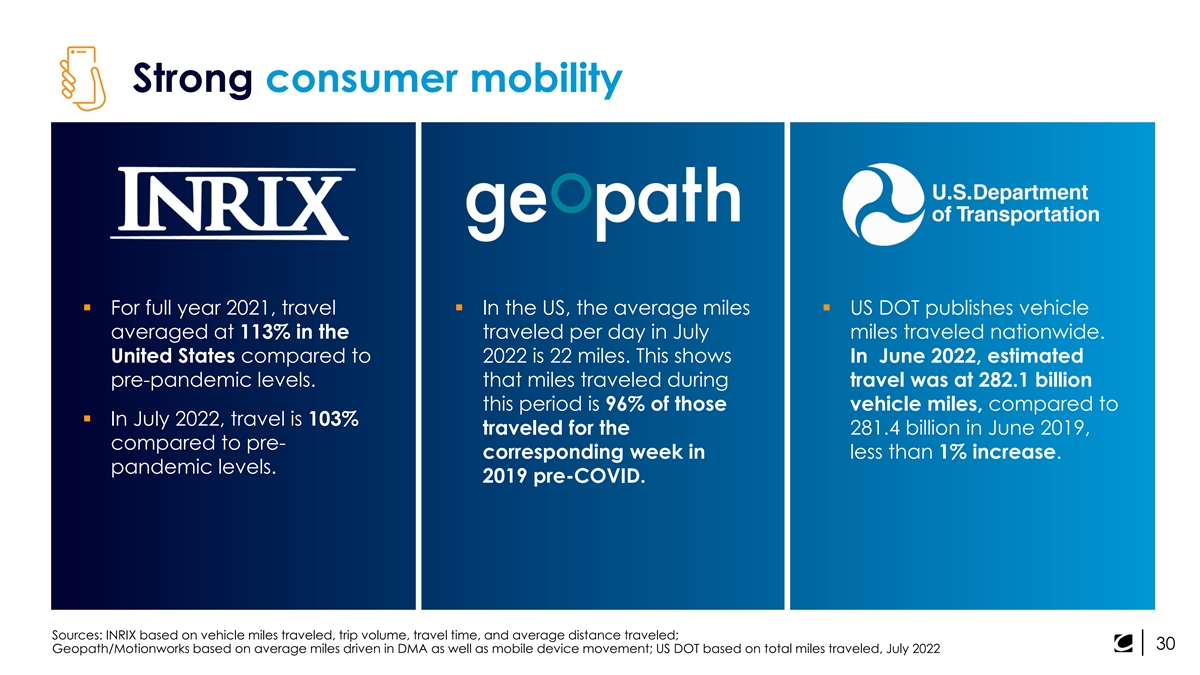

Strong consumer mobility ▪ For full year 2021, travel ▪ In the US, the average miles ▪ US DOT publishes vehicle averaged at 113% in the traveled per day in July miles traveled nationwide. United States compared to 2022 is 22 miles. This shows In June 2022, estimated pre-pandemic levels. that miles traveled during travel was at 282.1 billion this period is 96% of those vehicle miles, compared to ▪ In July 2022, travel is 103% traveled for the 281.4 billion in June 2019, compared to pre- corresponding week in less than 1% increase. pandemic levels. 2019 pre-COVID. Sources: INRIX based on vehicle miles traveled, trip volume, travel time, and average distance traveled; 30 Geopath/Motionworks based on average miles driven in DMA as well as mobile device movement; US DOT based on total miles traveled, July 2022

Consumers notice & like Out of Home Noticing Noticing OOH OOH ads % % ads more than 43 62 much more in pre-COVID cities of 1M+ % 85 of viewers find OOH ads useful Types of OOH ad messages consumers find most useful: ▪ 42% special offers and promotions ▪ 38% COVID safety and hygiene ▪ 29% awareness of new business/service Source: OAAA, The Harris Poll, 2022 31

Consumers feel negatively towards online ads Are annoyed Are concerned with ads that about personal interrupt security and % % viewing, data when 78 73 listening, and using online reading devices experiences Are actively Frequently trying to skip online spend less % % ads due to 68 43 time on digital device their burnout devices Source: OAAA, The Harris Poll, 2022 32

An impactful creative canvas 33

Innovative creative solutions 34

Netflix’s Resident Evil Video 35

Iconic, strategic locations Outdoor & Airports 1 70,000+ displays Outdoor & Airports reach 130 Million 2 Americans weekly 92 DMAs including 3 of the top 44 50 Sources: 1: CCOA Inventory, June 2022 / 2: Geopath OOH Ratings (P5+), August 2022 / 3: Based on CCOA Outdoor & Airport inventory in Nielsen DMAs, 2021 36

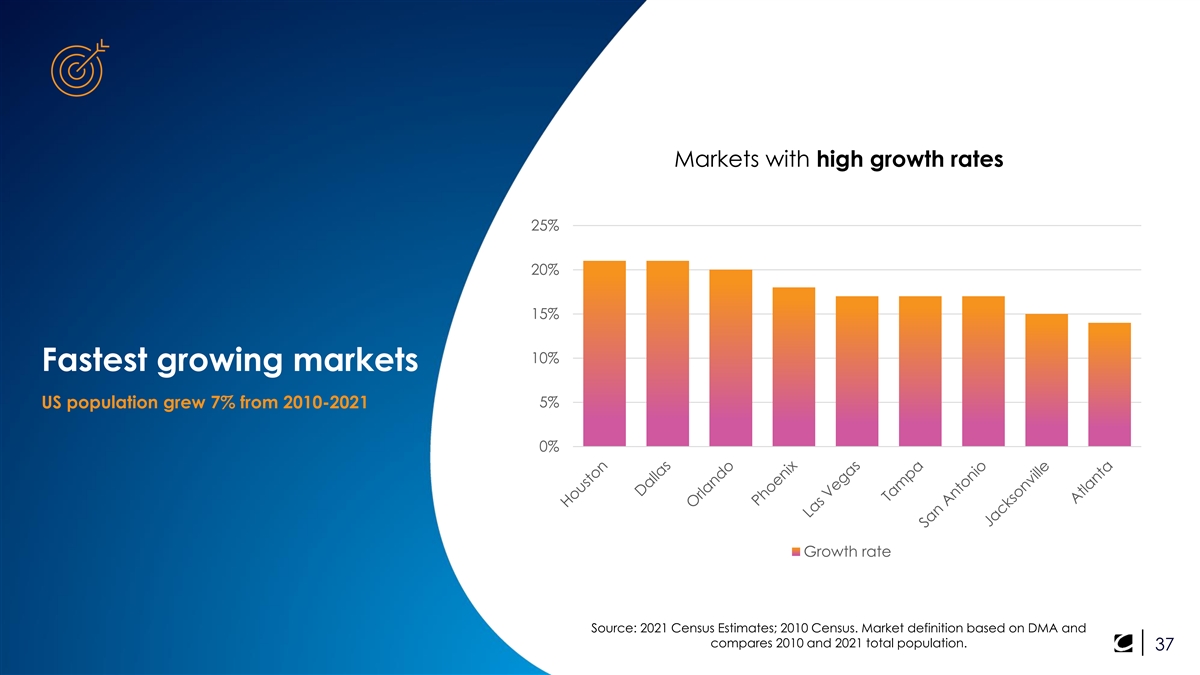

Markets with high growth rates 25% 20% 15% 10% Fastest growing markets 5% US population grew 7% from 2010-2021 0% Growth rate Source: 2021 Census Estimates; 2010 Census. Market definition based on DMA and compares 2010 and 2021 total population. 37

OOH & online activation OOH drives up to 40% of consumer online actions, while accounting for 4% of total media spend. 528 530 Online purchase Online search Share Index Share Index 489 586 Website visit Social media search Share Index Share Index 480 App download 696 Social media post Share Index Share Index Source: Consumer Insights: OOH and Online Activation, comScore; May 2022 38

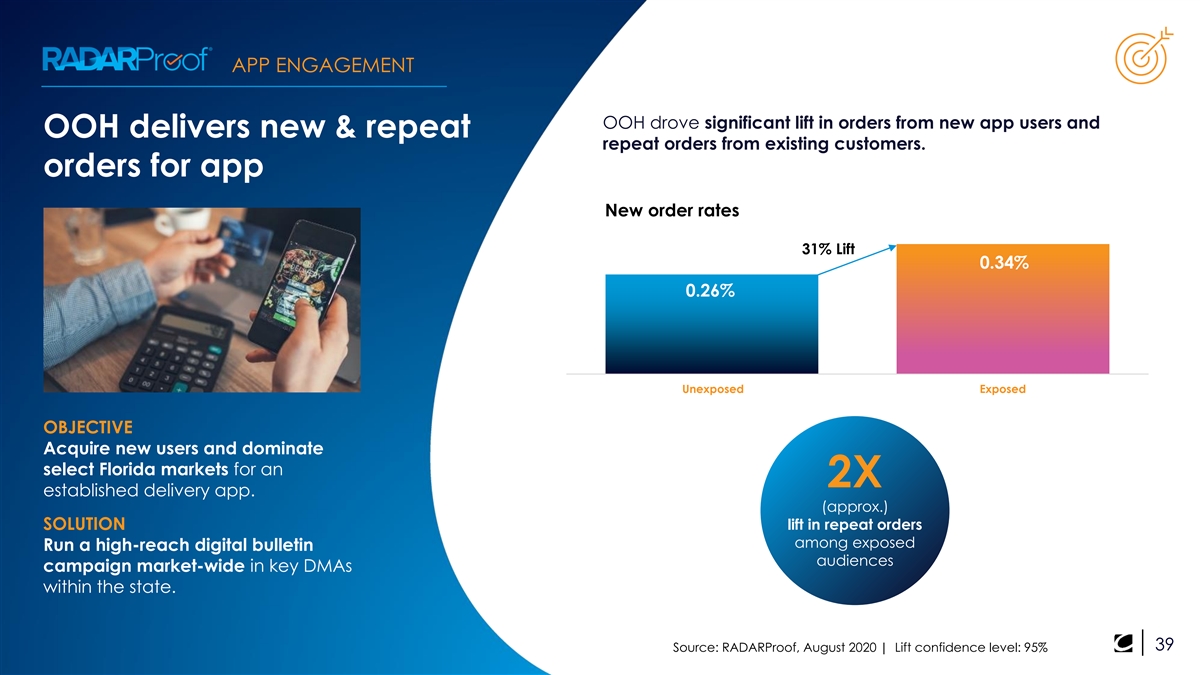

APP ENGAGEMENT OOH drove significant lift in orders from new app users and OOH delivers new & repeat repeat orders from existing customers. orders for app New order rates 31% Lift 0.34% 0.26% Unexposed Exposed OBJECTIVE Acquire new users and dominate select Florida markets for an 2X established delivery app. (approx.) SOLUTION lift in repeat orders among exposed Run a high-reach digital bulletin audiences campaign market-wide in key DMAs within the state. 39 Source: RADARProof, August 2020 | Lift confidence level: 95%

Changing needs of modern marketers 40

Why this matters 41

Mobile Consumer society attitudes Changing expectations OOH strengths of marketers Measurable Marketers’ impact needs 42

Think and act like digital media 43

Customer case for technology Erika Goldberg Chief of Business Operations 44

Drive Enable Increase productivity new sales customer in traditional channels retention business 45

A manual, paper-driven, redundant process

Planning Buying The vision for end-to-end Activation workflow Invoicing Reporting 47

Unified inventory management 48

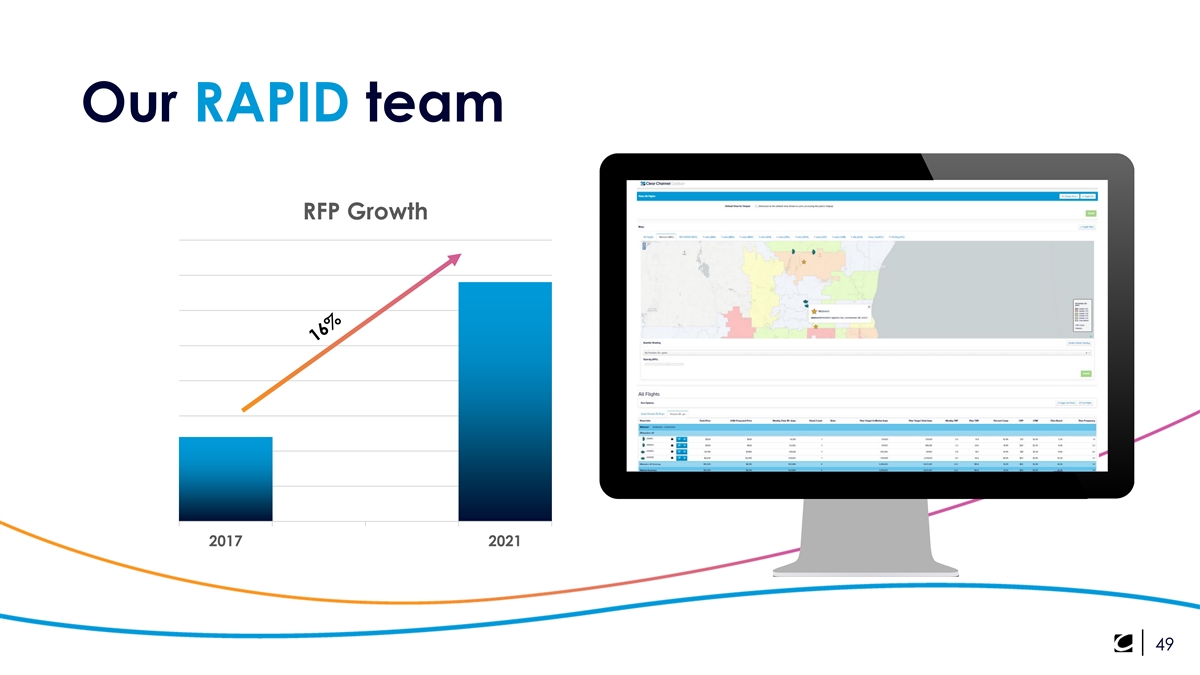

Our RAPID team RFP Growth 2017 2021 49

Connecting the pipes 50

AdQuick partnership 51

From paper contracts to digital orders 52

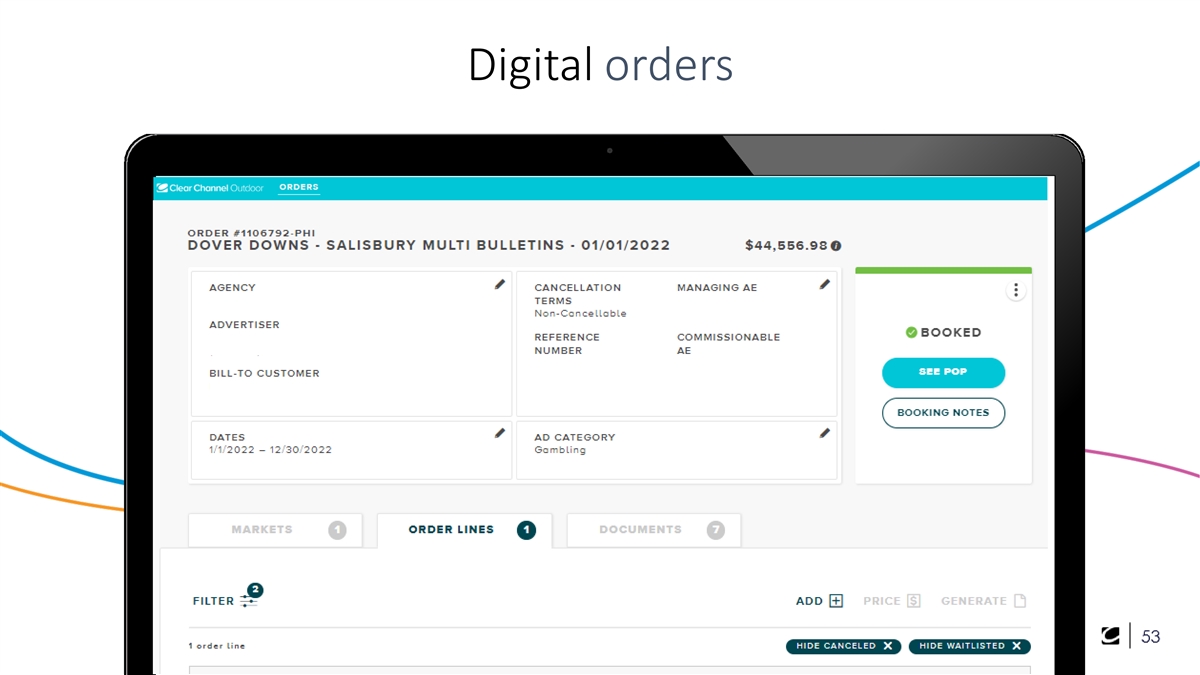

Digitalorders 1

Technology-driven operations 54

A more efficient Operations approach 55

Digital flexibility 56

The foundation for programmatic 57

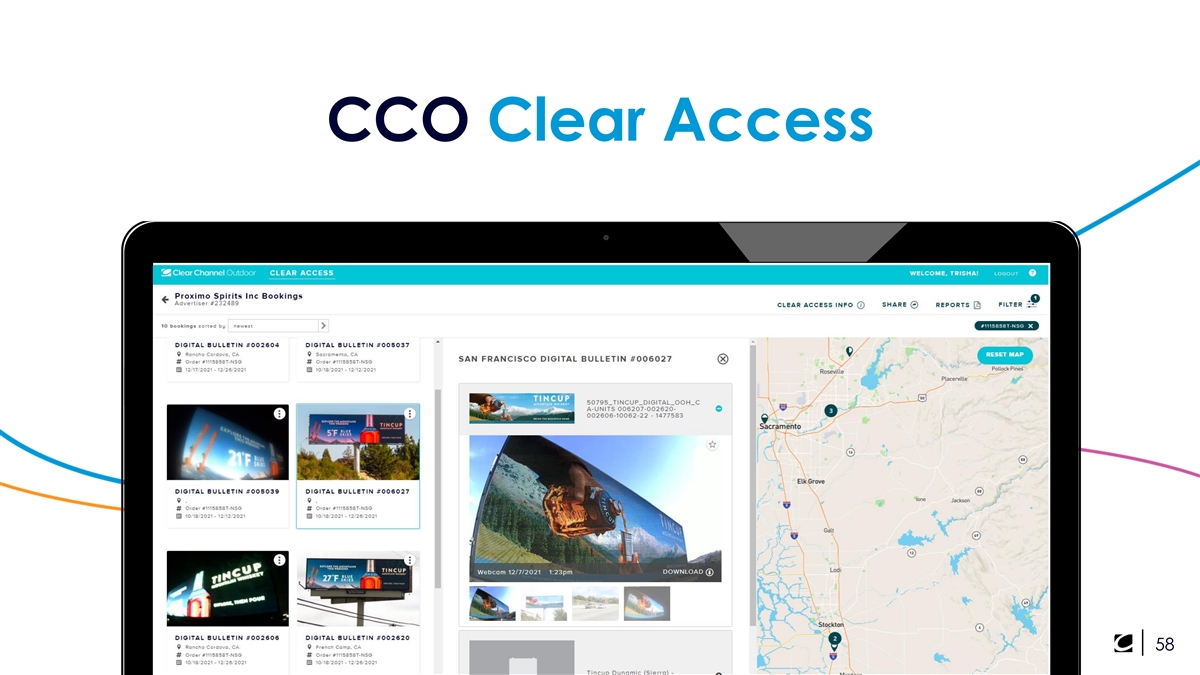

CCO Clear Access 58

What comes next? Drive Enable Increase productivity new sales customer in traditional channels retention business 59

Clear Channel Outdoor RADAR suite of solutions Dan Levi Chief Marketing Officer 60

RADAR’s suite of solutions more effectively plan, amplify and measure impact By using mobile location data, which provides insights into consumer mobility and behavior, we can better understand and measure exposed OOH audiences 61

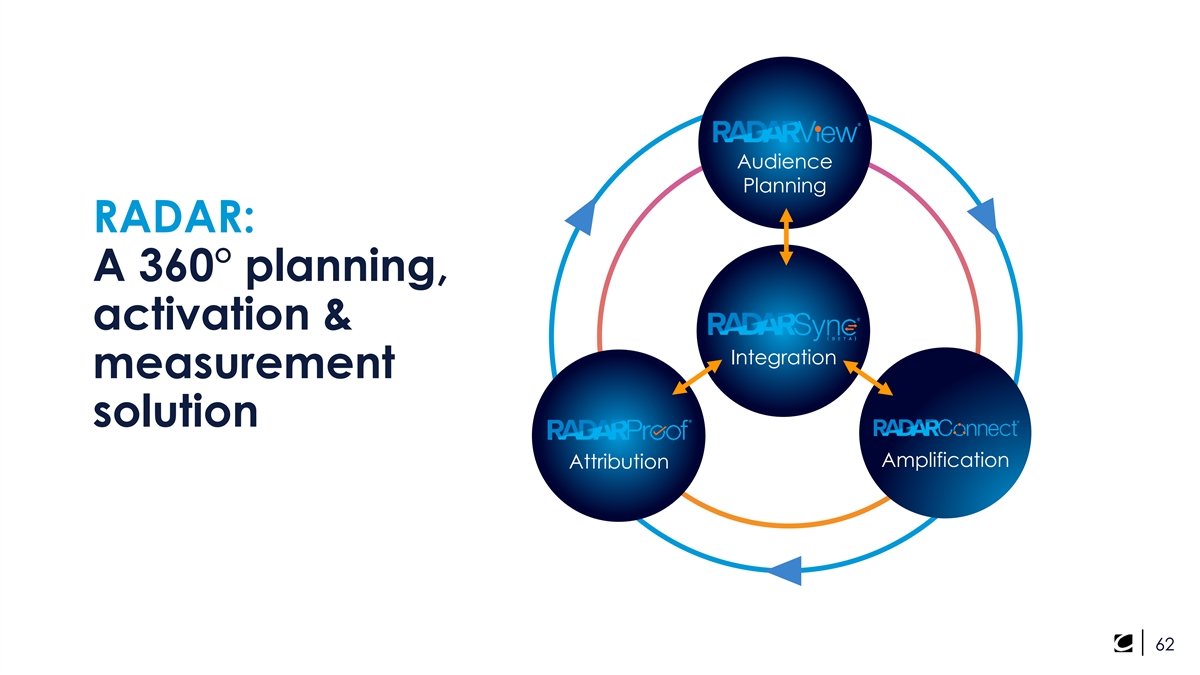

Audience Planning RADAR: A 360° planning, activation & Integration measurement solution Amplification Attribution 62

Mobile data delivers audience-based insights As people move throughout the day, their mobile phones provide an understanding of where they go and the routes they take to get there. 63

CCO RADAR delivers audiences exposed to OOH Four criteria for accurate and verified OOH exposure: Viewing distance (set by Geopath) Direction of travel/roadway Location signal strength (frequency, recency and number of signals/devices) Digital Exposure (exact time/duration spot airs, matched to users’ location data)

Efficient audience & location targeting A powerful tool to explore the best OOH solutions to reach your desired audience * Comprehensive view of CCO roadside inventory across 28 DMAs Access to 1,500+ behavioral audience segments plus demographic and location targeting Detailed audience insights for single locations and entire campaigns *Bus/transit/rail currently not available 65

Amplify reach & engagement Amplify OOH and reinforce messaging when and where it matters ▪ Strategic approach to mobile and digital retargeting drives high engagement and response ▪ Easy to activate and extend reach of OOH and digital initiatives ▪ Detailed reporting and insights on key digital goals including CTR, conversions, visits, etc. 66

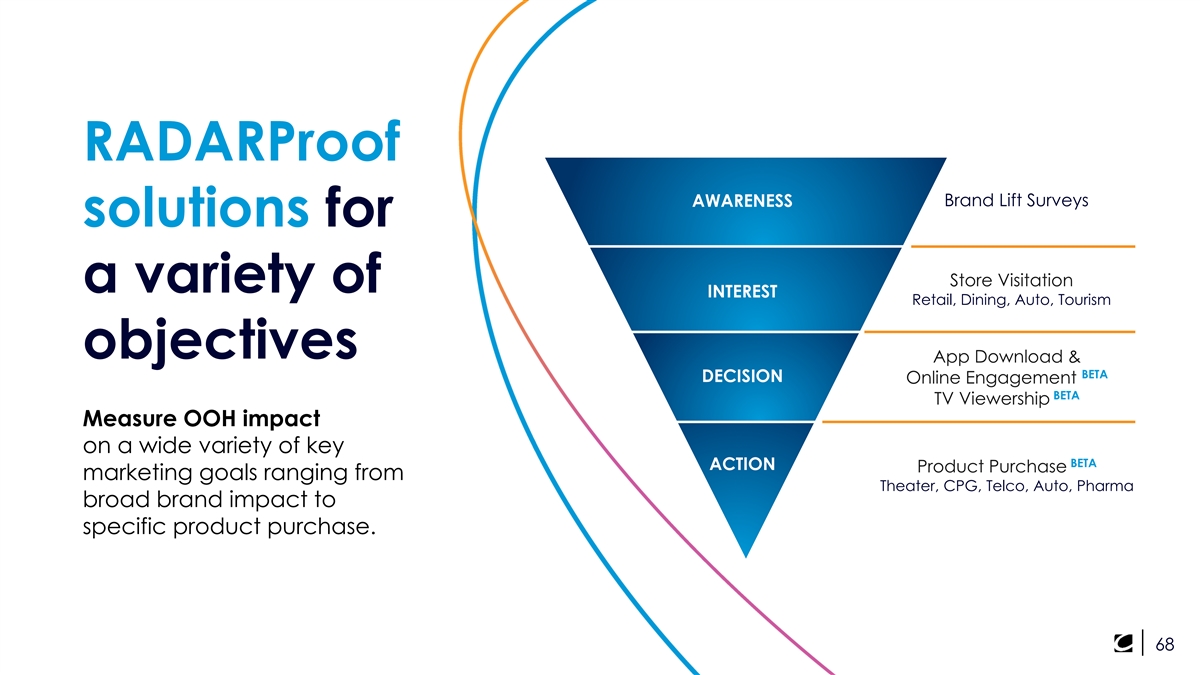

Measure the impact of out-of-home Measure campaign outcomes to understand OOH effectiveness ▪ Attribution solutions for a variety of marketing goals including visitation, brand affinity, TV tune in, mobile app usage, and more ▪ Broad range of leading mobile research & data partners ▪ Transparent reporting and insights to optimize future campaigns 67

RADARProof Brand Lift Surveys AWARENESS solutions for Store Visitation a variety of INTEREST Retail, Dining, Auto, Tourism objectives App Download & BETA DECISION Online Engagement BETA TV Viewership Measure OOH impact on a wide variety of key BETA ACTION Product Purchase marketing goals ranging from Theater, CPG, Telco, Auto, Pharma broad brand impact to specific product purchase. 68

OOH drives quick service restaurant visits & delivers actionable insights Of audiences exposed to OOH % will travel more than 5 miles to 60 visit QSR stores Of those exposed to OOH will % travel 15+ miles from where 27 they live or work Lift in store visitation among % 170 those exposed 6+ times to OOH RADARProof visit studies demonstrate strong results for QSR brands going beyond close proximity Source: CCO RADAR / Cuebiq, 2017-2018 based on visits studies for Arby’s, McDonald’s, Schlotzsky’s and three other restaurants tracking 3.1 million total devices 69

Full funnel measurement 70

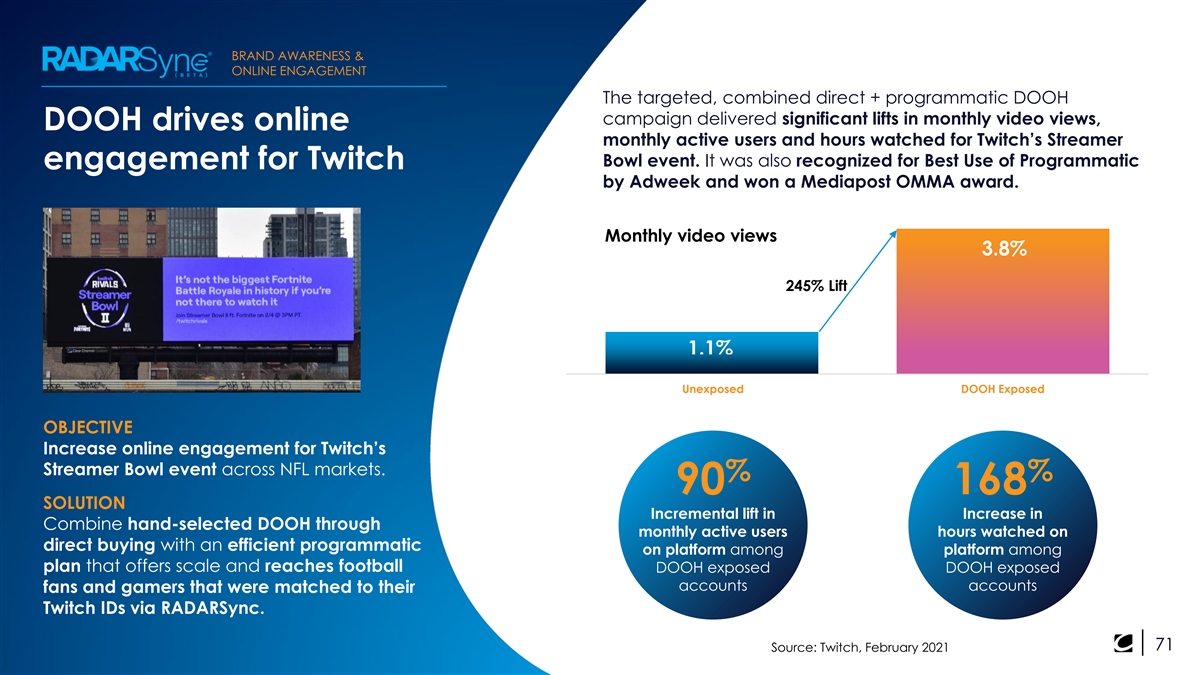

BRAND AWARENESS & ONLINE ENGAGEMENT The targeted, combined direct + programmatic DOOH campaign delivered significant lifts in monthly video views, DOOH drives online monthly active users and hours watched for Twitch’s Streamer Bowl event. It was also recognized for Best Use of Programmatic engagement for Twitch by Adweek and won a Mediapost OMMA award. Monthly video views 3.8% 245% Lift 1.1% Unexposed DOOH Exposed OBJECTIVE Increase online engagement for Twitch’s Streamer Bowl event across NFL markets. % % 90 168 SOLUTION Incremental lift in Increase in Combine hand-selected DOOH through monthly active users hours watched on direct buying with an efficient programmatic on platform among platform among plan that offers scale and reaches football DOOH exposed DOOH exposed accounts accounts fans and gamers that were matched to their Twitch IDs via RADARSync. 71 Source: Twitch, February 2021

Twitch Video 72

Integrated audience insights Measure, plan and optimize OOH as an integrated part of your media mix ▪ Aligns mobile data on exposed OOH st rd audiences with 1 and 3 party insights ▪ Streamlined, privacy compliant process working with leading identity resolution partners ▪ Highly customized data solutions tailored to customer goals 73

Opening doors to opportunity Amplification Attribution Audience Planning Integration 74

Programmatic as a Driver of Growth Cathy Muldowney SVP Programmatic Sales 75

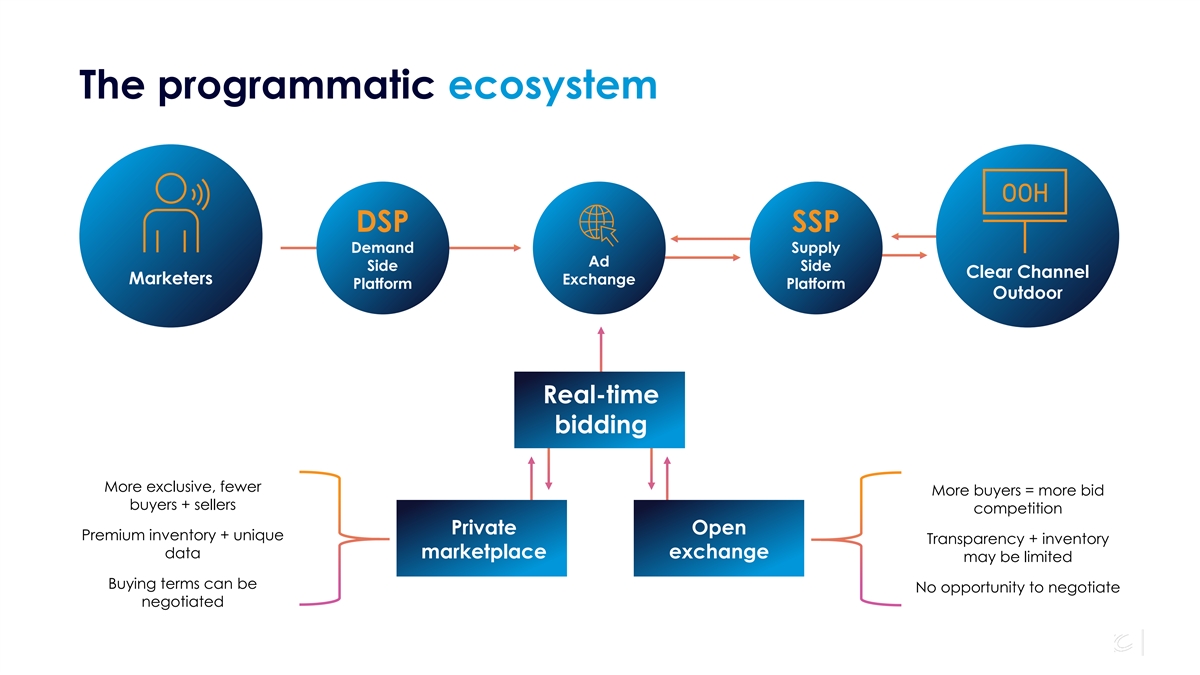

The programmatic ecosystem DSP SSP Demand Supply Ad Side Side Clear Channel Marketers Exchange Platform Platform Outdoor Real-time bidding More exclusive, fewer More buyers = more bid buyers + sellers competition Private Open Premium inventory + unique Transparency + inventory data marketplace exchange may be limited Buying terms can be No opportunity to negotiate negotiated 76

Programmatic drives digital growth Digital display marketplace $12B $119B 9% 89% 91% 11% 2011 2021 Direct Programmatic Source: Digital display eMarketer 2020; OOH Programmatic eMarketer Sep 2021 77

CCO’s key innovations Integration with Magnite (Omnichannel SSP) PMP Transaction with DSPs First to market The Trade Desk Inflight Insights Dynamic Creative Partnership Testing Availability RADARView Audience First to market Targeting Availability First to market 2018 2020 2021 2022 2016 2017 2019 Dedicated Programmatic RTB Service Mediation Layer Sales Team Programmatic Guaranteed First to market First to market Availability TSQ & Spectaculars Airports inventory Google/DV360 Partnership Availability availability First to market RADARProof Measurement of PGM Campaigns First to market 78

Driving Customer scale access Primary focuses for programmatic Data Incrementality solutions 79

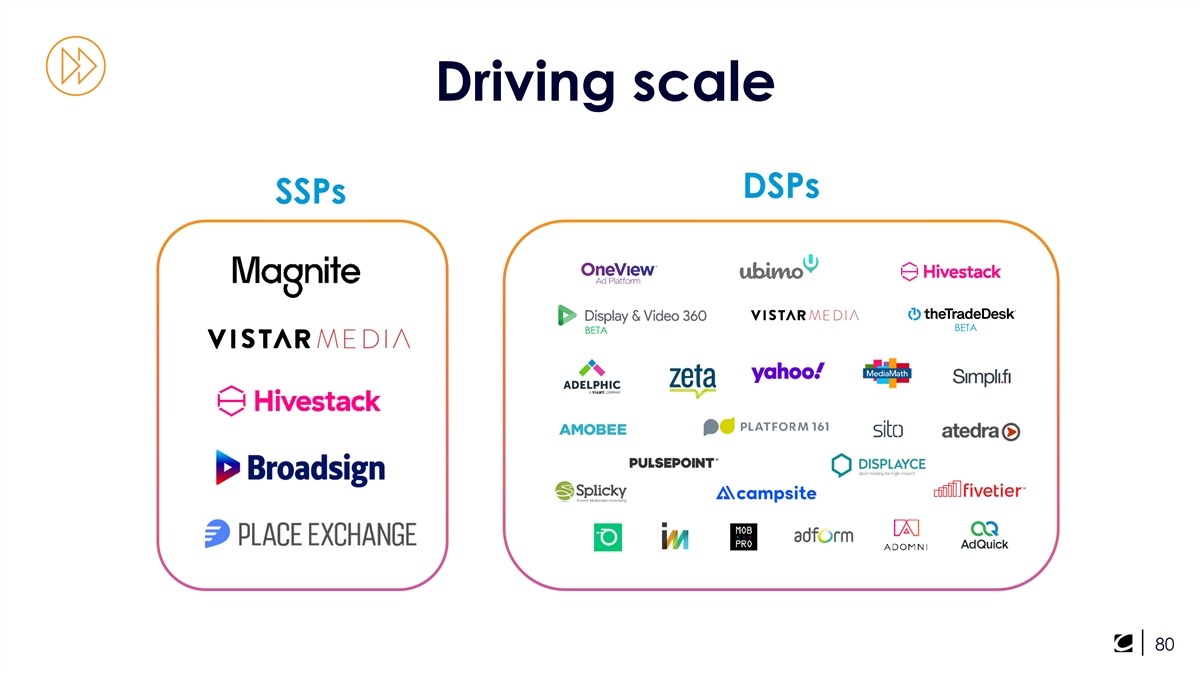

Driving scale DSPs SSPs BETA BETA 80

Customer National Small Current sweet spot access & budgets budgets solutions Agency partnerships 81

Ensuring National Small Current sweet spot incrementality budgets budgets % 75 + of revenue Agency partnerships 82

Data solutions to drive growth Inflight insights objectives ▪ Create lightweight RADARProof attribution metrics that can be available mid-campaign vs. post- campaign ▪ Lower feasibility thresholds to make these insights available to more customers ▪ Provide directional insights that can support future optimization of programmatic OOH 83

Driving Customer scale access Primary focuses for programmatic Data Incrementality solutions 84

Short break September 8, 2022

Financial Overview Brian Coleman Chief Financial Officer 86

Highlights Expanded disclosures ▪ Revenue and inventory breakdown 1 ▪ AFFO Enhanced guidance ▪ Company reaffirms Q3 guidance and is providing additional FY2022 guidance Long-range outlook ▪ 2022-2025 long-range outlook: Revenue, 1 1 Adjusted EBITDA , AFFO 1 Non-GAAP measure. See slide 2 and the Appendix for definitions and uses of these measures and reconciliations to GAAP. 87

Disclosures and guidance implemented since Separation Revenue-related: ▪ Quarterly revenue guidance by segment ▪ Digital vs. non-digital – Americas and Europe ▪ Billboard & other vs. Transit – Americas ▪ Local vs. National – Americas Expenses & capex: ▪ Site lease expense breakout – Americas and Europe ▪ Annual capex guidance ▪ Segment and growth/maintenance breakout added in Q2 Other: ▪ Display count breakout by segment and product type ▪ New segments 1 1 ▪ New financial measures: Adjusted EBITDA , Adjusted Corporate expenses 1 88 Non-GAAP measure. See slide 2 and the Appendix for definitions and uses of these measures and reconciliations to GAAP.

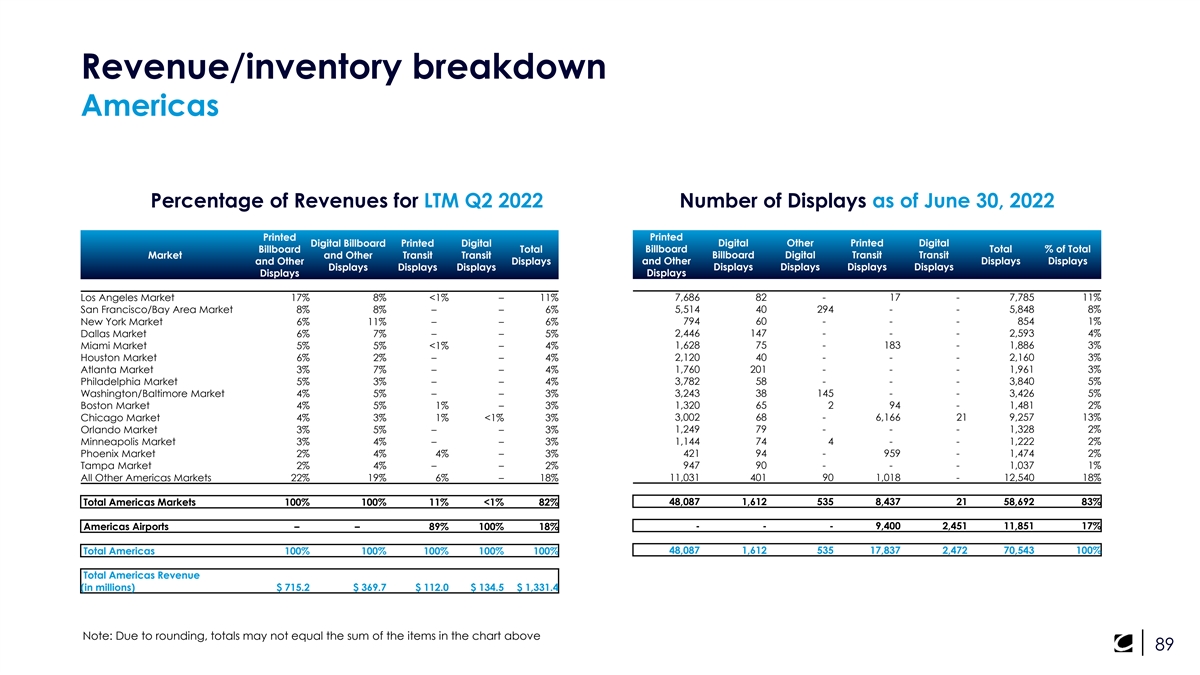

Revenue/inventory breakdown Americas Percentage of Revenues for LTM Q2 2022 Number of Displays as of June 30, 2022 Printed Printed Digital Billboard Printed Digital Digital Other Printed Digital Billboard Total Billboard Total % of Total Market and Other Transit Transit Billboard Digital Transit Transit and Other Displays and Other Displays Displays Displays Displays Displays Displays Displays Displays Displays Displays Displays Los Angeles Market 17% 8% <1% – 11% 7,686 82 - 17 - 7,785 11% 5,514 40 294 - - 5,848 8% San Francisco/Bay Area Market 8% 8% – – 6% New York Market 6% 11% – – 6% 794 60 - - - 854 1% Dallas Market 6% 7% – – 5% 2,446 147 - - - 2,593 4% Miami Market 5% 5% <1% – 4% 1,628 75 - 183 - 1,886 3% Houston Market 6% 2% – – 4% 2,120 40 - - - 2,160 3% 1,760 201 - - - 1,961 3% Atlanta Market 3% 7% – – 4% Philadelphia Market 5% 3% – – 4% 3,782 58 - - - 3,840 5% Washington/Baltimore Market 4% 5% – – 3% 3,243 38 145 - - 3,426 5% Boston Market 4% 5% 1% – 3% 1,320 65 2 94 - 1,481 2% Chicago Market 4% 3% 1% <1% 3% 3,002 68 - 6,166 21 9,257 13% 1,249 79 - - - 1,328 2% Orlando Market 3% 5% – – 3% Minneapolis Market 3% 4% – – 3% 1,144 74 4 - - 1,222 2% Phoenix Market 2% 4% 4% – 3% 421 94 - 959 - 1,474 2% Tampa Market 2% 4% – – 2% 947 90 - - - 1,037 1% All Other Americas Markets 22% 19% 6% – 18% 11,031 401 90 1,018 - 12,540 18% 48,087 1,612 535 8,437 21 58,692 83% Total Americas Markets 100% 100% 11% <1% 82% Americas Airports – – 89% 100% 18% - - - 9,400 2,451 11,851 17% 48,087 1,612 535 17,837 2,472 70,543 100% Total Americas 100% 100% 100% 100% 100% Total Americas Revenue (in millions) $ 715.2 $ 369.7 $ 112.0 $ 134.5 $ 1,331.4 Note: Due to rounding, totals may not equal the sum of the items in the chart above 89

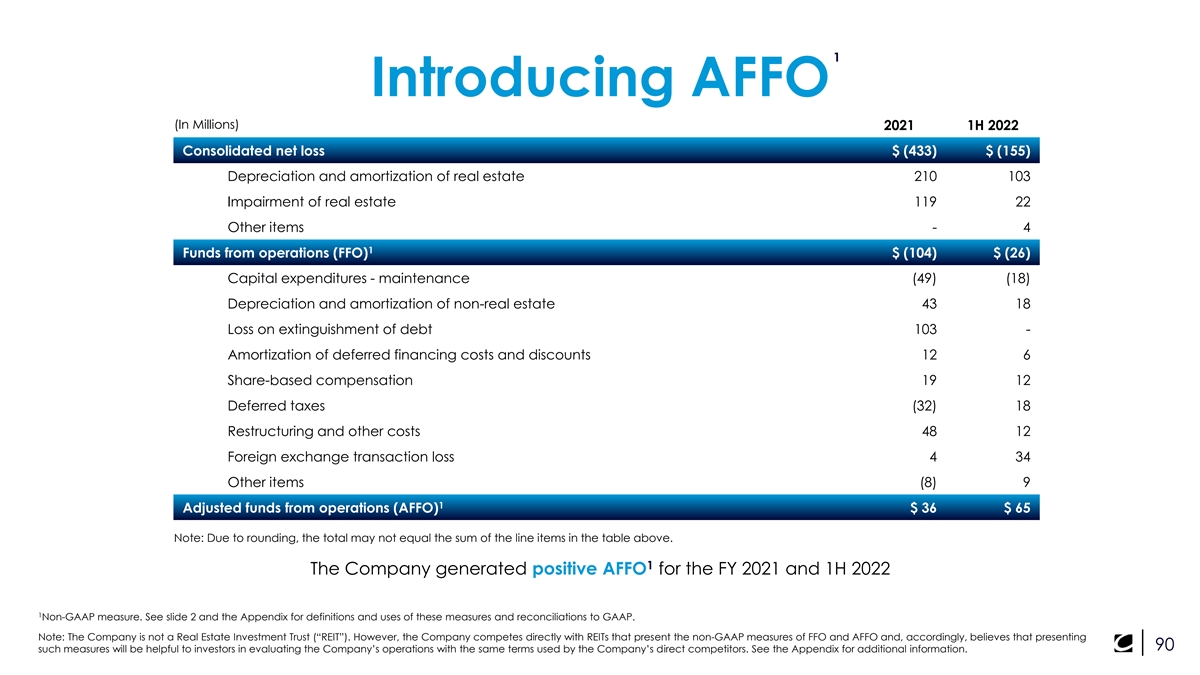

1 Introducing AFFO (In Millions) 2021 1H 2022 Consolidated net loss $ (433) $ (155) Depreciation and amortization of real estate 210 103 Impairment of real estate 119 22 Other items - 4 1 Funds from operations (FFO) $ (104) $ (26) Capital expenditures - maintenance (49) (18) Depreciation and amortization of non-real estate 43 18 Loss on extinguishment of debt 103 - Amortization of deferred financing costs and discounts 12 6 Share-based compensation 19 12 Deferred taxes (32) 18 Restructuring and other costs 48 12 Foreign exchange transaction loss 4 34 Other items (8) 9 1 Adjusted funds from operations (AFFO) $ 36 $ 65 Note: Due to rounding, the total may not equal the sum of the line items in the table above. 1 The Company generated positive AFFO for the FY 2021 and 1H 2022 1 Non-GAAP measure. See slide 2 and the Appendix for definitions and uses of these measures and reconciliations to GAAP. Note: The Company is not a Real Estate Investment Trust (“REIT”). However, the Company competes directly with REITs that present the non-GAAP measures of FFO and AFFO and, accordingly, believes that presenting 90 such measures will be helpful to investors in evaluating the Company’s operations with the same terms used by the Company’s direct competitors. See the Appendix for additional information.

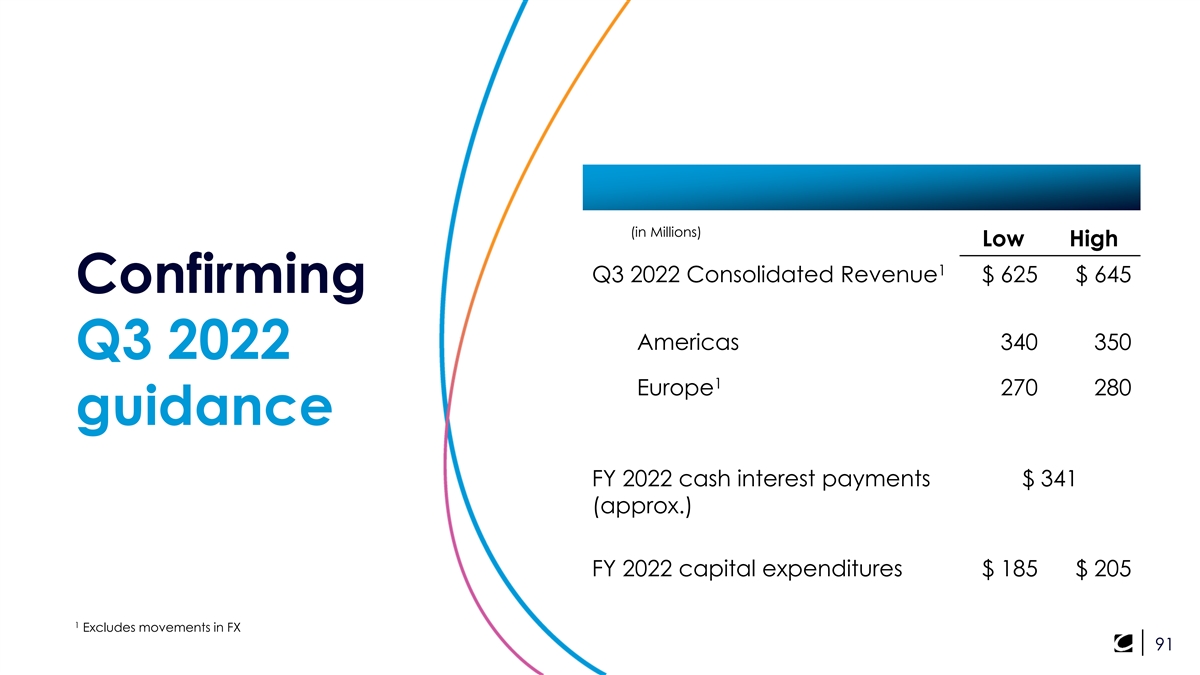

(in Millions) Low High 1 Q3 2022 Consolidated Revenue $ 625 $ 645 Confirming Americas 340 350 Q3 2022 1 Europe 270 280 guidance FY 2022 cash interest payments $ 341 (approx.) FY 2022 capital expenditures $ 185 $ 205 1 Excludes movements in FX 91

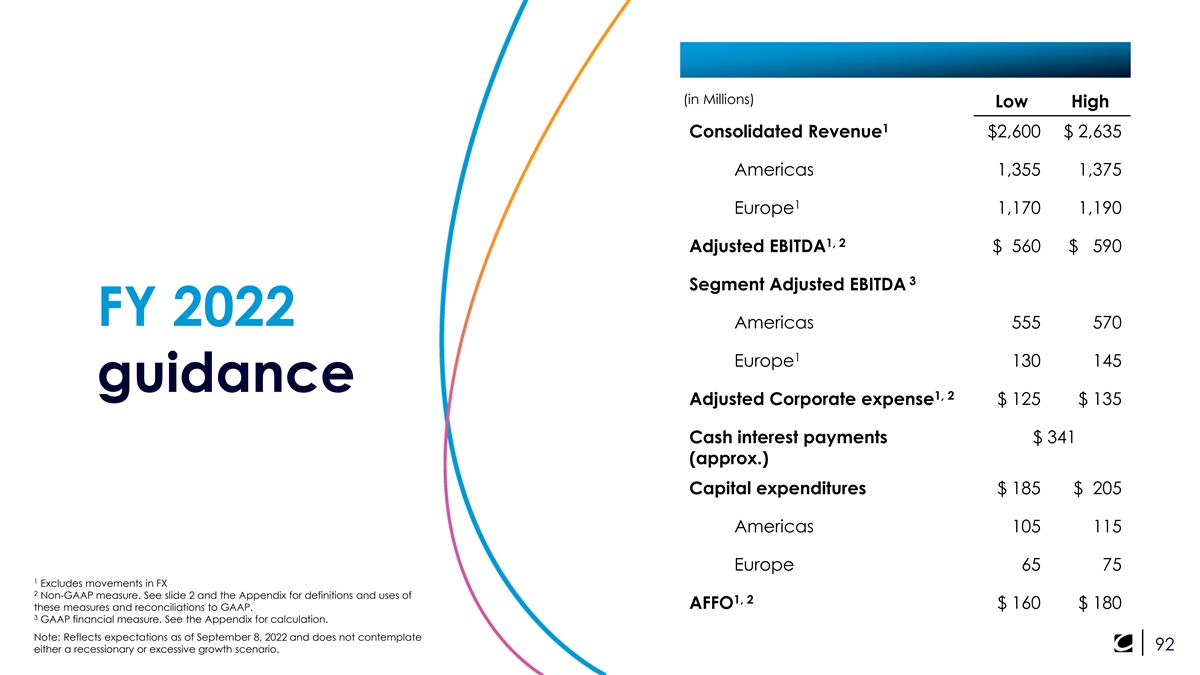

(in Millions) Low High 1 Consolidated Revenue $2,600 $ 2,635 Americas 1,355 1,375 1 Europe 1,170 1,190 1, 2 Adjusted EBITDA $ 560 $ 590 3 Segment Adjusted EBITDA FY 2022 Americas 555 570 1 Europe 130 145 guidance 1, 2 Adjusted Corporate expense $ 125 $ 135 Cash interest payments $ 341 (approx.) Capital expenditures $ 185 $ 205 Americas 105 115 Europe 65 75 1 Excludes movements in FX 2 Non-GAAP measure. See slide 2 and the Appendix for definitions and uses of 1, 2 AFFO $ 160 $ 180 these measures and reconciliations to GAAP. 3 GAAP financial measure. See the Appendix for calculation. Note: Reflects expectations as of September 8, 2022 and does not contemplate 92 either a recessionary or excessive growth scenario.

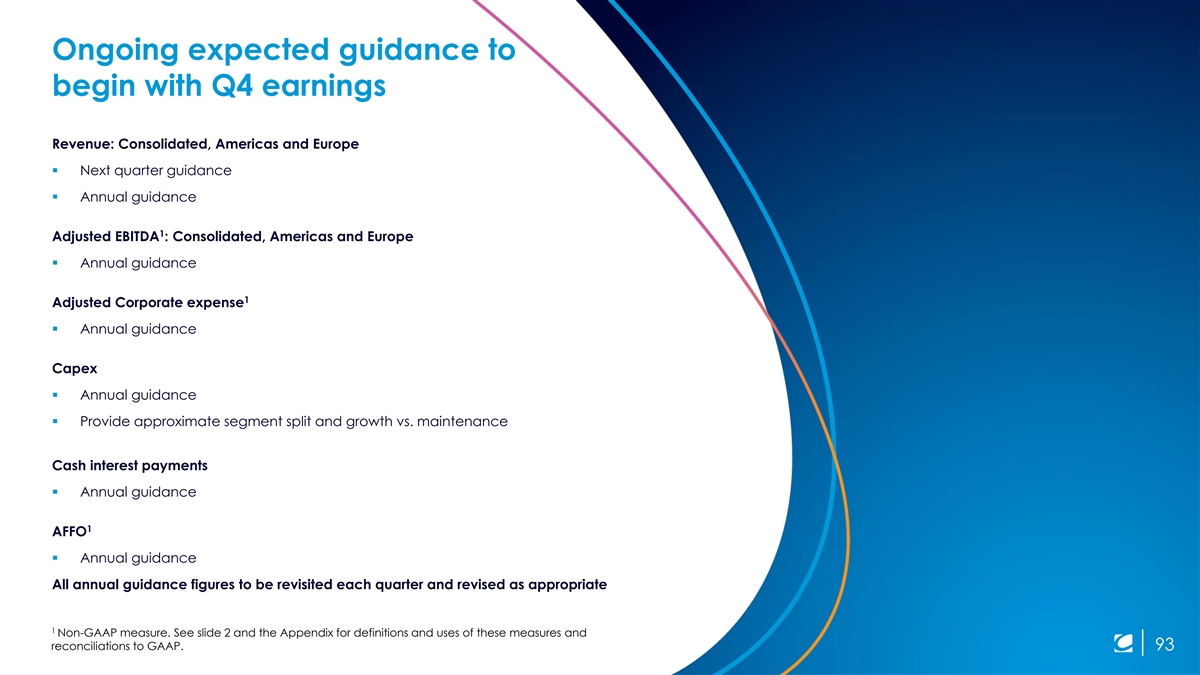

Ongoing expected guidance to begin with Q4 earnings Revenue: Consolidated, Americas and Europe ▪ Next quarter guidance ▪ Annual guidance 1 Adjusted EBITDA : Consolidated, Americas and Europe ▪ Annual guidance 1 Adjusted Corporate expense ▪ Annual guidance Capex ▪ Annual guidance ▪ Provide approximate segment split and growth vs. maintenance Cash interest payments ▪ Annual guidance 1 AFFO ▪ Annual guidance All annual guidance figures to be revisited each quarter and revised as appropriate 1 Non-GAAP measure. See slide 2 and the Appendix for definitions and uses of these measures and reconciliations to GAAP. 93

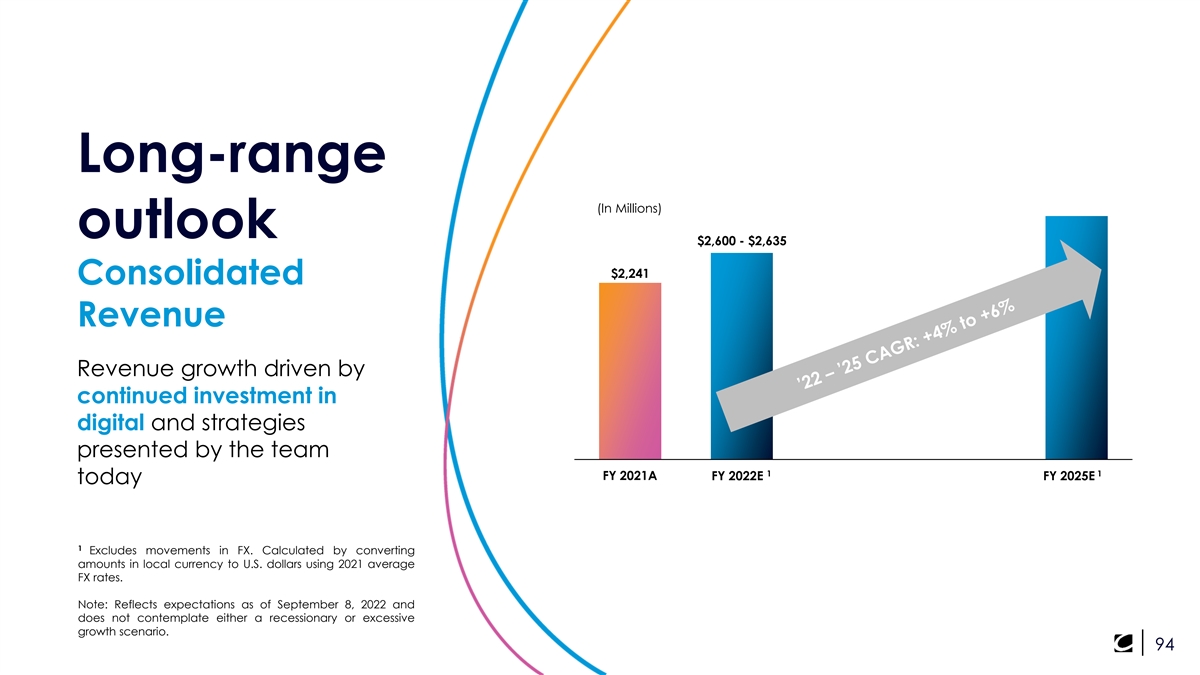

Long-range (In Millions) outlook $2,600 - $2,635 $2,241 Consolidated Revenue Revenue growth driven by continued investment in digital and strategies presented by the team 1 1 FY 2021A FY 2022E FY 2025E today 1 Excludes movements in FX. Calculated by converting amounts in local currency to U.S. dollars using 2021 average FX rates. Note: Reflects expectations as of September 8, 2022 and does not contemplate either a recessionary or excessive growth scenario. 94

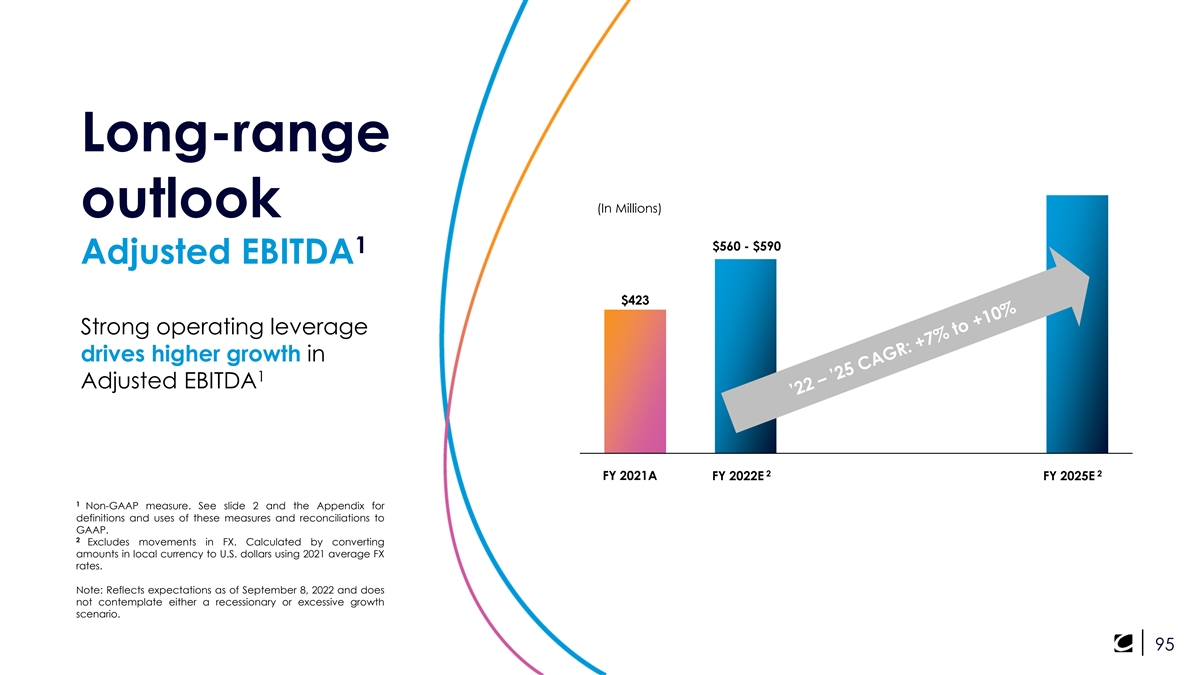

Long-range (In Millions) outlook $560 - $590 1 Adjusted EBITDA $423 Strong operating leverage drives higher growth in 1 Adjusted EBITDA 2 2 FY 2021A FY 2022E FY 2025E 1 Non-GAAP measure. See slide 2 and the Appendix for definitions and uses of these measures and reconciliations to GAAP. 2 Excludes movements in FX. Calculated by converting amounts in local currency to U.S. dollars using 2021 average FX rates. Note: Reflects expectations as of September 8, 2022 and does not contemplate either a recessionary or excessive growth scenario. 95

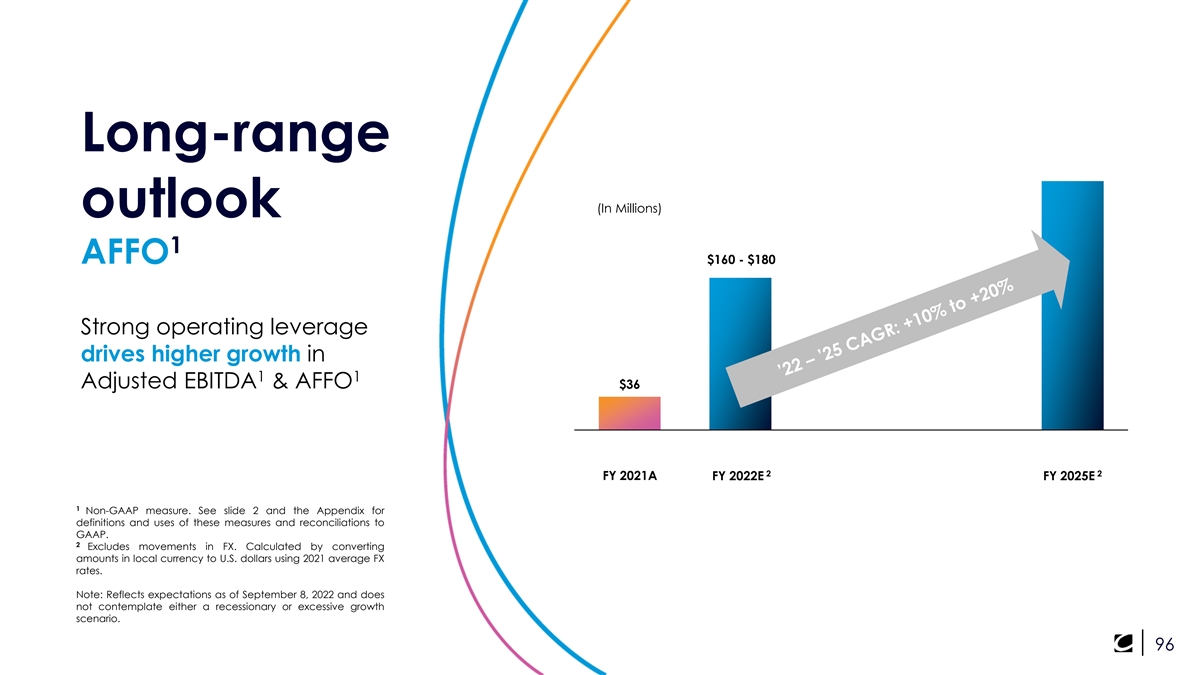

Long-range (In Millions) outlook 1 AFFO $160 - $180 Strong operating leverage drives higher growth in 1 1 Adjusted EBITDA & AFFO $36 2 2 FY 2021A FY 2022E FY 2025E 1 Non-GAAP measure. See slide 2 and the Appendix for definitions and uses of these measures and reconciliations to GAAP. 2 Excludes movements in FX. Calculated by converting amounts in local currency to U.S. dollars using 2021 average FX rates. Note: Reflects expectations as of September 8, 2022 and does not contemplate either a recessionary or excessive growth scenario. 96

Clear Channel Outdoor Investor Day 2022 September 8, 2022

Q&A 98

99

Appendix 100

Non-GAAP financial information Non-GAAP Financial Information In order to provide a more comprehensive understanding of the information used by the Company’s management team in financial and operational decision making, the Company supplements its GAAP consolidated financial statements with certain non-GAAP financial performance measures. The Company presents Adjusted EBITDA, Adjusted Corporate expenses, Funds From Operations (“FFO”) and Adjusted Funds From Operations (“AFFO”) because the Company believes these non-GAAP measures help investors better understand the Company’s operating performance as compared to other out-of-home advertisers, and these metrics are widely used by such companies in practice. Please refer to the reconciliation of non-GAAP financial measures to their most directly comparable GAAP financial measure within this Appendix. The Company defines, and uses, these non-GAAP financial measures as follows: Adjusted EBITDA is defined as consolidated net income (loss), plus: income tax expense (benefit); all non-operating expenses (income), including other expense (income), net, loss on extinguishment of debt, and interest expense, net; other operating expense (income), net; impairment charges; depreciation and amortization; non-cash compensation expenses included within corporate expenses; and restructuring and other costs included within operating expenses. Restructuring and other costs include costs associated with cost savings initiatives such as severance, consulting and termination costs and other special costs. The Company uses Adjusted EBITDA as one of the primary measures for the planning and forecasting of future periods, as well as for measuring performance for compensation of Company executives and other members of Company management. The Company believes Adjusted EBITDA is useful for investors because it allows investors to view performance in a manner similar to the method used by Company management and helps improve investors’ ability to understand the Company’s operating performance, making it easier to compare the Company’s results with other companies that have different capital structures or tax rates. In addition, the Company believes Adjusted EBITDA is among the primary measures used externally by the Company’s investors, analysts and peers in its industry for purposes of valuation and comparing the operating performance of the Company to other companies in its industry. As part of the calculation of Adjusted EBITDA, the Company also presents the non-GAAP financial measure of “Adjusted Corporate expenses,” which the Company defines as corporate expenses excluding restructuring and other costs and non-cash compensation expense. The Company uses the National Association of Real Estate Investment Trusts (“Nareit”) definition of FFO, which is consolidated net loss before depreciation and amortization of real estate, gains or losses from the disposal of real estate, impairment of real estate and adjustments to eliminate unconsolidated affiliates and noncontrolling interest. The Company defines AFFO as FFO before (i) maintenance capital expenditures; (ii) straight-line rent effects; (iii) depreciation and amortization of non-real estate; (iv) loss on extinguishment of debt; (v) amortization of deferred financing costs and discounts; (vi) share-based compensation; (vii) deferred taxes; (viii) restructuring and other costs; (ix) transaction costs; (x) foreign exchange transaction gain or loss; (xi) non-service related pension costs or benefits; and (xii) other items including adjustment for unconsolidated affiliates and noncontrolling interest and nonrecurring infrequent or unusual gains or losses. The Company is not a Real Estate Investment Trust (“REIT”). However, the Company competes directly with REITs that present the non-GAAP measures of FFO and AFFO and, accordingly, believes that presenting such measures will be helpful to investors in evaluating the Company’s operations with the same terms used by the Company’s direct competitors. The Company calculates FFO in accordance with the definition adopted by Nareit. Nareit does not restrict presentation of non-GAAP measures traditionally presented by REITs by entities that are not REITs. In addition, the Company believes FFO and AFFO are already among the primary measures used externally by the Company’s investors, analysts and competitors in its industry for purposes of valuation and comparing the operating performance of the Company to other companies in its industry. The Company does not use, and you should not use, FFO and AFFO as an indication of the Company’s ability to fund its cash needs or pay dividends or make other distributions. Because the Company is not a REIT, the Company does not have an obligation to pay dividends or make distributions to stockholders and does not intend to pay dividends for the foreseeable future. Moreover, the presentation of these measures should not be construed as an indication that the Company is currently in a position to convert into a REIT. A significant portion of the Company’s advertising operations is conducted in foreign markets, principally Europe, and Company management reviews the results from its foreign operations on a constant dollar basis. The Company presents the GAAP measures of consolidated revenue and revenue and Segment Adjusted EBITDA for the Europe segment, as well as non-GAAP financial measures of Adjusted EBITDA, Adjusted Corporate expenses, FFO and AFFO excluding movements in foreign exchange rates because Company management believes that viewing certain financial results without the impact of fluctuations in foreign currency rates facilitates period-to-period comparisons of business performance and provides useful information to investors. These measures, which exclude the effects of foreign exchange rates, are calculated by converting the current period’s amounts in local currency to U.S. dollars using average foreign exchange rates for the comparable prior period. Since these non-GAAP financial measures are not calculated in accordance with GAAP, they should not be considered in isolation of, or as a substitute for, the most directly comparable GAAP financial measures as an indicator of operating performance or, in the case of Adjusted EBITDA, FFO and AFFO, the Company’s ability to fund its cash needs. In addition, these measures may not be comparable to similar measures provided by other companies. See reconciliations of consolidated net loss to Adjusted EBITDA, corporate expenses to Adjusted Corporate expenses and consolidated net loss to FFO and AFFO in the tables set forth below. This data should be read in conjunction with the Company’s most recent Annual Report on Form 10-K, Form 10-Qs and Form 8-Ks. These reports are available on the Investor Relations page of the Company’s website at investor.clearchannel.com. Segment Adjusted EBITDA The Company has two reportable segments, which it believes best reflect how the Company is currently managed: Americas and Europe. The Company’s remaining operating segment, Latin America, does not meet the quantitative threshold to qualify as a reportable segment and is disclosed as “Other.” Segment Adjusted EBITDA is the profitability metric reported to the Company’s chief operating decision maker for purposes of making decisions about allocation of resources to, and assessing performance of, each reportable segment. Segment Adjusted EBITDA is a GAAP financial measure that is calculated as Revenue less Direct operating expenses and SG&A expenses, excluding restructuring and other costs. Restructuring and other costs include costs associated with cost savings initiatives such as severance, consulting and termination costs and other special costs. 101

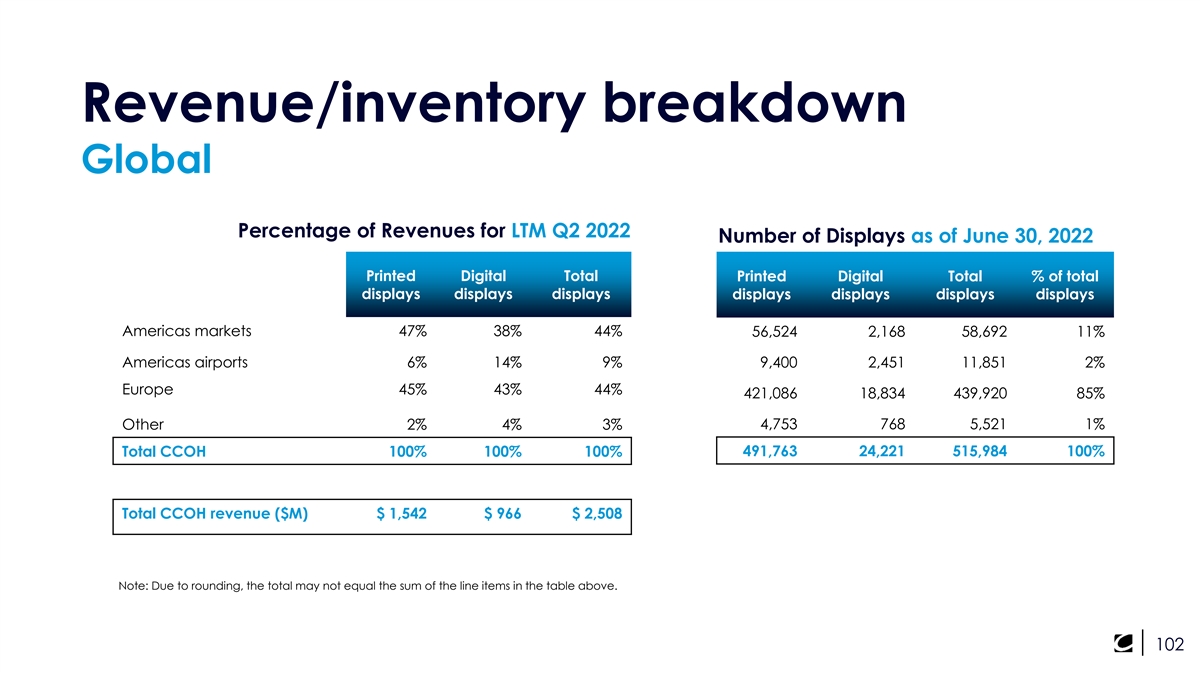

Revenue/inventory breakdown Global Percentage of Revenues for LTM Q2 2022 Number of Displays as of June 30, 2022 Printed Digital Total Printed Digital Total % of total displays displays displays displays displays displays displays Americas markets 47% 38% 44% 56,524 2,168 58,692 11% Americas airports 6% 14% 9% 9,400 2,451 11,851 2% Europe 45% 43% 44% 421,086 18,834 439,920 85% Other 2% 4% 3% 4,753 768 5,521 1% Total CCOH 100% 100% 100% 491,763 24,221 515,984 100% Total CCOH revenue ($M) $ 1,542 $ 966 $ 2,508 Note: Due to rounding, the total may not equal the sum of the line items in the table above. 102

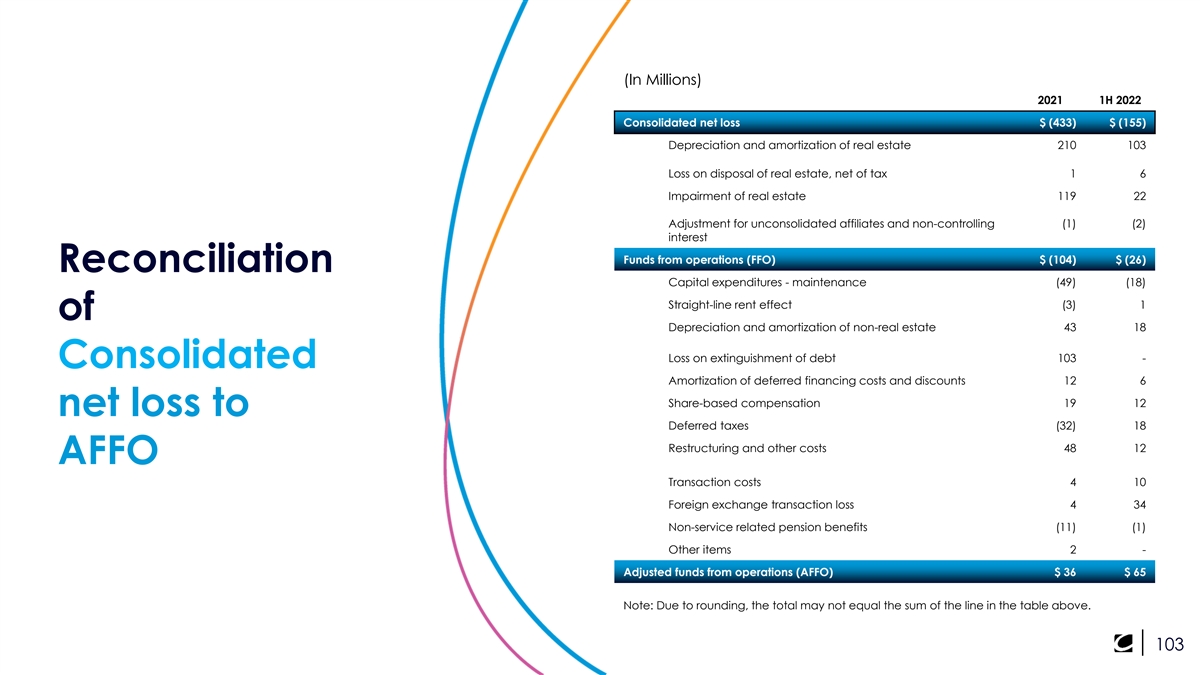

(In Millions) 2021 1H 2022 Consolidated net loss $ (433) $ (155) Depreciation and amortization of real estate 210 103 Loss on disposal of real estate, net of tax 1 6 Impairment of real estate 119 22 Adjustment for unconsolidated affiliates and non-controlling (1) (2) interest Funds from operations (FFO) $ (104) $ (26) Reconciliation Capital expenditures - maintenance (49) (18) Straight-line rent effect (3) 1 of Depreciation and amortization of non-real estate 43 18 Loss on extinguishment of debt 103 - Consolidated Amortization of deferred financing costs and discounts 12 6 Share-based compensation 19 12 net loss to Deferred taxes (32) 18 Restructuring and other costs 48 12 AFFO Transaction costs 4 10 Foreign exchange transaction loss 4 34 Non-service related pension benefits (11) (1) Other items 2 - Adjusted funds from operations (AFFO) $ 36 $ 65 Note: Due to rounding, the total may not equal the sum of the line in the table above. 103

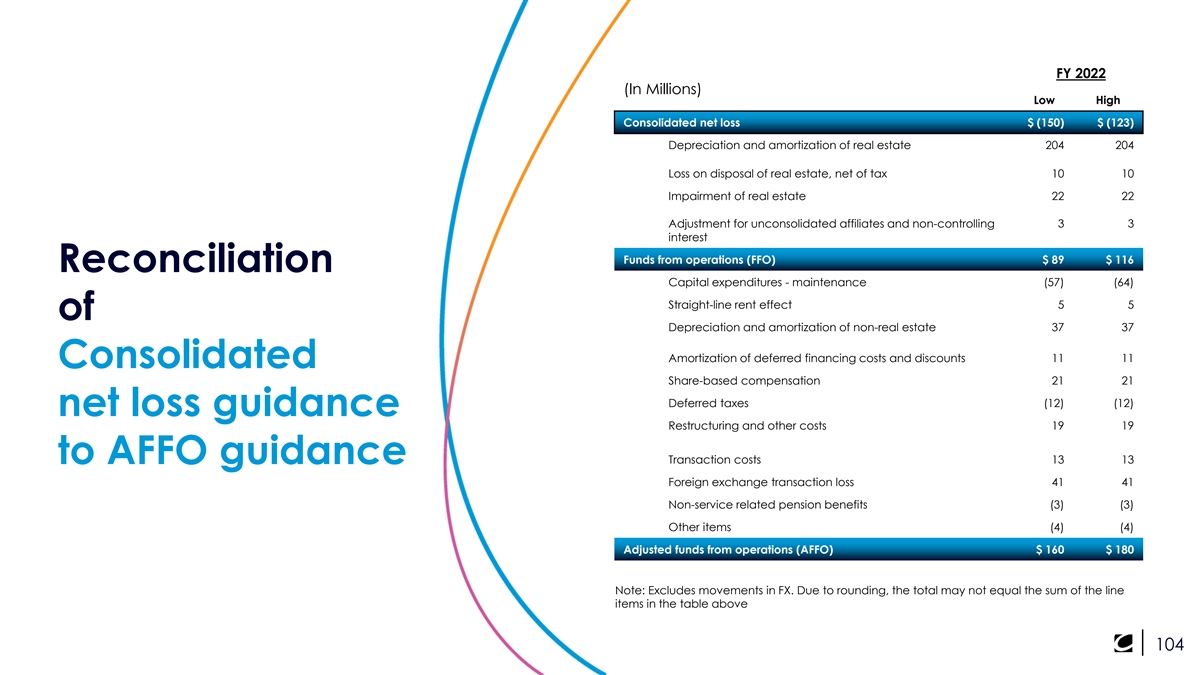

FY 2022 (In Millions) Low High Consolidated net loss $ (150) $ (123) Depreciation and amortization of real estate 204 204 Loss on disposal of real estate, net of tax 10 10 Impairment of real estate 22 22 Adjustment for unconsolidated affiliates and non-controlling 3 3 interest Funds from operations (FFO) $ 89 $ 116 Reconciliation Capital expenditures - maintenance (57) (64) Straight-line rent effect 5 5 of Depreciation and amortization of non-real estate 37 37 Amortization of deferred financing costs and discounts 11 11 Consolidated Share-based compensation 21 21 Deferred taxes (12) (12) net loss guidance Restructuring and other costs 19 19 to AFFO guidance Transaction costs 13 13 Foreign exchange transaction loss 41 41 Non-service related pension benefits (3) (3) Other items (4) (4) Adjusted funds from operations (AFFO) $ 160 $ 180 Note: Excludes movements in FX. Due to rounding, the total may not equal the sum of the line items in the table above 104

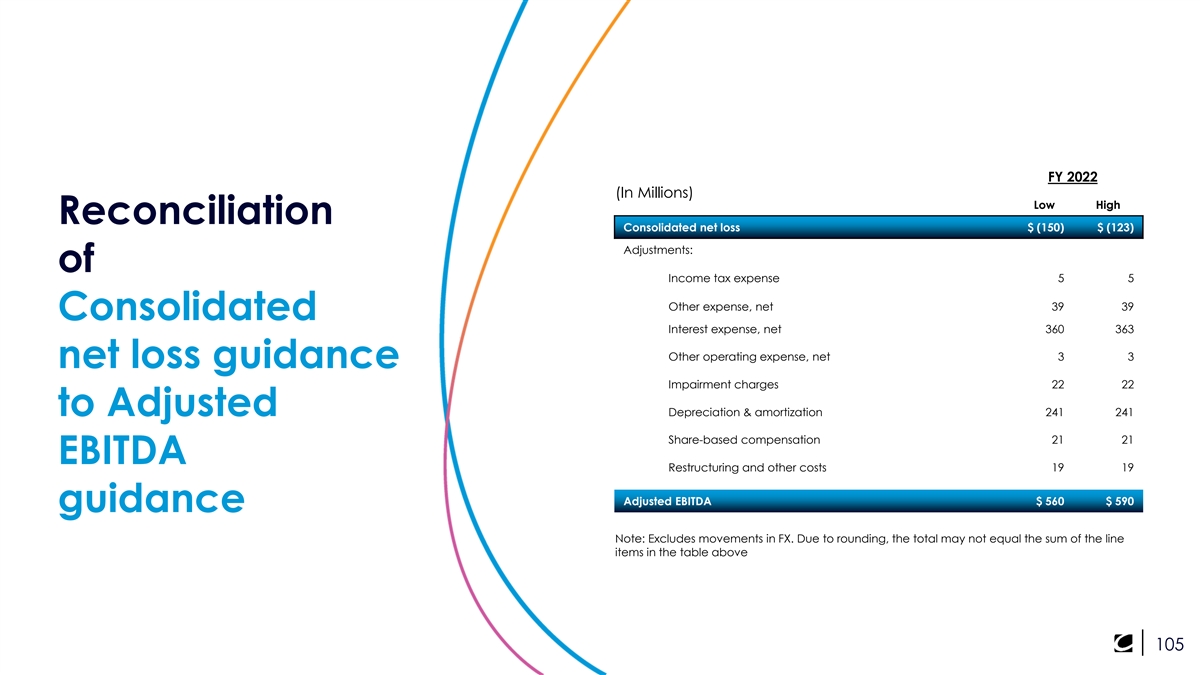

FY 2022 (In Millions) Low High Reconciliation Consolidated net loss $ (150) $ (123) Adjustments: of Income tax expense 5 5 Other expense, net 39 39 Consolidated Interest expense, net 360 363 Other operating expense, net 3 3 net lossJXLGDQFH Impairment charges 22 22 Adjusted WR Depreciation & amortization 241 241 Share-based compensation 21 21 EBITDA Restructuring and other costs 19 19 Adjusted EBITDA $ 560 $ 590 guidance Note: Excludes movements in FX. Due to rounding, the total may not equal the sum of the line items in the table above 105

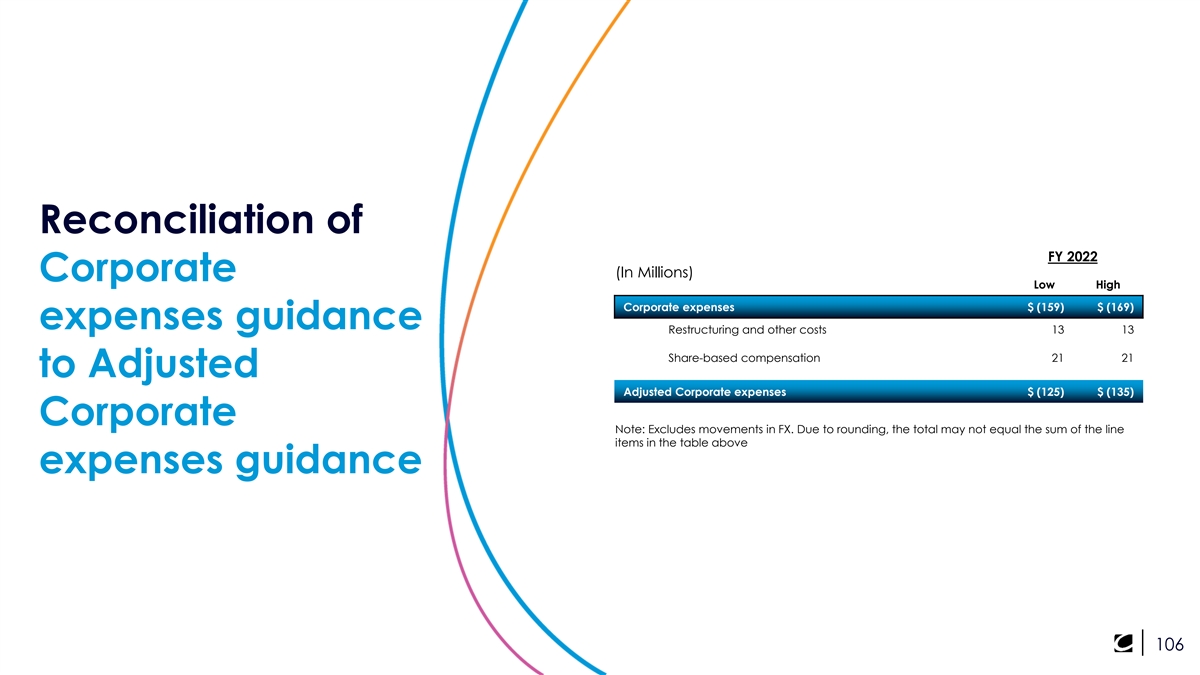

Reconciliation of FY 2022 (In Millions) Corporate Low High Corporate expenses $ (159) $ (169) expenses JXLGDQFH Restructuring and other costs 13 13 Share-based compensation 21 21 to Adjusted Adjusted Corporate expenses $ (125) $ (135) Corporate Note: Excludes movements in FX. Due to rounding, the total may not equal the sum of the line items in the table above expenses guidance 106